Donald Trump is reiterating his promise that as president he would usher in an "American economic revival," ending the malaise that has gripped the country since the financial crisis of the past decade. But his economic plans are underpinned by an assumption about human behavior that many economists say is unrealistic, and if he's wrong his proposals could be a fiscal disaster.

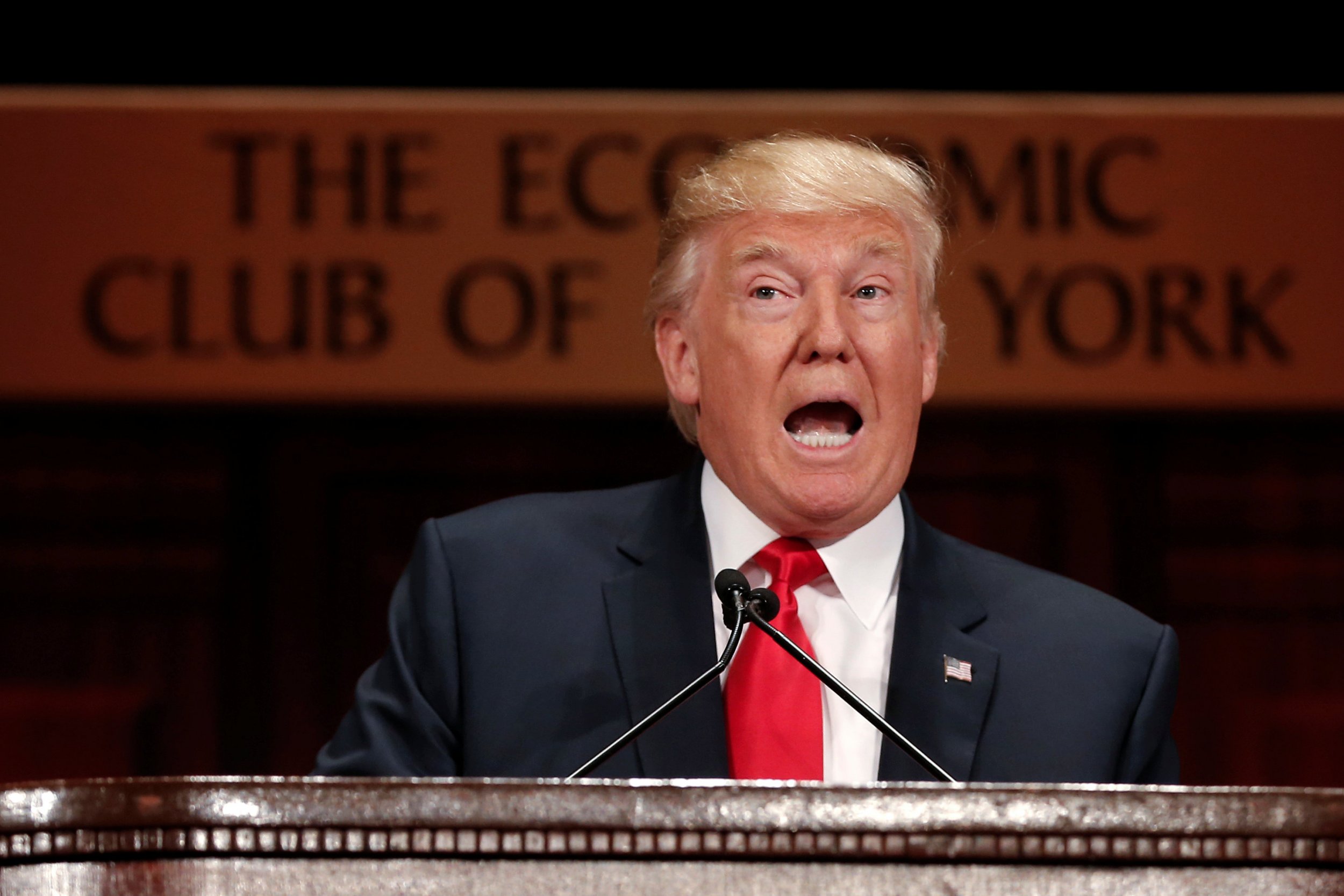

Before an audience at the New York Economic Club on Thursday, the Republican presidential nominee asserted that he will be able to slash corporate and income taxes, particularly for working- and middle-class Americans, a move that would reduce federal tax revenue by an estimated $4.4 trillion. Trump maintained a big chunk of that loss would be made up because the lower tax rates would motivate American businesses to invest more money and hire more people. And that spending in turn would increase the amount of taxes coming in from companies and workers. The idea is basically the economic equivalent of having your cake and eating it too—lower taxes, without having to cut big government spending programs like Social Security or Medicare.

Trump explained it this way: "Over the next 10 years, our economic team estimates that under our plan the economy will average 3.5 percent growth and create a total of 25 million new jobs." And "this growth means that our jobs plan...will be completely paid-for in combination with proposed budget savings." He predicted his plan could recoup $1.8 trillion in savings from "trade, energy and regulation reform" and another $800 billion from what he called a "Penny Plan" that would reduce "non-defense, non-safety-net spending by 1 percent of the previous year's total each year." But that still leaves a $1.8 trillion gap.

Trump assumes that will be covered as Americans respond to the changes in their tax rates. But his "dynamic scoring model," as it's called, is based on the presumption that people always put their economic well-being first and foremost in their decision-making, says Louise Sheiner, a senior fellow in economic studies at the Brookings Institution. Meanwhile, "in the real world, they don't even know their marginal tax rate," she says. In other words, economic research shows people just "don't respond that much in their behavior to the changes in the incentives." Thus, while tax cuts would trigger some growth, it would not likely be nearly as much as the Trump model suggests.

That is backed up by analysis conducted by the nonpartisan Congressional Budget Office and Joint Committee on Taxation, which calculate the costs of proposed legislation. Numerous critics of dynamic scoring have pointed out that those widely used studies haven't found anywhere near the same economic impacts as some conservative analysts have claimed.

Of course, this is the source of a decades-long debate between conservative supply-side economists and their liberal critics. Conservatives point back to the 1980s and even before then to show that the country has been able to spur growth of 3 percent and even 4 percent or more. But Marc Goldwein, senior vice president of the centrist think tank Center for a Responsible Federal Budget, says there's been only one recent 10-year period "where we did get consistent growth around 3.5 percent." That was in the 1990s, when two specific dynamics were at play. First, the United States experienced a technology boom, which sped up productivity. At the same time, a generation of Baby Boomers were in their 40s and 50s, an age range when employees tend to be most productive, economists say. "Now they're retiring, and...increasingly each year fewer and fewer of them are working at all," Goldwein says.

Demographic changes of that kind are not exactly something the government can control or wave a magic wand and re-create. In other words, it would be very difficult, if not impossible, for Trump to replicate the results—and thus pay for his tax cuts.

Uncommon Knowledge

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

About the writer

Emily spearheads Newsweek's day-to-day coverage of politics from Washington, D.C. She has been covering U.S. politics, Congress and foreign affairs ... Read more