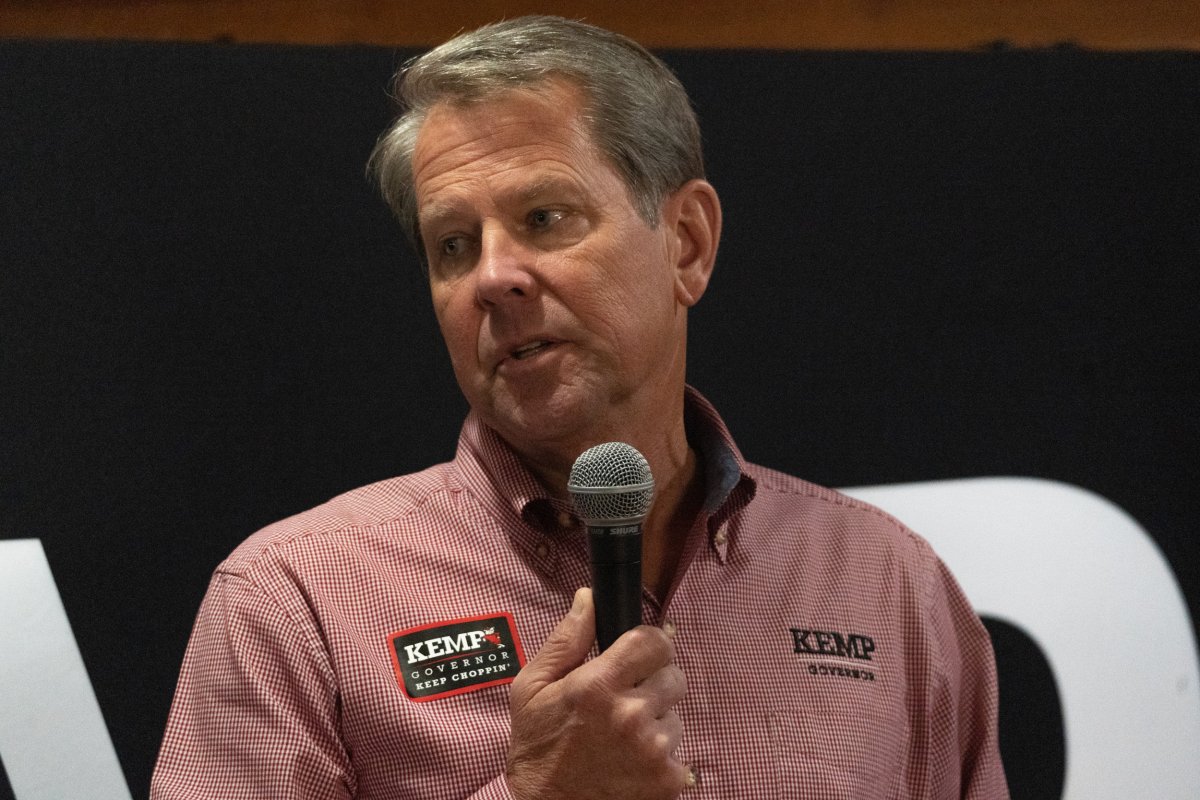

Georgia Governor Brian Kemp approved legislation that could lead to millions less in taxes that residents of the state will have to pay.

The tax rate in the state of more than 11 million residents will fall from 5.75 percent to 5.39 percent, the governor's office said in a statement. The new rate will take effect in 2025 for returns filed for the 2024 tax year.

The reduced taxes means that Georgians will be paying a total of an estimated $1.1 billion less in taxes for the year, the governor's office said, citing the state's budget office for the estimate. Over the next decade, residents in the state will pay $3 billion less in taxes.

Read more: 7% Interest Savings Account Rates

"As a result of conservative budgeting and our pro-growth, business friendly environment, billions of more dollars will now be kept in the pockets of hardworking Georgians rather than being devoted to creating more government bureaucracy and red tape," Kemp said in a statement.

The governor also signed into law legislation approved by lawmakers that will lower the corporate income tax to 5.39 percent from 5.75 percent for the 2024 year, which his office said was "matching the corporate income tax rate to the individual income tax rate for the corresponding year - furthering our state's commitment to maintaining a business friendly environment that creates good paying jobs throughout the state for hardworking Georgians."

There were other proposed tax changes in the state. Kemp signed into law a variety of legislation that promised to change the way the state taxes its residents.

For example, the governor's office also said Kemp approved regulations that if approved by the state's voters in a constitutional amendment, will allow local governments to institute a "statewide homestead valuation freeze."

"[This] limits the appreciation of property values to the inflation rate," the governor's office said. "[It] also provides for a special local option sales tax for counties and municipalities to provide for property tax relief."

Another rule change that Kemp approved related to the state's income tax dependent exemption, which was increased by 33 percent to "allow residents to deduct $4,000 per dependent rather than the current $3,000 per dependent."

Read more: Where to Park Your Refund: CD vs. High-Yield Savings Account

Georgia will also expand the criteria for how a property can designated as historic.

"[This] extends the sunsets for the tax credits for rehabilitation of historic homes and structures to December 31, 2029, and for the tax credits for rural zone revitalization to December 31, 2032," the statement from the governor's office said.

Uncommon Knowledge

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

About the writer

Omar Mohammed is a Newsweek reporter based in the Greater Boston area. His focus is reporting on the Economy and ... Read more

To read how Newsweek uses AI as a newsroom tool, Click here.