Millions of Americans will feel the brunt of another Federal Reserve interest rate hike, the largest level in over two decades.

Fed Chairman Jerome Powell, part of the 12-member Federal Open Market Committee (FOMC), announced the .25 basis point rate increase from 5.25 percent to 5.5 percent—the largest level in 22 years and the 11th hike of the past 12 U.S. central bank policy meetings, beginning in March 2022.

The Fed has repeatedly touted its effort of bringing inflation down to 2 percent. A potential additional interest hike in September remains on the table, according to Powell, while "robust" job gains and a low unemployment rate haven't subsided "elevated" levels of inflation evaluated by the FOMC.

"Price stability is the responsibility of the Federal Reserve," he told reporters on Wednesday. "Without price stability, the economy doesn't work for anyone. In particular, without price stability, we will not achieve a sustained period of strong labor market conditions that benefit all."

The FOMC plans to use a data-dependent approach moving forward, he added, saying that the effects of policy tightening on demand are most noticeable in the most interest-rate-sensitive sectors of the economy like housing and investment.

Powell acknowledges that the full effects of these hikes on the inflation rate "will take time."

"My colleagues and I are acutely aware that high inflation imposes significant hardship as it erodes purchasing power, especially for those least able to meet the higher costs of essentials like food, housing and transportation," he said. "We are highly attentive to the risks that high inflation poses to both sides of our mandate, and we are strongly committed to returning inflation to our 2 percent objective."

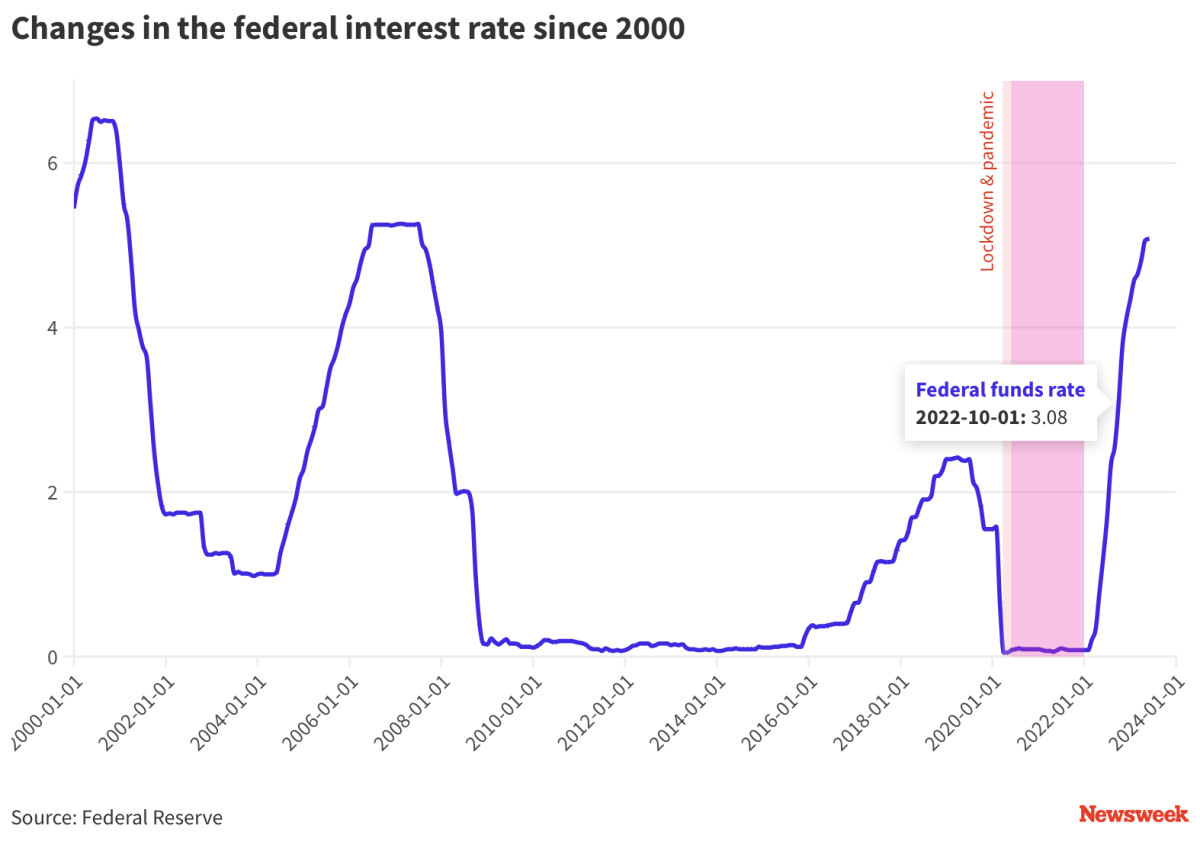

A chart from the Federal Reserve shows interest rates near 0 percent during the COVID-19 pandemic and associated lockdowns. The federal interest rate passed 3 percent on October 1, 2022, and has surpassed levels from the 2008 market crash/recession.

David Duston, president and founder of the MoneyWorks Group, told Newsweek via phone that the Fed inadvertently or not admitted that inflation is still heavily impacting American lives, wallets and savings.

"Inflation is moderate, which means that inflation is really here and it's kicking people where it hurts," Duston said. "And there's a lot of people feeling the squeeze. Only 30 percent of retirees even feel like they can make it through retirement because of the inflationary environment that we're in."

He expects continued rate increases due to the current state of the economy, saying it harkens back to other periods of financial turmoil that ushered in recessionary periods.

"I don't know that they're afraid to admit it or not, but I feel that we're already in one," Duston said. "And it's just starting."

Quincy Krosby, chief global strategist for LPL Financial, told Newsweek via phone that the FOMC's announcement "was not shrouded in hawkish or even dovish tones" and presented a tone of pragmatism.

"The market is data dependent," Krosby said. "I think sometimes the market is even more data-dependent than the Fed. The market will make a determination whether or not it believes that the Fed is poised to raise rates based on the same data that the Fed examinates...And we do know that there is a dichotomy within the board of the Fed between the hawks and the doves."

She said the Fed also has a good sense of the market's attitudes, evidenced by how fluctuations were minor or essentially nonexistent following the announcement.

Powell tried to normalize rates in 2018 and the market telegraphed that with a major sell-off by December of that year, she noted, acknowledging Powell's demeanor today as opposed to when he made past statements about rate increases.

"Sometimes [Powell] meanders into the dovish channel, then goes over to the hawkish channel," she said. "He was fairly centered, fairly neutral and pragmatic. And I think the market picked that up very clearly."

Bill Adams, chief economist at Comerica Bank, told Newsweek via phone that he believes the interest rate hikes may have hit their peak.

He cited a decrease in energy and a cooling off of the housing market, which he in turn suspects will flow through to slower core inflation over the next two quarters.

"The Fed has been concerned about inflation from non-shelter, non-energy services, which are sometimes called super core inflation," he said. "But that also has slowed in the last couple of months.

"So, the trajectory of inflation looks much more encouraging over the last couple of months than it did even at the beginning of 2023, which makes it easier to see a path for the Fed to gradually reduce interest rates in 2024."

Duston believes middle America and those on their way out of college will especially feel these rate hikes—in addition to 20-somethings that cannot afford to purchase homes for themselves and occupy their parents' residences instead.

He said older Americans who either haven't prepared for their retirements or are approaching it and thought they would have more to live off, are also struggling.

"You've got somebody that orders a pizza on a credit card for $18-$20 and ends up paying the minimum payment, and now they're gonna pay 30 percent interest on a credit card and end up paying 30 bucks for that same pizza," Duston said. "Yeah, they're feeling the squeeze and it's gonna cost them a lot a lot in the long run."

Uncommon Knowledge

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

About the writer

Nick Mordowanec is a Newsweek reporter based in Michigan. His focus is reporting on Ukraine and Russia, along with social ... Read more

To read how Newsweek uses AI as a newsroom tool, Click here.