Undoubtedly the most pressing issue for the U.K. economy is the impact that uncertainty ahead of the EU referendum is having on activity. Concerns over the referendum have risen, most evident in a spike in uncertainty over public policy (measured mostly through media citations), to levels last seen at the height of the Eurozone crisis.

We're already seeing some signs that uncertainty is affecting economic activity. The Purchasing Managers' Indices—an indicator of the economic health of the manufacturing sector—weakened in April, and at least some of this fall has been attributed to referendum uncertainty. While it's difficult to disentangle this from other factors weighing on growth, the referendum is clearly an issue on CEOs' radar: jitters are apparent when I talk to businesses up and down the country.

And we are seeing a more tangible impact elsewhere. Some surveys of businesses' investment intentions, including the Bank of England agents' scores, have deteriorated significantly. And again, when I talk to our members at the Confederation of British Industry (CBI), many of them note that they're holding off on spending projects until things are a bit more certain. We've taken this into account in our latest assessment of economic conditions, and it's driving a small part of our downgrade to GDP growth forecasts in 2016, from 2.3 percent to 2.0 percent.

It's clear that businesses are putting other decisions on hold too. The Bank of England's Monetary Policy Committee (MPC) have noted several signs of this: for example, some IPOs and private equity deals have been postponed and corporate credit demand has softened.

It's not just activity and forward planning being hit either. Uncertainty around the outcome of the referendum has had a clear impact on the exchange rate. The pound has fallen by around 9 percent since its peak in November 2015 (on a trade-weighted basis), reversing just under half of its rise since March 2013. In its inflation report released last week, the Bank of England estimated that around half of the 9 percent fall reflects uncertainty ahead of June's referendum. With the referendum still over a month away, we could very well see a further fall in sterling ahead.

The economic implications of this are, as yet, unclear. We might see a small boost to export competitiveness and inflation from a lower exchange rate, but it depends on the degree of offset from other factors: for example, tepid global momentum could offset an export boost, and low commodity prices will in any case keep a lid on inflation.

So it's clear that referendum uncertainty is having some impact on the economy so far, which is unsurprising. And there is the very real risk that we could see even more of an effect as we get closer to the referendum: pipelines of orders and activity could clog up; investment intentions may weaken further; the pound could fall further; and financial market volatility could spike up (markets, outside of currency movements, have been relatively calm so far).

Having already been a driver behind a downgrade to our growth forecasts, uncertainty ahead of the referendum is therefore the number one risk to the UK's economic outlook.

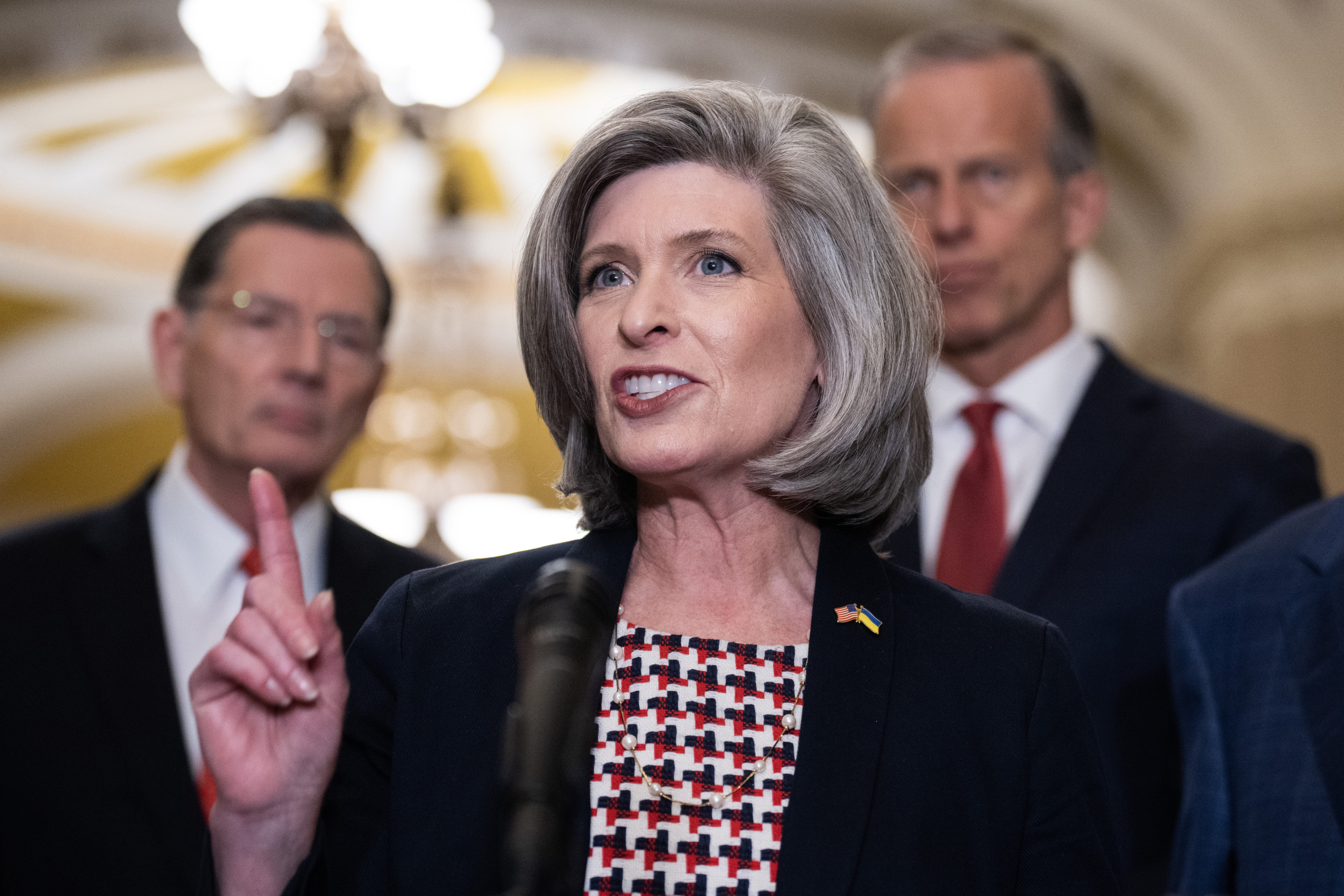

Anna Leach is head of economic analysis at the CBI.

Uncommon Knowledge

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

About the writer

To read how Newsweek uses AI as a newsroom tool, Click here.