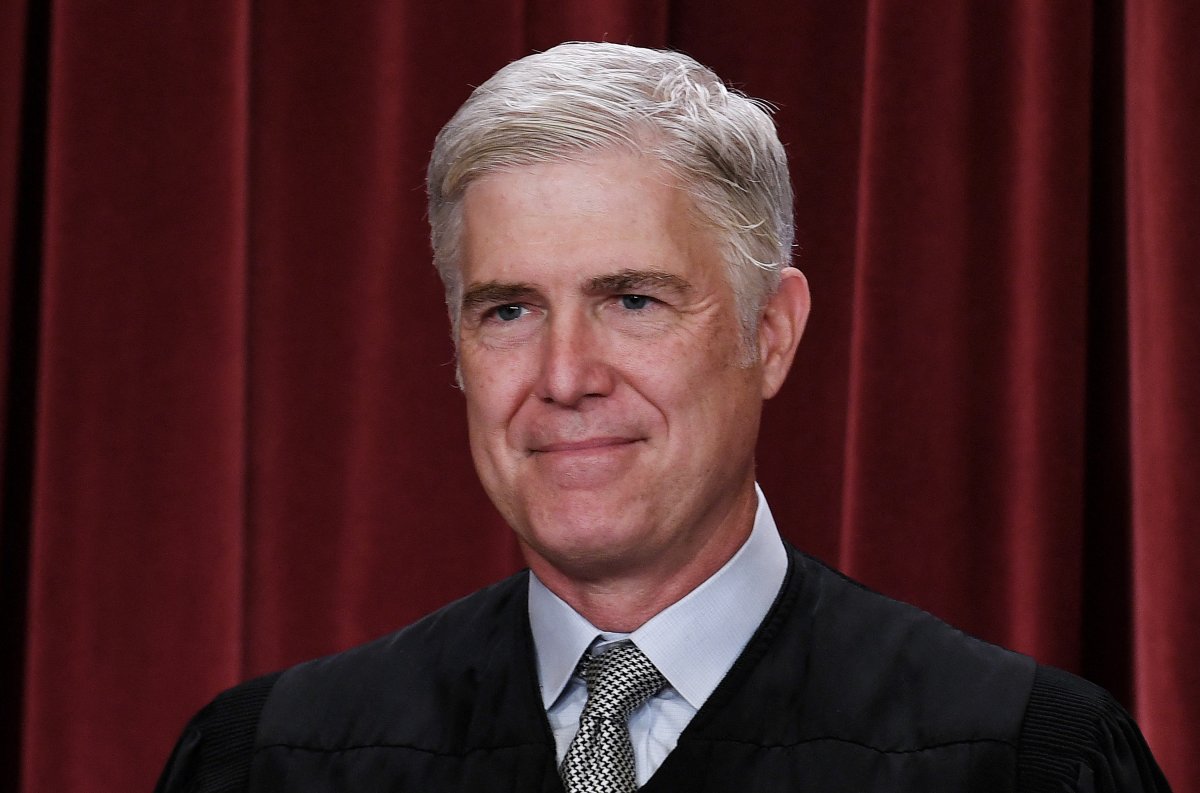

The Supreme Court denied granting a rehearing to Monica Toth, an 82-year-old grandmother fighting the Internal Revenue Service (IRS), but Justice Neil Gorsuch broke from his peers in the ruling.

Thousands of requests for review come before the Supreme Court each year and justices deny most of them. Toth's case was elevated to the Supreme Court last year after two lower courts ruled in the IRS's favor after it penalized Toth $2.1 million—half of her fund's sum of $4.2 million—because she had failed to report funds that she held in a foreign bank account. Toth challenged the ruling, but the Supreme Court denied her rehearing, so the lower courts' rulings stand, requiring Toth to pay the funds.

Toth alleged that this violated the Eighth Amendment, which prohibits cruel and unusual punishments as well as excessive fines, but the Supreme Court denied hearing the case.

"Aside from a few types of cases, the Supreme Court has the discretion to hear appeals, and here, only Justice Gorsuch wanted to do so. With the exception of death penalty cases, you don't see a lot of successful Eighth Amendment challenges, so I'm not surprised. By rejecting Toth's petition, the lower court decision stands and she will have to pay the civil penalty," attorney and former federal prosecutor Neama Rahmani told Newsweek.

Rahmani added that the results of the decision may not seem fair, but the case wasn't an issue for the Supreme Court to consider.

"It's a legislative and executive branch issue," Rahmani said. "If there is no constitutional or other protection, the IRS can impose these types of civil penalties."

According to a report by the New York Post, the funds originated from a gift from Toth's father shortly before he died. Her father had fled Nazi Germany during World War II and sought refuge in Argentina. Once Toth became an adult, she relocated to the United States and obtained citizenship.

Haunted by the memories of an oppressive nation, her father wanted to designate a sum of money for his daughter in case she ever needed to flee. Her father allocated $4.2 million into a Swiss bank account for Toth prior to his death.

Toth was required to pay $40,000 in back taxes after learning that she failed to file a Foreign Bank and Financial Accounts report to the IRS each year. Toth had not been aware of a rule requiring U.S. citizens with more than $10,000 in foreign bank account funds to file the report each year.

Toth paid the back taxes, but the IRS sought penalties of more than $2 million after alleging that Toth violated the Bank Secrecy Act of 1970, which requires U.S. financial institutions to assist U.S. government agencies to detect and prevent money laundering, and penalized her for the action.

The lower courts ruled in the IRS' favor, alleging that penalties were not the same as fines, and therefore the penalties did not violate the Eighth Amendment.

Uncommon Knowledge

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

About the writer

Anna Skinner is a Newsweek senior reporter based in Indianapolis. Her focus is reporting on the climate, environment and weather ... Read more

To read how Newsweek uses AI as a newsroom tool, Click here.