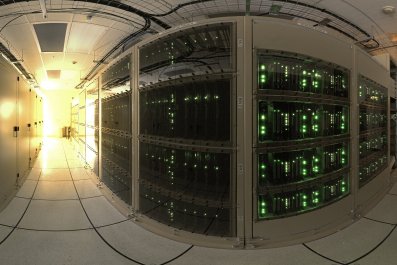

Russia is using cut-price nuclear energy deals as leverage to influence EU states and shore up long-term alliances in the Middle and Far East, according to energy analysts.

Analysis of recent deals secured by Russia's state nuclear corporation Rosatom reveals a costly drive by Moscow to lock countries including Hungary, Bulgaria, Slovakia, the Czech Republic, Iran, Turkey, Jordan, Egypt, India, Bangladesh, Vietnam and Argentina into arrangements that will mean they rely on a supply of nuclear fuel from Russia for decades.

Russia recently agreed a €10 billion loan deal to expand and supply Hungary's Paks nuclear power plant, one of several ongoing nuclear energy projects Russia has its sights on in Eastern Europe. Besides the 10-year Hungarian deal, Bulgaria, Slovakia, the Czech Republic and Ukraine rely on Russian nuclear fuel to function. These five countries with a collective population of 80 million are reliant on Russian nuclear co-operation for some 42% of their electricity supply.

Lili Bayer, Eurasia analyst for global intelligence firm Stratfor, argues that the Hungarian plant is one example of Russia's distinct strategy to maintain energy dependence in Europe on Russia.

"This is both a commercial and political strategy," Bayer says. "Russia is really pushing for projects like the one in Hungary because they will be providing 80% of the financing and it gives the Kremlin long-term leverage until Hungary pays the money back."

According to Bayer, lucrative deals such as the one in Hungary show that Russia is willing to spend big to retain its monopoly in the former Soviet-bloc though Russia's economic crisis will make this strategy more difficult. Russia used to supply these plants with fuel exclusively but now Western companies such as Westinghouse have developed fuel compatible for the Soviet-style reactors.

Petr Topychkanov, analyst at the Carnegie Endowment in Moscow, says Rosatom is also developing nuclear projects outside Europe in the Near and Far East to similar political ends. Elsewhere Rosatom subsidiaries are currently developing nuclear projects in India, Iran, Bangladesh, Turkey and Jordan, while also currently bidding to build plants in Egypt and Vietnam.

A deal to build a new plant in Argentina was agreed at the end of April.

"For this purpose Russia is ready to offer very lucrative conditions for contracts including financial support," says Topychkanov.

"Moscow understands that if relations break down and Russia decides to stop supply, it is extremely difficult to find alternative sources for host countries. It believes it has a good chance to have predictable relations with that country if it is the one providing them with nuclear fuel," he says.

"This is a part of Rosatom's big strategy and of course this big strategy is supported by the Russian government," Topychkanov adds.

Nuclear expert John Large says he sees alarming parallels between European over-dependence on Russian gas and Russian nuclear fuel.

"Gazprom cutting Ukraine's energy just goes to show you that there is a political need for fuel diversity away from Russia," Large says.

"If Putin had the valve on nuclear fuel as well, although the effect would be slightly longer term, it can get incredibly uncomfortable."