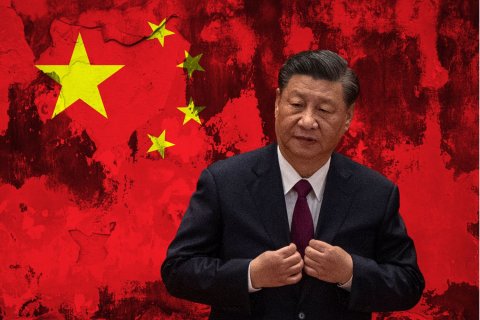

Chinese leader Xi Jinping appeared to revise his long-term economic outlook when he opened a major political event last month, hinting at modest growth that casts fresh doubt on China's capacity to surpass the United States in the future.

Beijing's two-step plan to build what it calls a "great modern socialist country in all respects" by 2049, the centennial of the People's Republic of China, involves first raising levels of public wealth and doubling the national economy by 2035.

To achieve that, economists believed China would need to maintain annual gross domestic product growth of at least 5 percent, a once-realistic trajectory that might have seen it one day overtake the U.S. economy in GDP terms—valued at $23 trillion versus China's $17.73 trillion in 2021, according to the World Bank's records.

This first milestone, known as the "basic realization of socialist modernization," was declared in 2020 and had been expected to take 15 years to achieve. But on October 16, as Xi opened the Chinese Communist Party's twice-a-decade national congress, the target appeared less ambitious.

Two years ago, Xi said it was "entirely possible" to double national GDP and GDP per capita by 2035. His latest pronouncement, however, omitted the former goal.

"By 2035, our overall development goal is to significantly increase economic strength, scientific and technological capabilities, and comprehensive national power; substantially grow GDP per capita to reach that of a mid-level developed country," China's president said.

China Abandons GDP Target

Chicago-based economic analyst Houze Song observed Beijing was "quietly abandoning its ambition to become the world's largest economy" in Xi's report at the CCP's 20th National Congress.

The original 2035 target included both measurements. "In contrast, the 20th work report only mentions new milestones for per capita income, not GDP," Song said. The 2035 goal was drafted before China's 2020 census was released in spring 2021. "I believe there are two main reasons behind abandoning the 2035 GDP target. First, Beijing realized that its population will decline more rapidly than anticipated, which makes it more difficult to achieve high growth," Song told Newsweek.

"Moreover, the GDP target has become less binding in recent years. It was abandoned in 2020, and this year, it seems Beijing doesn't care much about missing the 5.5 percent growth target," said Song, who is a research fellow at the Paulson Institute and author of Substack called MacroPolo Econ.

"China's pursuit of economic development is changing. It used to focus on high economic growth, but now the emphasis is on 'quality,'" said economist Ya-Ling Lin, an associate research fellow at the Institute for National Defense and Security Research in Taipei. "What we've seen in recent years is the Chinese government emphasizing environmental issues and balanced development."

Beijing is restructuring its economy toward high technologies like semiconductors. "China wants to become a powerful nation to resolve its past predicament of being 'big but not strong,' in order to effectively compete with the U.S.," said Lin.

China's Economy Loses Its Engine

China's once-a-decade census revealed a declining birth rate and a shrinking workforce. It led to renewed urgency to beat the so-called "middle income trap" of growing old before

growing rich. Births among China's 1.4 billion people—the most in the world—were projected to fall to new lows in 2022, dipping below 2021's 10.6 million babies, the fewest on official record since the 1950s. Its working-age population, which peaked in 2014, would decline by some 35 million people by the middle of the present decade, official demographers said. The looming demographic crisis directly concerns the country's medium- to long-term productivity.

Xi addressed the issue during his opening remarks at the party congress, telling CCP delegates that the government would "optimize our population development strategy by establishing a policy system to support birth rates and reduce the costs of childbirth, parenting and education."

Beijing imposed a restrictive one-child policy between 1980 and 2015, before allowing two children, a shift that lasted six years before it expanded to a three-child policy in May 2021. By July, however, all restrictions were scrapped. In their place, officials introduced incentives including tax deductions, housing subsidies and financial rewards for having more children.

China's Zero-COVID Struggles

Many point to Xi's heavily centralized approach to domestic governance, including his economic policy of propping up state-owned firms, as stifling private sector growth. In recent years, his decision to double down on "dynamic zero COVID"—his signature public health strategy—has hit productivity, driven small and medium businesses to closure and raised youth unemployment.

Some 200 million people across China were experiencing some form of restricted movement in the week leading up to the party congress—citywide or neighborhood-specific lockdowns, as well as a continuation of the country's mandatory quarantine policy for domestic and international travelers. There was a brief expectation that the rest of China would follow Hong Kong's loosening of COVID regulations in September, given the city's previous tendency to stick to the central government's rhythm.

However, it quickly became apparent that zero COVID's strong ideological links to Xi's personal achievements meant that the zero-tolerance approach could be framed as nothing less than a total success and would need to remain in place going forward. China's president said as much in his speech.

On October 17, China's National Bureau of Statistics abruptly delayed the release of third-quarter GDP figures and other fiscal data without providing a reason, in a move that surprised economists and probably unnerved investors, who look at transparency and regularity as major indicators of confidence in the world's second-largest economy.

China watchers following Xi's two-hour speech during the opening session of the CCP National Congress on October 16 made note of the fact that he mentioned the "economy" 22 times, versus 102 times at the 18th party congress in 2012, when he became CCP general secretary. The "market" was said just three times compared to 24 a decade ago, while "security" rose from 36 to 50 references.

Previous annual growth rates in China underpinned the economic forecast that justified the original 2035 target, but Beijing also faces more immediate policy decisions ahead, said political scientist Philip Hsu, a visiting fellow at the Brookings Institution. "Apparently China's economy is not in good shape and is likely to remain so perhaps at least until the second half of next year. I think this is among the main reasons why the target of doubled national GDP by 2035 is no longer mentioned in the work report this time," he told Newsweek.

"The delay in releasing the Q3 data, which can be expected to look mediocre at best, is probably an attempt to avert disgracing the party congress," said Hsu, who is also a professor of political science and the director of the Center for China Studies at National Taiwan University. "My guess is that both Xi and [Chinese Premier] Li Keqiang understand that as far as the most crucial problem of economic slowdown—structural pathology of the property sector—remains unresolved sufficiently, it'll be difficult to return to the growth rate of years ago," he said.

"The policy of zero COVID adds to, but is not the leading factor of, the slowdown. Rapidly declining consumption and investment that result chiefly from the zero-COVID policy are relatively easy to bounce back from once the policy is relaxed to a certain extent," he said.

"But of course Xi's assertion in the party congress that the zero-COVID policy is to be continued cannot be trivialized. Whereas local governments have attempted various measures to inject credit into the property sector, confidence and price have not improved much, and it is questionable for how long the injection can be sustained given the rapidly growing local debts almost everywhere in China," Hsu noted.

China's Semiconductor Uncertainty

Separately, Beijing also has yet to formulate a policy response to the U.S. Commerce Department's October 7 announcement of semiconductor export restrictions to China, a blacklist that cuts off Chinese firms from high-end American chip-making technology.

Jake Sullivan, the national security adviser to President Joe Biden, said the restrictions were "premised on straightforward national security concerns.

"These technologies are used to develop and field advanced military systems including weapons of mass destruction, hypersonic missiles, autonomous systems and mass surveillance," he told an audience at Georgetown University on October 13.

The long-term impact of the sanctions could be hard to accurately predict. At the very least, observers said they foresaw an effective kneecapping of China's leading chip-makers, which were no longer allowed access to any components or software of U.S. origin or featuring American involvement.

Unique to the latest round of export controls was its impact not only on hardware, but on human capital, too. U.S. citizens or green card holders must apply for a Commerce Department license in order to work for Chinese chip manufacturers, or face prosecution.

The restrictions were expected to cause an exodus of U.S. talent from an industry key to

China's long-term ambitions to lead in science and technology. Beijing warned high-tech decoupling would hit American businesses just as hard.

Chinese companies were able to circumvent weaker U.S. restrictions in the past. "However, the stronger sanctions are bound to greatly impact and delay China's advanced semiconductor manufacturing," Lin said. Beijing has few good options. With its progress in high-end chip-making stalled, the Chinese government would in all probability seek to enlarge its market share of mature equipment, continue to pour massive state subsidies into its semiconductor industry and seek talent from elsewhere, including Taiwan, she said.

"To what degree these coping strategies will mitigate the impacts from U.S. restrictions appears quite uncertain to me," said Hsu. "The key issue is probably not whether China will, but how soon China can overcome the restrictions and achieve what it desires technologically.

"The U.S. restriction will influence immensely China's military power and economic prowess. A wide spectrum of China's domestic industries, beyond AI, EV, robotics, and 5G, will be debilitated. At the same time, many U.S. firms still in heavy transactions with Chinese firms will be much impacted as well," he said.

When Beijing finally released the delayed GDP data on October 24, it showed third-quarter growth of 3.9 percent, an increase of 0.4 percent from the previous quarter. It placed China's year-on-year growth at 3 percent, well short of its publicly stated 2022 target of 5.5 percent annual growth in GDP.

Although the results actually outpaced some economic forecasts, the fiscal data did little to shore up investor confidence. Chinese and Hong Kong stock indexes dove sharply the same Monday morning the data was released, ending the day at some of their lowest values in over a decade.

It was no coincidence that the rout followed the CCP's confirmation the day before that delegates had unanimously reelected Xi for a norm-breaking third five-year term. Having packed the party's top leadership positions with loyal technocrats, China's leader now wields more power over the country than any figure since founding father Mao Zedong.

This story was updated 11/1, 8:00 p.m.

About the writer

John Feng is Newsweek's contributing editor for Asia based in Taichung, Taiwan. His focus is on East Asian politics. He ... Read more