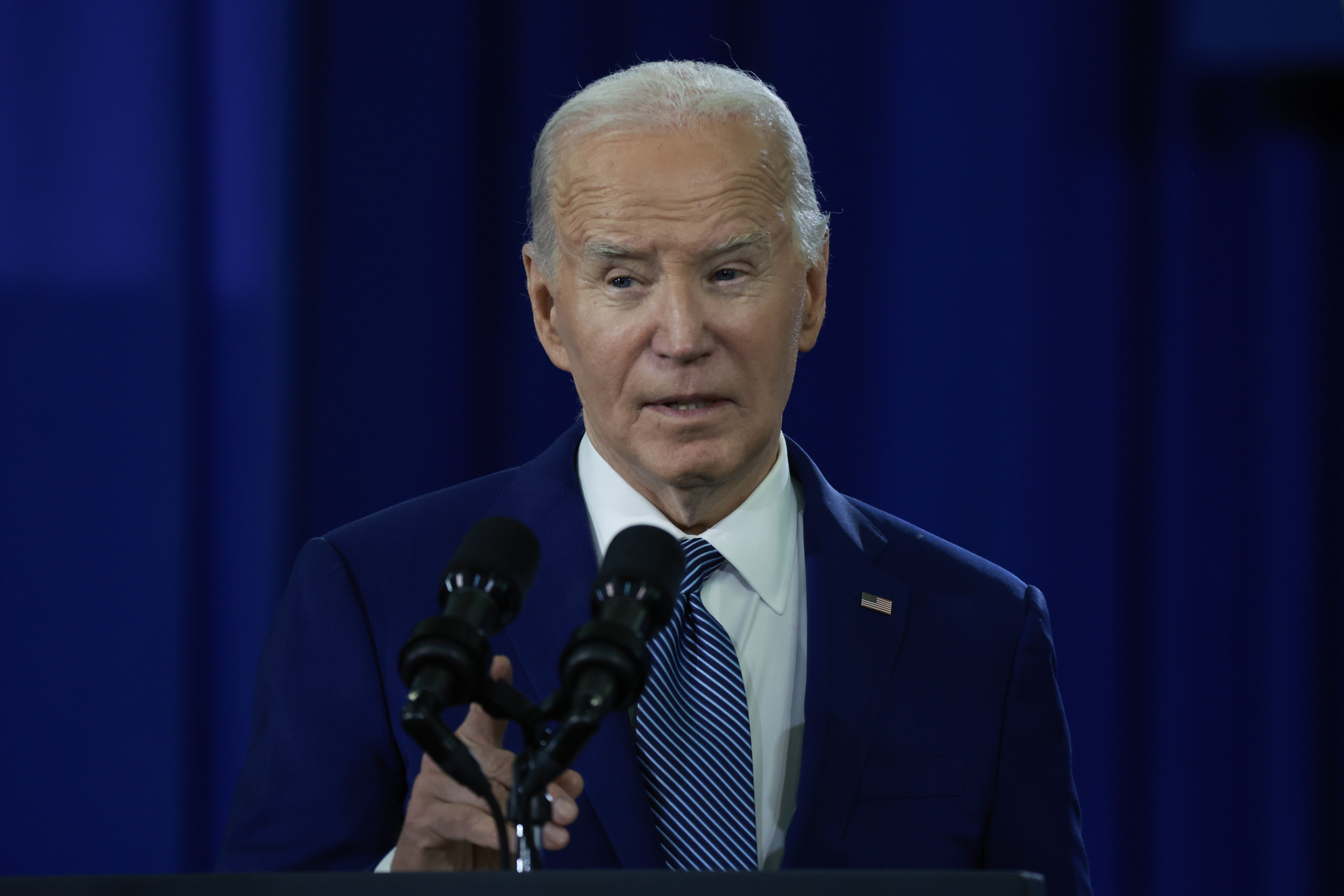

President Joe Biden received bad news on the economy just before his visit to Scranton, Pennsylvania, on Tuesday.

Federal Reserve Chairman Jerome Powell said that inflation has struggled to progress towards the central bank's target band and that policymakers need more "confidence" that inflation was cooling before they can lower interest rates. A delay in rate cuts could be a blow to Biden as it suggests that borrowing costs are likely to stay higher for longer, stifling areas of the economy like the housing market.

Housing economists have suggested that housing affordability is becoming an election issue for voters. A March survey by real estate platform Redfin revealed that more than half of voters say the issue may affect who they vote for.

"Housing affordability is top of mind for voters because elevated mortgage rates and home prices, along with an acute housing shortage, have pushed the dream of homeownership out of reach for many Americans," Daryl Fairweather, Redfin's chief economist, said in a note published on the platform's website.

Powell made his remarks at a think tank in Washington, D.C., slightly earlier than Biden who was in Scranton, Pennsylvania, where he spoke about his tax plans and views about the economy.

The Fed chair pointed out that the U.S. economy had shown resilience and has grown while employers continue to add jobs amid an environment of tight monetary conditions. But he warned that inflation has proven stubborn to cool down to the 2 percent central bank target. In March, the Consumer Price Index (CPI) inflation came in at 3.5 percent, higher than the previous month's readings.

"The recent data has clearly not given us greater confidence and instead indicate that it's likely to take longer than expected to achieve that confidence," Powell said. "Right now, given the strength of the labor market and progress on inflation so far, it's appropriate to allow restrictive policy further time to work and let the data and the evolving outlook guide us. Come what may, we remain strongly committed to returning inflation over time, sustainably to 2 percent."

Analysts took Powell's comments to mean that borrowing costs are likely to stay elevated.

"He essentially underscored that the downward trajectory of inflation has essentially stalled," Quincy Krosby, chief global strategist for LPL Financial, said in a note shared with Newsweek. "He made it clear—rather than his more ambiguous stance regarding a rate easing timetable—that the 'higher for longer' narrative remains intact."

Biden's Latest Economic Plan

Later on Tuesday, Biden spoke about his ideas for the economy that he thinks will build the middle class from the ground up. He said he wanted to introduce a plan to tax billionaires and include a tax credit for homebuyers.

"My plan calls for a minimum federal income tax of 25 percent—just 25 percent—on billionaires," he said. "That would raise $500 billion over the next 10 years."

He suggested that the money could be used to help fund things like childcare, which could help improve economic growth, but housing costs are also top of mind for voters. In the February Redfin survey, more than 64 percent of those polled said elevated housing costs make them think negatively about the economy.

The President said his economic plan also includes trying to help households with homebuying costs.

"We got a lot more work to do. The cost of housing is so important. I want to provide families...with $10,000 tax credit to help their first home or trade up for a little more space. It's important and by the way, it'll grow the economy," Biden said.

The Fed's elevated rates—which at their current 5.25 to 5.5 percent range are at their highest in more than two decades—are contributing to high housing costs.

Higher borrowing costs have helped make home loans expensive and made it challenging for prospective buyers to afford a home, something the Biden Administration has tried to tackle. Those prolonging elevated rates may also stifle business investments.

Newsweek contacted the Biden campaign for comment via email on Tuesday.

Uncommon Knowledge

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

About the writer

Omar Mohammed is a Newsweek reporter based in the Greater Boston area. His focus is reporting on the Economy and ... Read more

To read how Newsweek uses AI as a newsroom tool, Click here.