This article originally appeared on The Motley Fool.

President Donald Trump is no stranger to controversy. Then again, it's hard to argue that he hasn't made some exceptionally savvy decisions as a businessman throughout his life. Trump self-proclaimed his net worth to be $10 billion during his campaign, which would be quite the improvement from the $1 million loan he purportedly began with in the 1970s.

However, one controversy stands head and shoulders above the rest: Trump's refusal to release his federal income tax returns. Every president and presidential candidate for the past four decades has released his or her tax returns in the name of transparency. Yet Trump has stuck to the thesis that he's been advised not to release his tax returns while his taxes are under audit.

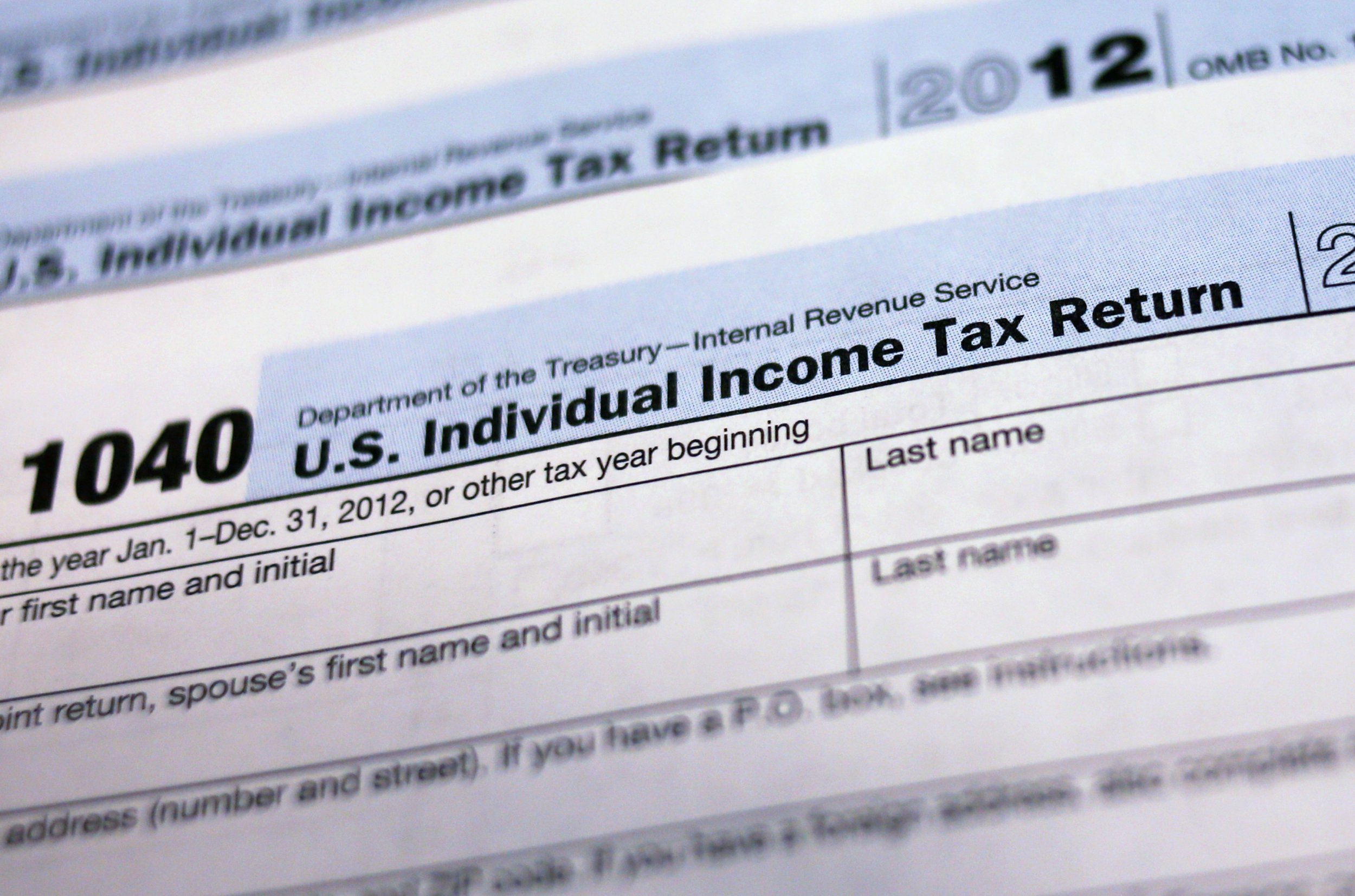

Trump's biographer, David Cay Johnston, obtained a partial release of Trump's 2005 federal income tax return. The source of the leak is at this time unknown. Contained in the partial release are the front and back of his Form 1040, the most basic tax form. The copy of these tax forms can be found on Johnston's website, DCReport.org. It should be immediately noted that while Form 1040 provides an overlay for what a person generated in income and paid in federal income taxes (or received as a refund), it's by no means comprehensive. We don't have access to any of the schedules or other forms that would normally accompany a tax report from a high-income individual like Trump, who has multiple channels of income. Just getting a glimpse of Trump's 1040 is akin to reading the headline figures from an earnings report but not having the details of how a company reached those figures.

Even though this tax release will probably raise just as many questions as answers, it did contain some must-know figures. Here are five of them.

1. $152 million in income

The obvious number that sticks out to most people is the more than $152 million in income Trump generated in 2005, based on the released copy of his Form 1040. Here's the rough (and rounded) breakdown of how Trump generated his income in 2005:

- $67.3 million from rental real estate, royalties, partnerships, S-Corporations, and trusts.

- $42.4 million from business income.

- $32.2 million from capital gains.

- $9.5 million from taxable interest.

- $399,000 from wages and salary.

- $314,000 from ordinary dividends.

One of the more intriguing data points that stands out is just how little Trump earned from tax-exempt interest vehicles (less than $47,000) and qualified dividends ($6,399). Again, we don't have the Schedule C, D, and E that would make this income easier to understand, but it's pretty evident that dividends aren't a big part of The Donald's income.

2. $103 million in loss adjustments

Trump may have earned a lot more than people realized in 2005, but he also managed to claim a smorgasbord of losses. According to the obtained tax return, Trump claimed roughly $103.2 million in losses. However, we have no clue how those losses arose, since the attached statement that would describe their origin isn't part of this release.

It should also be pointed out that a good chunk of Trump's $103.2 million loss was negated by the Alternative Minimum Tax (AMT), which we'll get to in a moment.

3. $5.31 million in federal income tax

According to the partially released tax return, despite making in excess of $152 million in income, Trump's federal income tax was calculated at just $5.31 million. This means he owed less than 4 percent of the $152 million that he earned after taking all of his losses and deductions into account. Trump's federal income tax bill may be so low because he's still offsetting his income based on $916 million in offsetting losses that was declared back in 1995.

However, a tax that's been around since 1969, the aforementioned AMT, which ensures that wealthy individuals aren't able to abuse income tax deductions and exemptions to skirt around owing federal taxes, wound up pulling quite a bit more out of Trump's pockets.

4. $31.3 million paid in Alternative Minimum Tax

Though the AMT is primarily designed to ensure that wealthy individuals and couples pay their fair share of taxes, the 2017 tax thresholds imply that single individuals earning more than $54,300, and couples filing jointly with more than $84,500 in income, could be hit with the AMT. In Trump's case, he made a wee bit more back in 2005.

As mentioned earlier, the AMT reduced the impact of Trump's $103.2 million in reported losses. The result is that the AMT required him to fork over an additional $31.3 million in tax.

It's worth pointing out that among Trump's numerous tax reforms proposed, he would eliminate the AMT, which would clearly be a benefit to wealthy and upper-middle-class individuals and families.

5. $38.4 million in total taxes paid

Lastly, Trump's final tax bill for 2005 worked out to roughly $38.4 million owed. However, about $1.9 million of what was owed derived from self-employment taxes. If we pull out self-employment taxes and focus strictly on what was taxed base on income, Trump paid an effective tax rate of 24 percent on his more than $152 million in income. For added context, a 24 percent tax rate is what a married couple making between $75,000 and $152,000 will often face, according to Quartz.

Again, this partial tax return still leaves a lot to be answered about where Trump generates his income. But it does highlight a tax system that certainly seems to favor the wealthy. Looking ahead, if Trump gets his way with his proposed individual tax reforms, it'll be even more favorable to the well-to-do.

For example, repealing the Affordable Care Act means saying goodbye to the 3.8 percent net investment income tax placed on investment income for individuals and couples earning in excess of $200,000 and $250,000, respectively, in modified adjusted gross income. It would also eliminate the 0.9 percent Medicare surtax added on all earned income in excess of $200,000 and $250,000 for respective individuals and married filers.

The rich also get added bonuses for making charitable contributions. Your peak ordinary income tax rate serves as the measure by which your deduction is determined. Trump, who easily falls into the highest ordinary income tax bracket of 39.6 percent, receives a $0.396 deduction for every $1 he donates. Comparatively, someone making $30,000 annually who falls in the 15 percent ordinary income tax bracket receives just a $0.15 deduction for every $1 donated. The charitable-giving deduction is one of the few deductions Trump plans to keep.

Uncommon Knowledge

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

About the writer

To read how Newsweek uses AI as a newsroom tool, Click here.