The middle class might not have to bend over and kiss its ass goodbye after all.

Two events at the end of May point the way to a more equitable future—as in, a future that's good for a broad swath of society, not just the tiny slice that can blow $55,000 on a Louis Vuitton City Steamer alligator bag.

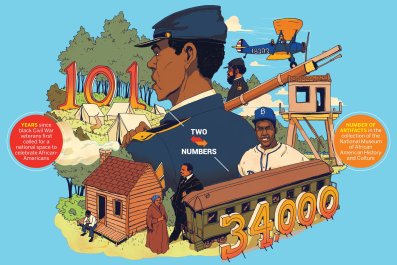

Those events are a crazy blockchain apparatus called the DAO raising $125 million, and the U.S. government adopting a new set of rules that will make it easier for almost anyone to buy equity in private companies.

Both might take a while to have a serious impact, yet both are about something really big: the democratization of capital. If you play that out, the movement will take power from the hands of Wall Street, hedge funds and venture capital companies and make it more likely that the middle class will share in the successes of the networked economy. That would be a lot better outcome than some of the predictions that say software and robots will punt 95 percent of the population out of meaningful work.

DAO: Arcane and maybe illegal

So let's start with the weird one: the DAO. The initials stand for "distributed autonomous organization." The basic code was built by a German programmer named Christoph Jentzsch, but once the DAO was set free on the internet, it became something of a self-actualized robot venture capital operation. Within two weeks, the investment fund raised $125 million from people all over the globe.

Boil it down, and the DAO is supposed to work like this: Anyone can put money into the fund, all the investors get to vote on which startups the DAO finances, and software-defined contracts autonomously track the performance of the companies and manage the fund. If a funded company succeeds, the software directs the proceeds back to the fund's investors. In other words, the whole thing works much like a venture capital outfit, except that investors in the fund don't have to be rich people or institutions like Harvard's endowment, and there is no VC in charge.

The DAO is like a test flight—most normal people would look at that contraption and sit this one out. First of all, it doesn't take real money. It is built on a digital currency called Ether, which is even more arcane and hard to get than bitcoin. And in many countries, including the U.S., the whole scheme might be illegal. "The list of technical hurdles goes on and on," wrote author and Wired founder Kevin Kelly in a Facebook post. He called the $125 million raised "pure speculation." Yet, Kelly said, "it does seem like the natural extension of social media and the inevitable decentralization of everything, so I am trying to buy a few Ether to see what happens."

Whatever becomes of the DAO, the concept and the technology behind it will not go away. It will only improve. And while this is a test flight, eventually these things will be relatively safe for all of us, and that could completely change capital markets and the way wealth gets distributed.

Crowdfunded equity

If the DAO seems like too much of a financial LSD trip, let's get a little more grounded. The new investment rules adopted by the Securities and Exchange Commission are a here-and-now version of the DAO's concept.

The rules allow private companies to get financed through crowdfunding and in exchange give equity to the investors. In the past, if you invested in a company on Kickstarter, for instance, in return you could receive only early access to the company's products or maybe a logoed coffee mug. If a startup wanted to offer equity, investors had to be accredited—which meant they had to have an annual income of at least $200,000 or a net worth of at least $1 million.

The old rules ensured that the rich had get-richer tools that were kept away from the rest of us because we allegedly didn't know how to use them safely.

Already, new kinds of crowdfunding sites are popping up to take advantage of the new rules—sites such as SeedInvest, FlashFunders and Wefunder. The home page of Wefunder gets right to the point: "Break the monopoly of the rich," it announces. "The wealthy enjoyed a government-protected monopoly on investing in high-growth startups. Everyone now has the right to invest in what they care about and believe in." Listings on the site range from a fiber-optic company to my favorite, Rodeo Donut. Tagline: "Gourmet donuts served with fried chicken and whiskey."

A company like Rodeo Donut makes another point about why these developments are so important. Yes, democratic crowdfunding and DAO-style mechanisms give more individuals a way to get a share of the economy. But this also means that it should become easier for tiny niche companies to raise money and get started. "It's going to really make a difference for businesses that are not especially fashionable for professional investors," James Dowd, CEO of North Capital Private Securities, told The New York Times. "You don't see a lot of capital flow into ordinary consumer and retail businesses."

This is key if we don't want to devolve into an economy of a few lords and a whole lot of serfs. As traditional middle-class jobs are disappearing, we're being told that the best career path is to be a kind of personal enterprise—some lifelong mix of entrepreneur, contractor and investor. If that's going to happen, the world will need mechanisms that let capital flow among and through a few billion people, not just an elite few million.

Naysayers throw around warnings that average folks don't know enough to get involved in private-company investing. They say that mechanisms like DAO or Wefunder are setups that will result in millions of common people losing their shirts.

But apparently software and robots are otherwise going to render us worthless. At least democratized capital gives the middle class a fighting chance. It also helps ensure a business can exist that serves up donuts with fried chicken and whiskey, and that is certainly a worthy goal for society.