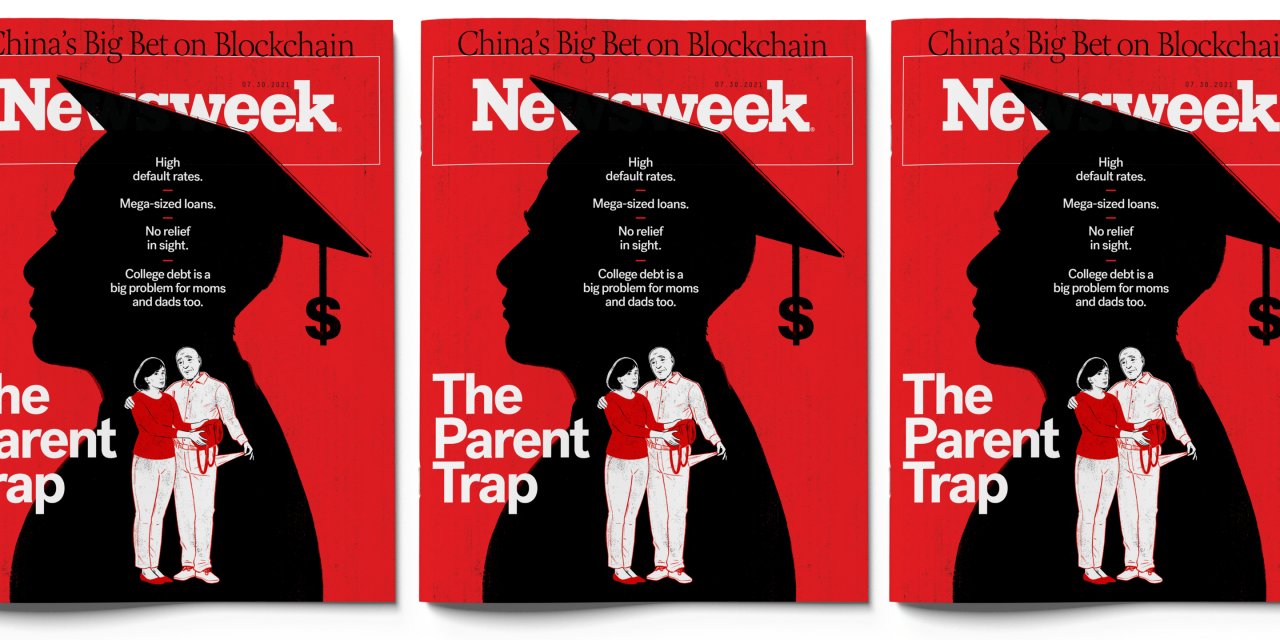

The debate over how to resolve the nation's student debt crisis is heating up again, as pressure builds on President Joe Biden to extend the pandemic pause on repayments due to expire in September and progressives renew calls to forgive some of the $1.6 trillion that Americans owe. Advocates speak eloquently about the strain college debt puts on young people starting out in life: They can't pay their bills, get married, buy a home, start a family or, often, move out of their parents' basements. Typically left out of the discussion: those parents, many of whom are weighed down by college loans of their own—struggling to pay their bills or save for the future, forced to postpone retirement or wonder if they'll ever be able to retire at all.

One out of every four federal dollars lent for undergraduate education last year went to parents and a stunning 22 percent of that $1.6 trillion in outstanding student debt, $336 billion in all, is held by people 50 and older, who typically borrowed to help pay for a child's or grandchild's higher education. Those numbers reflect an explosion in borrowing in recent years fueled by soaring tuition rates, a change in rules that has made it easier for parents to get loans and, in some cases, aggressive marketing tactics by schools that prompted more parents to borrow, in larger amounts. Over the past decade, a time when lending to undergraduates has actually been falling, parent borrowing under the federal PLUS loan program has increased 16 percent; over the past three decades, it's shot up more than 750 percent, the College Board reports.

Now, a new Newsweek analysis of parent-loan data recently released by the federal government shows how quickly many of these parents run into serious problems repaying what they owe, how deeply in the hole they are, which schools have the most serious problems and how much of a strain parents' college debt puts on the households that can least afford them.

According to the data, which covers nearly 1,000 colleges and universities that participated in the federal Parent PLUS loan program from 2017 to 2019, nearly one in 10 parents default or are seriously late with payments within just two years of their child leaving school. That parent default and delinquency rate hit 20 percent or more at over 150 schools and at least 30 to 40 percent at dozens of institutions—a rate high enough for an institution to lose federal funding if the loans had been made to undergraduates instead of parents.

The majority of these PLUS borrowers—nearly six in 10, in the Newsweek database—are from low-income households, busting the myth that it's mainly affluent parents, who can comfortably afford their payments, who take out these loans. At over 140 of the 979 schools analyzed, 80 percent or more of the parent borrowers were from low-income homes.

The problems are particularly acute at for-profit schools, the Newsweek analysis found. Default rates at these institutions, where three-quarters of the borrowers were typically from low-income households, ran double the national average—a particularly bad bargain for the parents shelling out this money given the historically low graduation rates at many of these schools. Among colleges where PLUS-loan default and delinquency rates were at least double the national average, another roughly 30 percent were historically Black colleges and universities, which rely heavily on parent loans due to institutional underfunding and a larger-than-average share of students coming from lower-income families.

Even if they're not falling behind on payments, the amounts parents borrow—far more than their children, typically—put a strain on budgets for many families. Newsweek has identified more than 150 schools where the median parent loan is more than the maximum $27,000 students typically are allowed to borrow in federal loans over four years and more than two dozen schools where parent loans typically exceed $50,000.

Something needs to change drastically, says Richard Fossey, a professor of education law and policy at the University of Louisiana, who has called on Congress to abolish the Parent PLUS program. Says Fossey, author of The Student Loan Catastrophe, "There are ways to go to school without putting parents in debt and people need to figure it out."

In addition to the personal crisis these loans create for many families, experts warn of the potential for serious damage to the U.S. economy if waves of parent borrowers default. Betsy Mayotte, president of The Institute of Student Loan Advisors, likens the situation to the 2008 mortgage crisis, when large numbers of new-home borrowers erroneously assumed that, if a bank said they qualified for the loan, that meant they could afford to repay the debt. When large numbers of homeowners subsequently defaulted, the country was plunged into the worst economic downturn since the Great Depression.

In testimony about parent loans at a U.S. Department of Education hearing last month, Mayotte said: "In any other forum, the practice of awarding loans in large amounts without regard to the borrower's ability to pay, while not providing tools for relief, would be considered predatory and unconscionable." Talking with Newsweek, she put it this way: "The Parent PLUS program is fraught with peril—for families and for the U.S. taxpayer."

'The Money Just Kept Coming'

In the 2019-20 school year, according to the most recent federal data, parents of nearly 754,000 college students took out PLUS loans, borrowing an average of $16,305. Like government loans for undergraduates, these loans can be a boon for college access, allowing families who would have had trouble paying for school help their children get a degree.

There are key differences, though, between the federal loans that students take out to pay for their higher education and the ones available to their parents—differences that increase the financial risks. For one thing, the amounts that parents can borrow are much higher: up to the full cost of attendance, including room, board, fees and other expenses, minus any financial aid the student receives. By contrast, loans to traditional undergraduates are typically capped at $5,500 to $7,500 a year.

The cost of borrowing for parents is higher too: 6.28 percent for the 2021-22 academic year plus an upfront fee of 4.228 percent, versus 3.73 percent for undergraduate loans with a 1.057 percent fee. Repayment starts as soon as the money is disbursed whereas students have an automatic six-month grace period after graduation before payments begin. Parents can elect to defer too but interest accrues from the moment the first dollar is dispensed.

The Newsweek analysis shows how quickly those amounts can add up. At Spelman College in Atlanta, for example, the median PLUS loan for parents with a child who graduated or left school between 2017 and 2019 was nearly $85,000, the highest of any school in the database. Also in the top 10, by loan amount: NYU in New York, with a median loan of nearly $67,000 and Loyola Marymount in Los Angeles, at $60,500. Many schools specializing in the arts were also among those with the largest loans, including Pratt Institute in Brooklyn, New York; Ringling College of Art and Design in Sarasota, Florida; Berklee College of Music in Boston and Savannah College of Art and Design in Georgia.

And that's just for one child. Consider that some parents take out these loans for multiple children and it's easy to see how big of a weight PLUS borrowing can grow to be. Perhaps surprisingly, the data shows that parent default and delinquency rates are actually lower-than-average at many of the schools associated with the biggest PLUS loans. But the staggering amounts may still be causing hardship, straining current living expenses and prompting some parents to rethink when and how they'll be able to retire.

That's the case for Phil Bender, a former public- school superintendent in Venice, Florida. When the oldest of his three daughters enrolled at Indiana's Butler University in 2014, the family was able to pay for the first year from savings. But when a college financial aid officer floated the idea of Parent PLUS loans, they seemed like the right call in subsequent years, Bender says.

Within four years, Bender's two other daughters had enrolled in college—one at Robert Morris University in Chicago (since merged into Roosevelt University) and the other at the public Florida Gulf Coast University—and he had taken out 10 more loans to pay for it. Today, with accrued interest, Bender owes more than $300,000. He deferred payment while the three girls attended graduate school but his oldest graduates this spring and he knows what's coming.

"I'm 66 years old and the chance of this debt being paid off in my lifetime is pretty slim."

"I'm 66 years old and the chance of this debt being paid off in my lifetime is pretty slim," says Bender, who expects to owe up to $1,400 per month for the loans. He's retired from his superintendent position but now consults and substitute teaches and doubts he'll ever be able to stop working completely.

"Looking back, it was a huge mistake, I don't think it should have been that easy," Bender says. "Nobody seemed to be very interested in how I was going to pay them back, the money just kept coming."

Few Barriers to Borrowing

For better or for worse, the Department of Education does make it easy for families to get PLUS loans—too easy, many experts say.

The application process only takes about 20 minutes, according to the department's website, and doesn't ask for any information about income or other debts to help determine whether a borrower can afford to repay the loan. There's a credit check but it's cursory at best: As long as the applicant isn't 90 or more days late on debt over $2,085 and hasn't had a bankruptcy, foreclosure or similar setback within the past five years, the loan will be approved.

"The result is that some parents are on the hook for debt most lenders never would have granted in the first place," says Sandy Baum, a senior fellow at the Urban Institute's Center on Education Data and Policy and author of Student Debt: Rhetoric and Realities of Higher Education Financing.

At the 979 schools for which Newsweek has data, 58 percent of parent loans went to lower-income households; at for-profit schools, the figure jumped to 75 percent. And there were at least 45 schools where 90 percent or more of parent borrowers had low incomes.

One of those schools is LeMoyne-Owen College, a private historically Black school in Memphis, where Enger Johnson's son Marquez was recruited to play basketball a couple of years ago. Johnson, 46, had just moved out of a homeless shelter when she sat down with one of the college's financial aid officers, intent on finding a way to afford the school. She ended up signing the paperwork to borrow through the Parent PLUS program; looking back, she's not quite sure how it happened and didn't understand what the loan entailed.

Now working as a security guard in Memphis, Johnson is behind on payments—nearly a third of the school's parent borrowers are delinquent or have defaulted on their loans, according to the federal data—and besieged by collection calls. She says appeals to the school for help have gone nowhere. "I explained to them I was just coming out of the shelter after being homeless," she said. "I was getting back on my feet. But whenever I call, I can't get anyone over there."

LeMoyne-Owen's financial aid director, Amanda Headen, who wasn't in the position when Johnson got her loan, said she was disappointed to hear what had happened and planned to do what she could to fix it. But the data suggests Johnson's situation is not entirely uncommon—either at LeMoyne-Owen or other schools dependent on parent loans for funding.

The federal government did make one attempt to tighten PLUS loan criteria a decade ago but the effort did not go well. The reforms led to a spike in loan denials, and some schools that relied heavily on parent borrowing, including many HBCUs, argued they were being unfairly targeted. The resulting backlash led to an apology from then-Education Secretary Arne Duncan and a loosening of the rules again in 2014.

Among the members of Congress who pressured the department to change its mind was Democratic Representative James Clyburn of South Carolina, who said stricter credit checks had made it particularly difficult for Black parents to send their children to college.

"We keep putting rules out there knowing full well the rule has a more adverse impact on people of color."

"We keep putting rules out there knowing full well the rule has a more adverse impact on people of color," Clyburn, now the House Majority Whip, tells Newsweek. "All you've got to do is look at the result. If you pass a law and the law has an adverse impact on Black students, it speaks for itself."

It's a Catch-22, say researchers who have studied the impact of PLUS loans on lower-income households and Black families. Looser credit standards improve college access for parents with limited financial resources but leave them with debts they struggle to pay. One out of every five PLUS borrowers and more than a third of Black borrowers have incomes below the federal poverty line, according to Baum. More broadly, her research shows, six in 10 Black parents with PLUS loans would be considered lower-income versus 25 percent of white PLUS-loan holders.

One sign of the problems this may cause for families is the relatively high PLUS loan default and delinquency rates at some HBCUs. Of the 182 schools in the Newsweek database with a combined rate that's at least twice the median, three in 10 percent were historically Black institutions.

One of them is Philander Smith College, in Little Rock, Arkansas, where more than nine out of 10 PLUS loans go to lower-income families and 30 percent of parents are behind or in default on their payments. Somewhat ironically, given the backlash against tightening lending standards 10 years ago, financial aid director Kevin Barnes blames the school's high default rate on the federal government for allowing risky borrowers to take out loans in the first place.

"We don't issue the credit decisions," Barnes tells Newsweek. "We're not responsible for collecting the payments."

The Role that Schools Play

Colleges do have a hand, though, in steering families to PLUS loans. Parents rarely know about this borrowing option until a college financial aid officer tells them, Fossey says. And some schools actively push parents to borrow instead of their children, according to Mayotte and other experts, in order to keep their student default rates down.

That's because a college or university stands to lose significant federal funding if 30 percent or more of its student borrowers are in default for three consecutive year or 40 percent or more default in a single year. But there isn't a comparable rule associated with parent loans.

"For the institutions, Parent PLUS loans are like a grant. They get the money regardless of what it does to the family."

"For the institutions, Parent PLUS loans are like a grant," said Rachel Fishman, deputy director for higher education research at New America, a Washington, D.C. think tank. "They get the money regardless of what it does to the family."

There's no way of knowing how many institutions put pressure on parents to borrow. Some schools, as a matter of policy, do not mention PLUS loans unless a student has exhausted other means of paying for their education and is still coming up short. Case in point: At Wayne State University in Detroit, where just 7 percent of the school's more than 1,000 parent borrowers defaulted in 2017-19, PLUS loans are regarded as a last resort.

"We found that parents don't always understand the implications of borrowing," says Catherine Kay, Wayne State's senior director of financial aid. "If you offer these loans from the front end, people sometimes borrow more than they need to. A parent could potentially borrow every year and the debt really adds up."

The University of New Orleans leaves all loans out of its initial aid offers, but does provide them as a final option, said Ann Lockridge, the financial aid director at the public university, where fewer than 80 parents used PLUS loans in 2017-19. The school had a 13 percent default rate in those years. By contrast, both Philander Smith and LeMoyne-Owen say they provide Parent PLUS loans as a financing option from the start.

It's a tricky conundrum for colleges and universities, many of which depend on maintaining steady enrollment for their survival. Smaller private colleges in particular depend on tuition, so losing Parent PLUS loans as a financing option could have dire consequences, they say.

Dillard University in New Orleans, where 15 percent of parent borrowers default, tried downplaying PLUS loans as an option a couple of years ago by mentioning them only as a backup plan, only to lose potential students who no longer saw Dillard as an affordable option, says David Page, vice president for enrollment management at the private, historically Black university. Families looked at the financing options the school offered upfront, such as scholarships, grants and traditional student loans, and didn't see a way to pay, he says.

"Ultimately it is their choice," says Page. "I think schools should have the opportunity to create whatever plan they find appropriate for their students."

Default Is Not the Only Danger

Parents, however, face some unique challenges in repaying their loans compared to student borrowers. The most obvious one: They do not have as much time left in their working lives to pack back what they owe and, typically already at or past their earnings peak, they cannot count on a rising income to make repayment easier in the future.

The amounts they owe are usually much larger too, since they can borrow up to the full cost of attendance each year and may take out loans for multiple children.

If parents run into problems making payments, though, they do not have access to as much help as their kids do. Parents are only eligible for one of the federal government's four income-based repayment plans, which lower the amount due each month by stretching payments beyond the standard 10-year schedule. Parents can switch to a plan that limits payments to nor more than 20 percent of discretionary income over 25 years, whereas the plans students commonly use limit payment to 10 percent of income.

The Consumer Financial Protection Bureau, in a 2017 report, documented the hardships student loans often result in for borrowers age 60 and older. It reported that a large portion struggle to pay basic living expenses and are more likely than same-aged people without student loans to skip going to the doctor or dentist or buying prescription drugs because they cannot afford it. They've also saved less for retirement and a growing portion have had a portion of their Social Security benefits offset because of unpaid student loans.

Phi Linh Ellis, a 38-year-old New Orleans pharmacist, is already anticipating the strain PLUS-loan payments will put on her family's budget. She and her husband borrowed $7,500 to help pay for their son's freshman year at the University of Holy Cross this past year and expect to owe at least $60,000 by the time he graduates. And the couple have two younger children in daycare who are likely to need their own tuition assistance someday.

"Any time you have a new debt you have to cut back on costs: groceries, eating out, anything that's not a fixed cost," says Ellis, who finished repaying her own student loans just a few years ago. "It does stress me out, especially knowing I have other children behind my son."

Repayment can be even more challenging for retired parents. A 2015 GAO report found that there were 870,000 or so student loan borrowers over age 65, of which 210,000 owed Parent PLUS loan debt; hundreds of thousands more likely had private loans, often co-signed with their children. Overall, the CFPB found that nearly three-quarters of college borrowers age 60 and older took out the loans on behalf of their children and grandchildren.

Even borrowers who are more prepared for the PLUS debt find themselves taken aback by it. Take New York City residents Lee Johnson and his wife, a retired nurse, who borrowed about $160,000 to send their son to the University of Florida in 2004 and their daughter to Spelman in 2008. The Johnsons did their homework, never missed a payment and have since paid off the loans in full. But they were still surprised by the high interest rates—around 7 percent at the time—and how quickly the debt added up.

"This is a big trap for poor people."

"I went to school for economics, so I understand the tricks of the trade but the average person knows nothing about this," says Johnson, 65, a retired truck driver. "This is a big trap for poor people."

For many parents, the struggles they face repaying PLUS loans might be worth it if borrowing achieved the desired result: getting their child a college degree. But many of the schools with the highest default rates have a graduation rate far lower than the 63 percent national average.

Consider Stevens-Henager College, a Utah-based school owned by the Center for Excellence in Higher Education, which has repeatedly faced criticism about its quality from graduates, accreditors and judges. Nearly 40 percent of PLUS borrowers at Stevens-Henager and its related Independence University defaulted within two years. Meanwhile, the eight-year graduation rate is just 32 percent, according to the Department of Education.

The college chain has a department meant to prevent defaults, but hasn't been able to get a handle on PLUS borrowers, says Scott Schuler, vice president of financial aid for the schools.

Close behind Stevens-Henager is Centura College, a for-profit school in Virginia where 38 percent of PLUS borrowers defaulted within two years and just 43 percent of students graduated in eight years. The college provides "intensive" financial counseling for its students, says Joel English, Centura's executive vice president but "for parents, we don't have such a program."

Solutions Proposed, None Taken

What's to be done? Student loan forgiveness was a hot topic in the presidential campaign and earlier this year but none of the proposals floated explicitly addressed parent debt. Since then, President Biden has said he is looking into forgiveness options, but it's not clear how that would work or whether his plan will include parents either. Several experts told Newsweek they're not convinced Biden will take action at all, despite pressure within his own party to do so, noting the president did not include student debt forgiveness in his proposed budget or infrastructure legislation.

Congress could take the lead in trying to implement a solution. But while legislators have occasionally attempted reforms, results are rare. "It certainly seems like an area that needs a champion," says Democratic Representative Eric Swalwell of California, who tells Newsweek he intends this year to reintroduce a 2019 bill he proposed to wipe out interest on federal student loans, including Parent PLUS debt.

Meanwhile, Representative Bill Foster, a Democrat from Illinois, tells Newsweek he hopes to propose a bill this year that will allow graduates to take over their parents' school loans. But that won't address what Foster says is the real driver of high college debt: state and federal education budget cuts that have pushed schools to raise tuition repeatedly in recent years. He says, "We seem to have just lost that social compact."

The Department of Education could reform aspects of the Parent PLUS loans without congressional approval, but it's not clear whether it will. The department did not respond to repeated interview requests.

Still, a few relatively minor changes could help large numbers of borrowers, experts say. Mayotte, for example, suggests allowing students to cosign parent loans, which would enable them to take over some responsibility for the debt if the parent runs into financial trouble. She also advocates broadening the income-based repayment options available to parents.

And both Mayotte and Fishman urge the federal government to pay more attention to a potential borrower's ability to repay the loan before allowing the parent to sign the contract.

For instance, Fishman says, the Department of Education could use information gathered in the FAFSA—the federal application for student aid—to determine whether a family has the financial means to repay a loan before offering one. A simple credit check is not enough, she notes, because it often leads to parents with no credit history, and therefore no blemishes on their record, being eligible for loans they can't afford.

Both Fishman and Baum also advocate expanding grant aid to lower-income families to lessen the need for loans in the first place. Baum's research shows that an extra $6,000 a year in Pell grants for four years, up from the current maximum of $6,345 now for the lowest-income borrowers, would wipe out the need for PLUS loans for about three-quarters of parents with incomes below the poverty level, including 85 percent of low-income Black PLUS borrowers.

Schools also have to do their part, these experts say. Tuition and fees have more than doubled in the past 30 years at both public and private colleges and universities, according to the College Board, and the added costs have required families to seek new ways to pay.

"Borrowing is a symptom of a cost disease. It's very expensive to go to college. The rest of the aid hasn't kept pace."

If schools reduce the cost of education and the federal government provides more money for Pell grants, parents won't need to borrow as much money, said Fishman, of New America. "Borrowing is a symptom of a cost disease," she says. "It's very expensive to go to college and it's expensive to cover living expenses. The rest of the aid hasn't kept pace."

In the meantime, their experiences with PLUS loans have parents like Michele and Paul Billich, small business owners in South Plainfield, New Jersey, rethinking their options for paying for college. The couple took out two PLUS loans totaling $49,000 for their daughter starting in 2009 as the economy fell off the table; they eventually closed the family construction-equipment company and, a dozen years after they first borrowed for college, they still owe a few thousand dollars. Says Michele, "We just didn't think we would be holding onto the debt for this long."

When it came time to send their two younger children to college, the family chose not to use PLUS loans, deciding the kids should have more of a financial stake in their own education.

Phil Bender, still sitting on $300,000 in student loans in Florida, is also wondering what he could have done differently. "Being strapped to this sort of debt into my 80s isn't something I look forward to," he says. All three of his daughters are planning to help pay back the loans, he says, but he knows he'll probably end up working long into what was supposed to be his retirement.

While he has regrets, though, Bender isn't sure what else he and his wife could have done to pay for their daughters' education. "If I had to do it over again, I don't know if I would have done anything differently or not," he says. "I had the opportunity to go to college and I wanted my daughters to have the opportunity to go to college. What else can a parent hope for?"

Matt Krupnick is a freelance journalist based in Los Angeles. His reporting has appeared in The New York Times, The Guardian, The Washington Post and the Hechinger Report, among other publications.

About the writer

Matt Krupnick is a freelance journalist based in Los Angeles. His reporting has appeared in The New York Times, The ... Read more