This article originally appeared on The Motley Fool.

It's time for roughly 150 million adults to start thinking about preparing their taxes for the 2016 calendar year.

According to a recent estimate from the Internal Revenue Service (IRS), taxpayers spent 8.9 billion hours complying with federal taxes during 2016, or the equivalent of nearly 13,000 lifetimes. Yet we as taxpayers soldier on because, for many of us, there's a pot of gold at the end of the rainbow in the form of a federal refund. Although a refund isn't necessarily optimal since it means you've lent the government money, without interest, for a period of months or even over a year, a majority of taxpayers do wind up receiving money back from Uncle Sam.

America's most common tax bracket

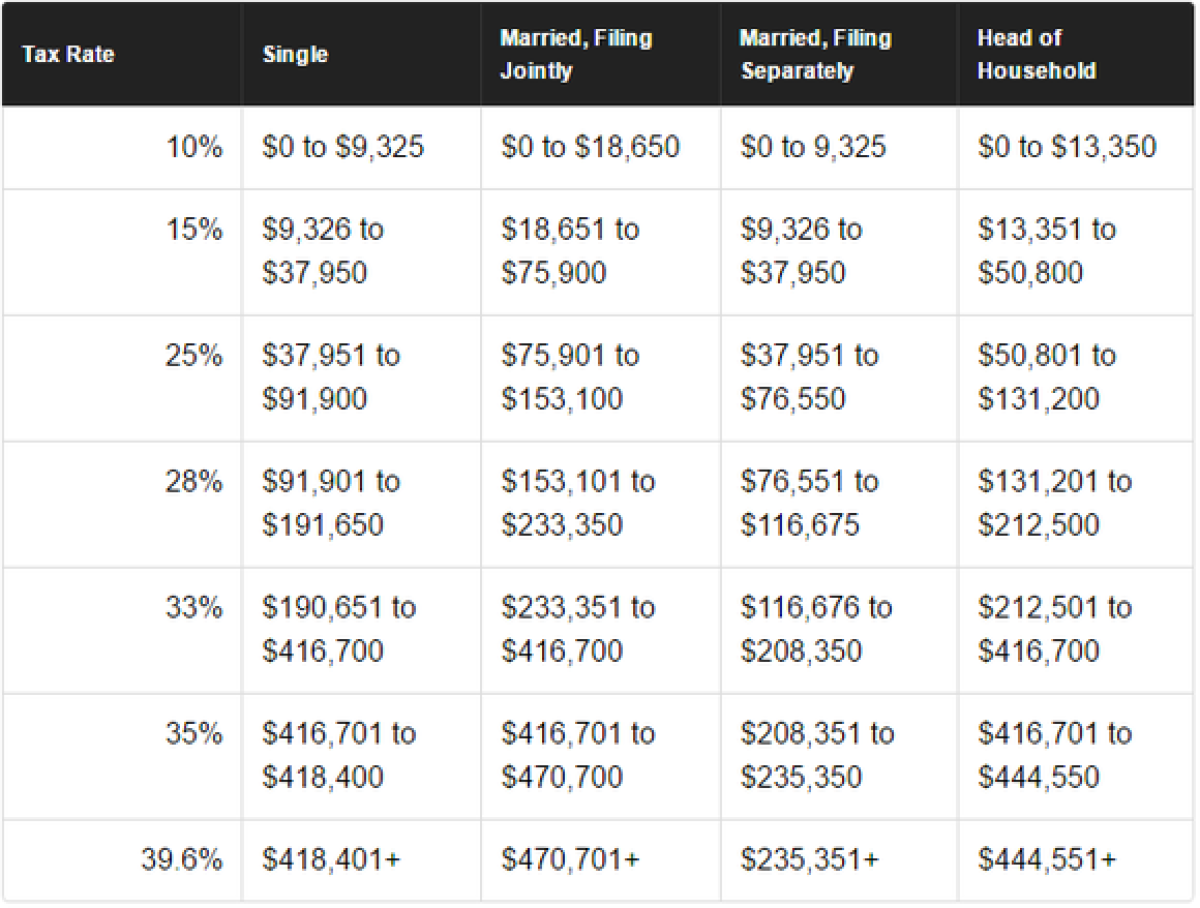

Of course, what we wind up paying in taxes comes down to what ordinary income tax bracket we fall into. The higher your income, oftentimes the more you'll owe the IRS, assuming you don't have a bevy of tax credits and deductions to fall back onto.

The income tax schedule for taxpayers has seven brackets, ranging from a low ordinary tax rate of 10 percent to a peak ordinary tax rate of 39.6 percent. Here you can see how the income ranges shake out for the various types of filing statuses:

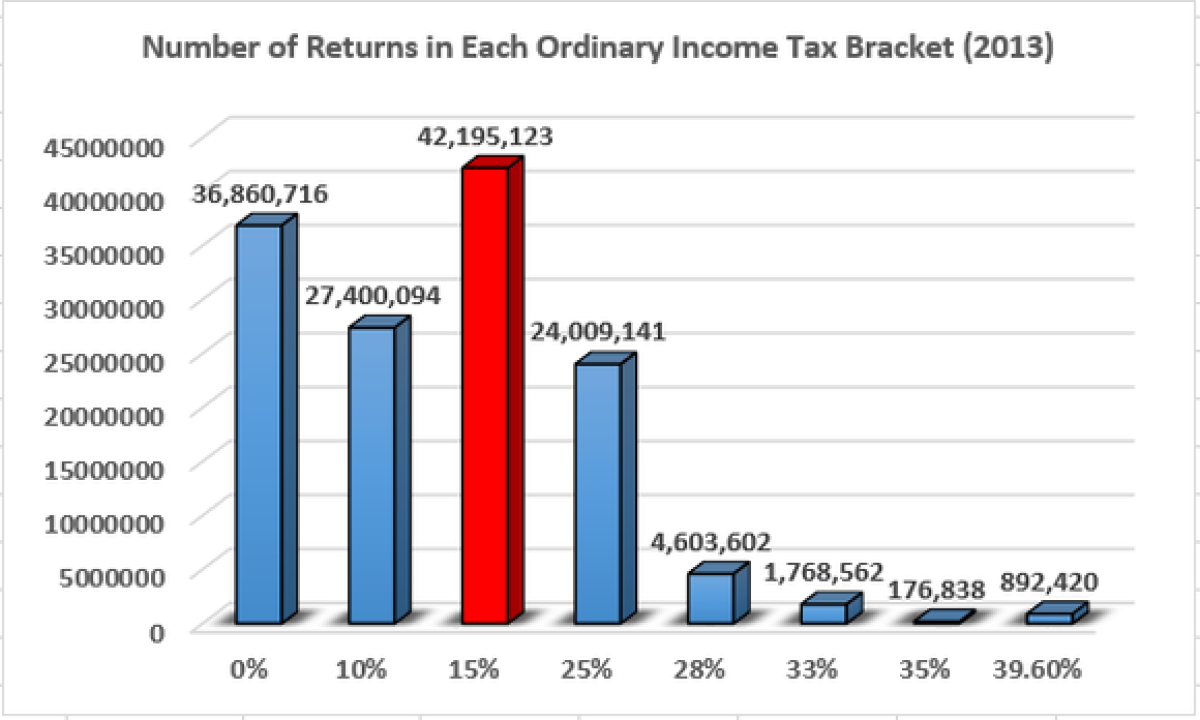

But have you ever wondered which tax bracket out of these seven, assuming you have taxable income, is the most common? Thanks to IRS data from 2013, and a little aggregation from the Tax Foundation, we can answer that question.

Nearly 42.2 million taxpayers had a peak marginal tax bracket of 15 percent in 2013, meaning (based on the income ranges from 2013) the most popular tax range had single individuals with adjusted gross incomes of between $8,925 and $36,250, or joint filers between $17,850 and $72,500.

What might be surprising is that the often left out 0% tax bracket came in a very close second, with nearly 36.9 million tax filers. These individuals and joint filers were able to get their income down to zero thanks to tax credits and deductions. In particular, the Earned Income Tax Credit is a valuable tool for lower-income working Americans, and it's easily the most overlooked credit. The IRS estimates that roughly 25 percent of taxpayers eligible for the EITC fail to claim it, either because the rules are too complicated, or they're unaware they qualify because they have zero taxable income and fail to file a tax return.

In total, 77 percent of American households, per the Tax Foundation, fall into the 15 percent tax bracket or lower, yet, according to the Tax Policy Center, the top 20 percent of income earners are responsible for paying 69 percent of all federal income taxes.

Trump could shake things up

However, big changes could be waiting in the wings for taxpayers in the coming months. As Donald Trump takes the Oval Office, taxpayers prepare for what could be a major shakeup to the seven-bracket tax schedule.

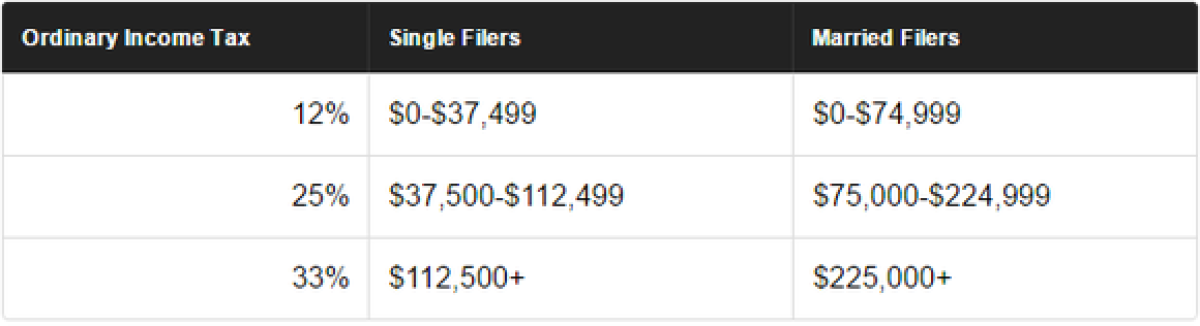

According to Trump's campaign website, he plans to simplify the current tax schedule to just three brackets, as shown below:

One of the more interesting aspects of this tax proposal is that it was revised in August 2016 to the 12%/25%/33% proposal we see now from Trump's original four-tier approach of 0%/10%/20%/25%. Why the change? Trump is eager to see individual income taxes cut for a majority of Americans, so he adopted the 12%/25%/33%, three-tier proposal offered previously by House Republicans. If the president and House are on the same page, it's simply a matter of getting the Senate on board to enact individual income tax reform. This still doesn't guarantee that reforms are coming, but it presumably improves the chances of tax reforms passing.

Furthermore, Trump has plans to do away with the laundry list of exemptions taxpayers currently enjoy. With the exception of the mortgage interest deduction and charitable giving deduction, Trump would essentially eliminate itemized deductions and simply fatten the standard deduction in return. In 2017, the standard deduction for single filers and joint filers is $6,350 and $12,700, respectively. If Trump gets his way, the standard deduction for single filers would vault to $15,000, and it would leap to $30,000 for joint filers.

If everything were to more or less remain equal to the data released from the IRS in 2013, roughly three-quarters of all taxpayers, if not more, would fall into the lowest tier (12%) under Trump's proposal.

All working Americans should be paying close attention to the tax discussion likely to come out Washington in the next few months as it'll undoubtedly have a bearing on your wallet.

Uncommon Knowledge

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

About the writer

To read how Newsweek uses AI as a newsroom tool, Click here.