The moment I wrote the final check to clear my student loans after completing my master's program is one I'll never forget. It took nearly nine years of strict budgeting to eliminate over $100,000 in student debt while working as a public servant. While I felt relieved to be debt-free, I couldn't shake the unease caused by the exorbitant cost of tuition.

Despite being my choice, the staggering expenses of higher education in the United States pose significant challenges for those of us who are self-reliant. Fortunately, my master's program constituted my sole student debt. During my undergraduate years, I relied on part-time jobs and ROTC support to cover most expenses. Back then, the cost of a state university education was far more reasonable than it is today. Since my graduate studies, however, my military service has entitled me to Post-9/11 GI Bill benefits, covering tuition, housing, and book costs for future academic pursuits.

Given these experiences, I believe the United States should seriously consider implementing a student loan debt forgiveness program modeled after the Post-9/11 GI Bill for those students who work in the public sector following their academic studies.

According to Forbes, the average amount of student loan debt carried by American students who need to borrow is almost $30,000. This figure reflects the broader challenge many Americans face in managing education-related debt.

Education is undeniably a public good, yet as states have shifted resources away from funding higher education, the burden of cost has increasingly fallen on individuals. This trend overlooks a fundamental principle: an educated populace is vital for ensuring America's competitiveness in an ever-evolving global landscape. As education expert Marc Tucker aptly notes, "We now have the worst-educated workforce in the industrialized world." This raises serious concerns about America's ability to compete effectively over the long term. Despite relatively higher wages in the U.S., sustained competitiveness hinges on more substantial investment in our workforce. Without adequate support for education and skills development, America risks falling behind in key areas crucial for economic growth and innovation.

While recent changes to student loan debt forgiveness programs are commendable, they represent only a partial solution. It's imperative that we not only expand existing programs but integrate them with opportunities for public service. Any comprehensive expansion of student loan forgiveness should include full forgiveness for individuals pursuing careers in public service.

If a borrower commits to serving in the Armed Forces, AmeriCorps, the Peace Corps, or other professions aimed at enhancing the public good (such as teachers, nurses, medical care workers, police officers, or fire fighters), they should be eligible for complete debt forgiveness, without having to first make payments over 10 years, which the Public Service Loan Forgiveness program currently requires. This payment requirement is unduly burdensome, especially for those dedicated to public service. It's crucial to streamline this process and ensure that individuals can embark on meaningful public service without being encumbered by student loan debt for an unreasonably long period.

Following a model akin to the Post-9/11 GI Bill, we could implement a system where individuals with existing student loan debt receive varying levels of forgiveness based on their commitment to qualifying public service. This approach would acknowledge and reward individuals who choose to serve their communities or country while also grappling with the financial burden of student loans. For example, someone who commits to a certain period of service in a recognized public service profession could become eligible for incremental levels of loan forgiveness. Like the GI Bill's structure, those who fulfill longer service obligations could receive greater levels of debt relief. This approach not only addresses the pressing issue of student loan debt but also incentivizes civic engagement and public service, fostering a culture of giving back to society.

Intertwining student loan forgiveness with public service presents a promising way to address the dual challenges of educational debt and societal needs. By adopting a model akin to the Post-9/11 GI Bill, we can incentivize individuals to pursue careers in public service while alleviating the financial burdens associated with higher education. Such an approach not only empowers individuals to contribute meaningfully to their communities and country but also fosters a sense of duty and civic engagement. It represents a tangible step towards realizing our aspirations for a more equitable society. Through collective action and thoughtful policy design, we can forge a path towards a brighter future where education is accessible, service is valued, and opportunity is within reach for all.

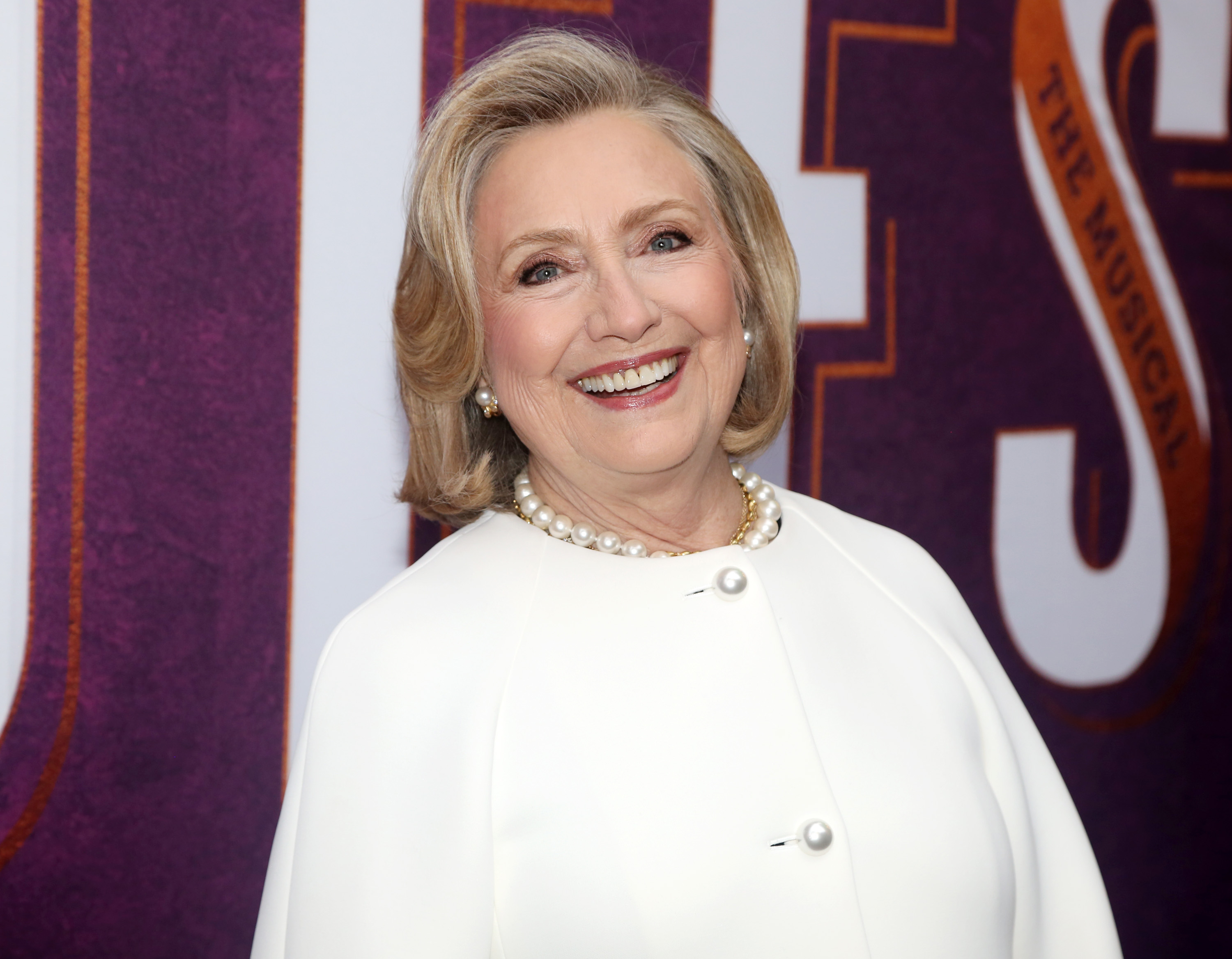

Jeffrey Roth is the best-selling author of Fires, Floods, and Taxicabs, and a long-serving member of the Army National Guard.

The views expressed in this article are the writer's own.

Uncommon Knowledge

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

About the writer

To read how Newsweek uses AI as a newsroom tool, Click here.