The U.S. Securities and Exchange Commission (SEC) has officially announced its approval for a series of Bitcoin Exchange-Traded Funds (ETFs), a decision that aligns with the earlier confirmation by the Chicago Board Options Exchange (Cboe) to Newsweek that trading of the ETFs is set to commence on Thursday.

The development follows closely on the heels of an alleged cybersecurity incident on the SEC's social media account, which had previously cast doubts on the approval process.

SEC Commissioner Mark Uyeda, in a statement issued Wednesday, shed light on the Commission's rationale behind the green light for these Bitcoin ETFs. While he agreed with the overall decision, the Commissioner didn't shy away from expressing his concerns over certain aspects of the process.

His statement highlighted three key points. First, Uyeda questioned the "significant size" test, a special requirement that the SEC has been using to evaluate Bitcoin ETFs. He pointed out that the test, which demands a certain level of market size and surveillance for Bitcoin markets, might not be fairly applied. In simple terms, he's concerned that Bitcoin is being treated differently and more harshly compared to other commodities, which could make it unfairly difficult for Bitcoin ETFs to get approved.

Secondly, the Commissioner criticized the SEC for suddenly introducing a new set of standards for approving the ETFs without clearly explaining or justifying the changes. Lastly, Uyeda said he was skeptical about why the SEC rushed the approval of the Bitcoin ETFs, suggesting that they might have been trying to avoid giving any single Bitcoin ETF an unfair advantage by being the first on the market.

Despite concerns, Uyeda agreed with the decision to approve the ETFs, saying that the SEC needs to be more transparent and consistent in how they make these decisions, which is crucial for maintaining trust in financial regulation.

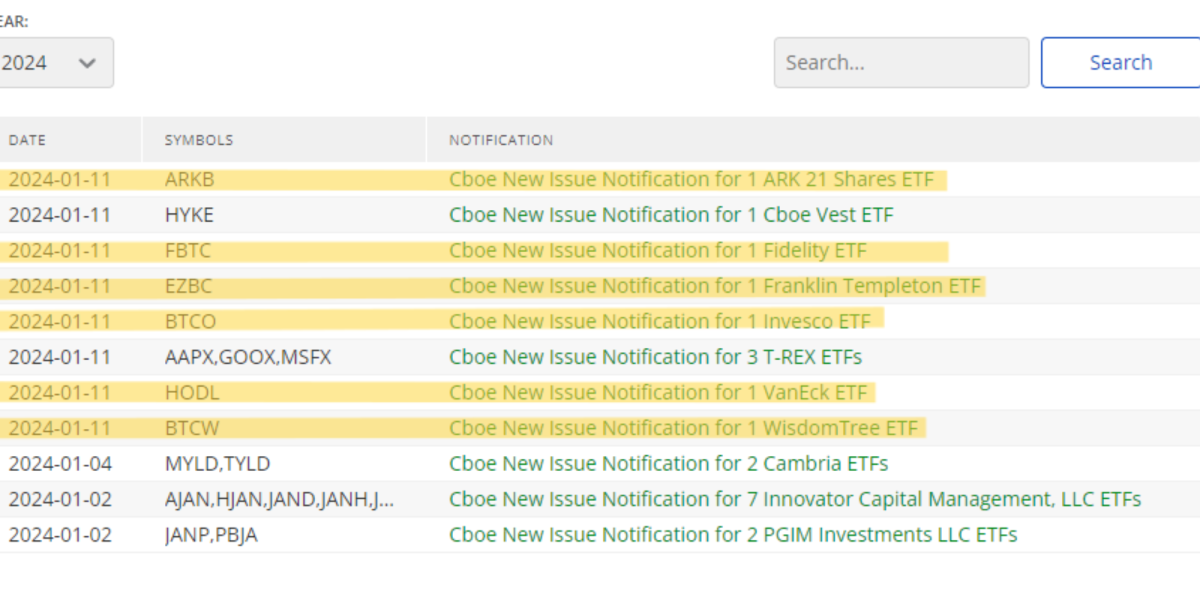

In alignment with the SEC's official stance, the Cboe confirmed to Newsweek prior to the SEC's announcement that six Bitcoin ETFs will launch for trading on Thursday. These ETFs include ARK 21Shares ETF (ARKB), Fidelity Wise Origin Bitcoin Fund ETF (FBTC), Franklin Bitcoin ETF (EZBC), Invesco Galaxy Bitcoin ETF (BTCO), VanEck Bitcoin Trust ETF (HODL), and WisdomTree Bitcoin Fund ETF (BTCW).

The previously reported Twitter hack of the SEC's account, which caused a stir by prematurely announcing the ETF approvals, now stands in a different light following the official confirmation. The incident, initially viewed with skepticism and concern, inadvertently foreshadowed the landmark decision.

In the wake of the official announcement, the market's reaction has been positive, with Bitcoin's price being pushed up nearly 1 percent for the day.

The SEC decision is a historic moment for the approximately $1.7 trillion digital asset sector. The approval of the ETFs, which will allow direct investment in Bitcoin, is expected to greatly expand access to the cryptocurrency, experts say.

The move marks a shift in the SEC's stance, ending a decade-long period of hesitation and opposition. It's a response, in part, to increasing demand from major financial entities and a changing regulatory landscape, according to an exclusive Bloomberg report, highlighted by recent court rulings criticizing the SEC's earlier rejections as "arbitrary and capricious."

Newsweek has reached out to the SEC via email for comment.

Update 1/10/24 5:26 p.m. ET: This article was updated with additional information.

Uncommon Knowledge

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

fairness meter

To Rate This Article

About the writer

Aj Fabino is a Newsweek reporter based in Chicago. His focus is reporting on Economy & Finance. Aj joined Newsweek ... Read more

To read how Newsweek uses AI as a newsroom tool, Click here.