Five years after the Panama Papers, the Pandora Papers have provided us with more evidence of the elaborate mechanisms that many rich and powerful people use and abuse to avoid paying taxes. Embarrassingly, these latest investigative reports reveal how the U.S. acts as a tax haven for foreign entities and individuals to illegally hide money from tax authorities, enabling tax evasion.

Thanks to the work of investigative journalists, we now know that there are numerous U.S.-based trusts sheltering more than $1 billion in combined assets linked to foreign countries and individuals accused of wrongdoing. More than 200 U.S. trusts have been identified in the Pandora Papers, with 81 trusts alone located in South Dakota and several more in Florida, Delaware, Texas and Nevada. Trusts are flexible financial accounts often used to pass inheritance on to heirs. It is clear that many wealthy individuals are using these trusts to shield a variety of assets from regulation, oversight and tax collectors. The trust companies themselves take in large fees.

By turning a blind eye to tax evasion at home and abroad, the United States is enabling the rich and powerful of the world to engage in corrupt and unfair practices.

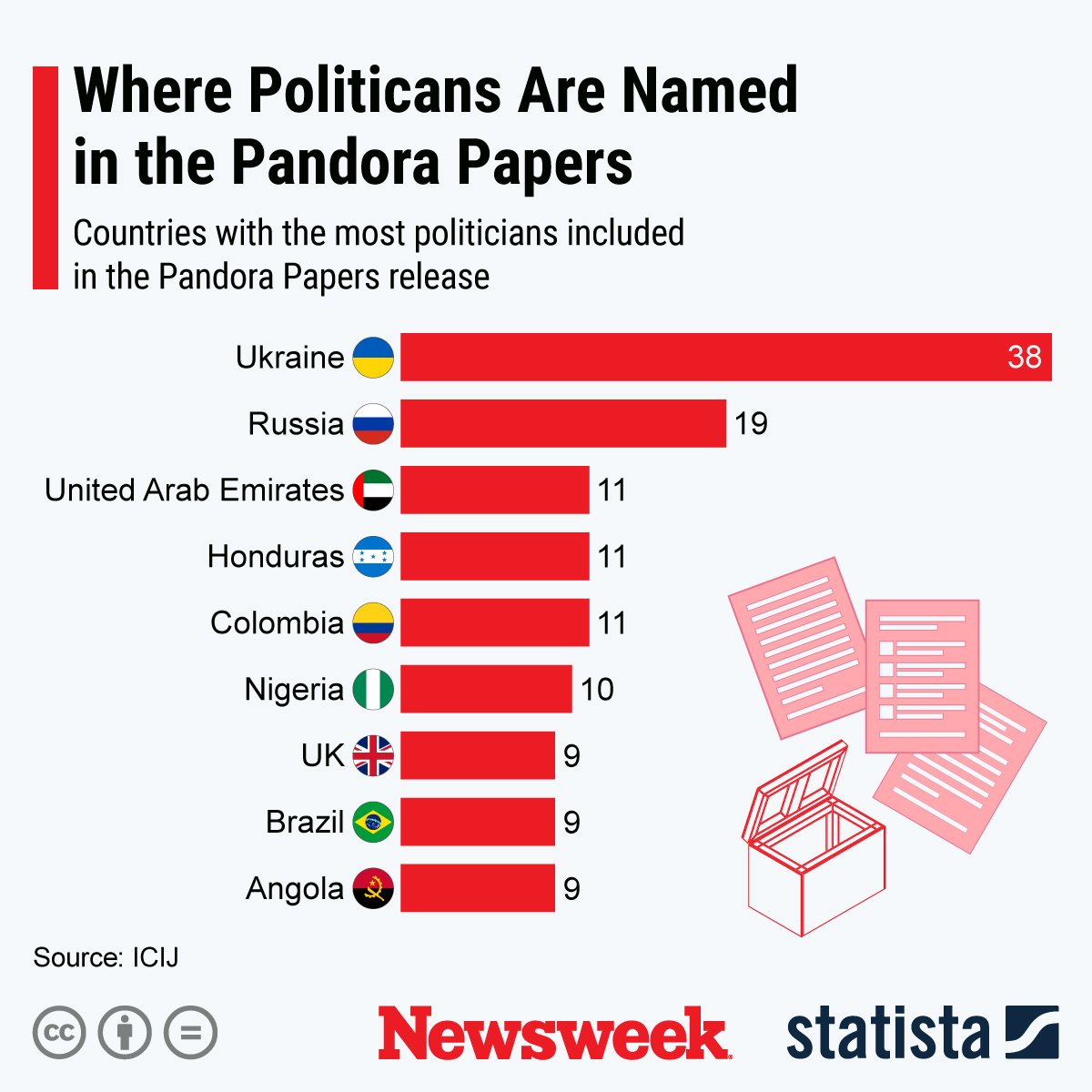

Tax evasion in Latin America has led to hundreds of billions of dollars of lost public revenue annually ($325 billion in 2018 alone, according to recent UN estimates). Three acting Presidents in Latin America—Chile's Sebastián Piñera, the Dominican Republic's Luis Abinader and Ecuador's Guillermo Lasso—have been exposed by the Pandora Papers.

As a result, the Latin America region, one of the most unequal in the world, is being deprived of critical resources that could create jobs and foster economic growth. Ordinary citizens are being robbed of tax revenues that could be invested in public services and infrastructure, or social welfare and poverty reduction programs—the precise type of investments that are needed to create more stabilization in the region.

Throughout our history, U.S. policies have exacerbated problems in Central and Latin America. Supporting tax havens that siphon needed resources from the people in this region renews an ugly legacy. And while the Pandora Papers expose a massive web of potential conflicts, crimes, and ethics violations, we can take immediate action to support Latin American peoples in their efforts to hold their leaders accountable.

Ecuador is a nation that has made significant strides in fighting tax evasion. In 2017, Ecuador revived a historic demand of developing countries and called for the creation of a UN intergovernmental tax body, which would be dedicated specifically to fighting these very types of illicit cash flows that disproportionately hurt lower-income nations. That same year, Ecuador also led a pioneering initiative to fight back against just this type of tax dodging. The government held a referendum in which Ecuadorians overwhelmingly voted in favor of banning holders of elected office as well as any others public officials from having assets in tax havens. Ecuadorians understood that fighting tax evasion was a cornerstone of state-building and democracy.

Now, following the Pandora revelations, Ecuador's legislators are looking into the financial dealings of the country's own president. President Guillermo Lasso had, as of 2017, 14 offshore companies and trusts in Panama as well as in Delaware and South Dakota—potentially in violation of the people's referendum. A high profile Ecuadorian congressional investigation into President Lasso's financial dealings is currently underway.

The United States can help. The Biden administration, State Department, the U.S. Treasury and the IRS should cooperate with Ecuador's Congressional investigation and share any information that can shed light on what assets linked to Lasso remain in U.S.-based tax shelters.

It is concerning that Secretary of State Antony Blinken held a recent meeting with President Lasso that could be perceived as a sign of U.S. support for the embattled head of state, even as he faces a Congressional inquiry for potential tax evasion at home.

Going forward, the United States must make clear that we do not tolerate unlawful tax dodging in Ecuador or in any other part of the world. The United States should not be complicit in unlawful acts that steal resources from people in need.

Support for democracy and economic development in our hemisphere requires us to do everything in our power to prevent economic and political elites at home and abroad from dodging taxes and hiding their assets in our country and others. The Pandora Papers has brought to the forefront an entrenched and shadow financial system catered to the powerful and elite. Now is the time to reign it in.

Raúl M. Grijalva is a U.S. congressman. He represents Arizona's 3rd congressional district.

The views in this article are the writer's own.

Uncommon Knowledge

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

About the writer

To read how Newsweek uses AI as a newsroom tool, Click here.