The headlines tell us that oil's fall below $30 a barrel in January and loss of nearly 50 percent of its value in 2015 could spell doom for everything from your individual retirement account to the world's stock markets. The World Bank has predicted oil could fall another 27 percent in 2016. This has to do with a massive oversupply, exacerbated by a faster-than-expected return of crude oil sales by Iran as sanctions lifted January 17, as well as a slowdown in growth among developing economies such as China.

Yet have you also noticed that for every downtick in the price of crude oil, you have a little more jingle in your pocket, especially if you drive a car? Economists liken falling energy prices to receiving an unexpected tax return in the mail, because it is cash you wouldn't have otherwise had, and, historically, you're likely to spend it.

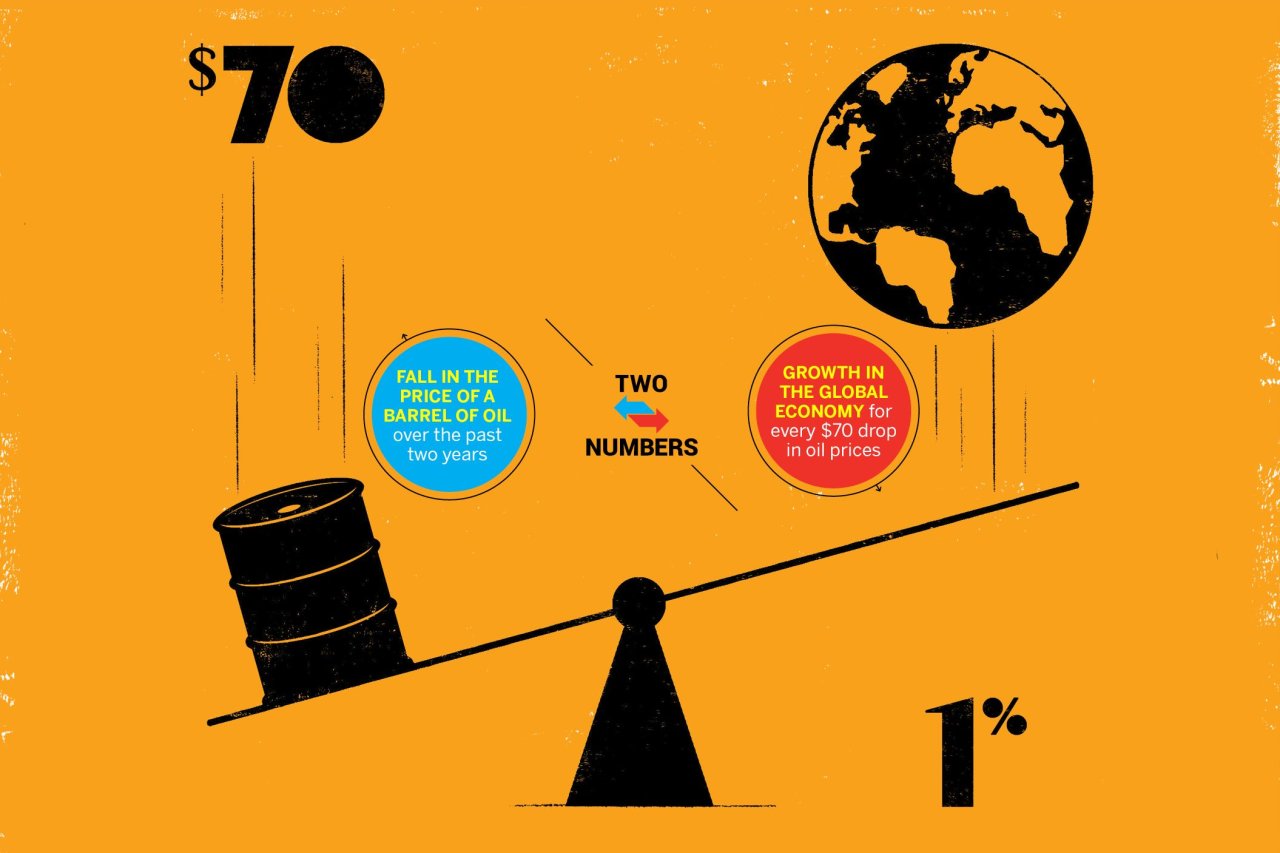

In fact, according to John Baffes, a senior economist at the World Bank, there's a rough calculation for this: For every $70 plunge in a barrel of oil, there's an estimated 1 percent increase in global economic growth, as measured by gross domestic product. "The idea is that as oil becomes cheaper, people save money and buy other things, which increases the GDP," Baffes says. "You buy more groceries, more clothes, and this increases jobs in the food and clothing industries, as well as other sectors."

One percent might not seem like a lot. But when you consider that the global economy only grew around 3.1 percent last year, an extra 1 percent carries enormous oomph. The price of oil has already dropped $70 from January 2014 to January 2016, so this boost has already begun to work its way through the system, with U.S. retail gasoline prices below $2 a gallon to a seven-year low.

The benefits do not spread across the economic universe evenly, Baffes notes. Countries whose economies do not rely on oil exports, like Japan, or are highly resilient, like the U.S., will do better than, for example, Russia or Saudi Arabia, which depend on selling oil. "The main question for economies when we see oil prices go down is, Why?" he says. "If oil goes down because the energy industry has become more efficient, then that helps growth. But if oil prices go down because of a weaker economy, it is because people don't have as many dollars to spend." This time, it's both.