After years of promising to repeal the Affordable Care Act, House Republicans last week introduced their replacement, the American Health Care Act, or AHCA. The proposed legislation has been ripped from both sides of the aisle due to concerns about increased insurance costs many people, particularly older Americans, may have to pay, as well as the potential loss of coverage that could result.

Missing from this debate about health care coverage has been any discussion of lowering the cost of care. The U.S. spends more than any other high-income country on health care. Prescription drugs account for about 17 percent of all health care spending; that's more than $370 billion per year, again exceeding all other countries. This total is the result of not only the high number of prescriptions written but also the high cost of the drugs prescribed. President Donald Trump has vowed to lower drug prices but has not yet proposed any concrete approach for doing so.

Pharmaceutical companies often justify the cost of drugs as necessary to support the research and development, or R&D, of innovative treatments. If we want cures for devastating diseases, they say, we have to pay for them. But that explanation does not stand up under scrutiny. Research by the Tufts Center for the Study of Drug Development put the cost of developing a new drug at $2.6 billion. But that research was supported by the pharmaceutical industry, and the estimate has been questioned.

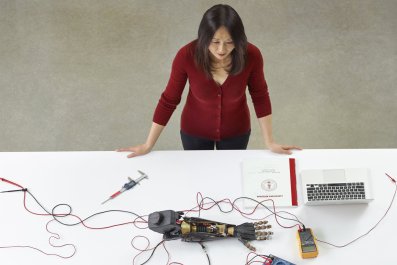

Shefali Shah has spent more than 15 years helping pharmaceutical companies navigate issues surrounding the cost of new medications. She has worked with biotech giants like Genentech, small biotechs bringing their first products to market and external consulting firms to pinpoint the magic dollar amount for a given medication.

Now an independent adviser, Shah spoke with Newsweek about drug prices: where they come from, who negotiates them and how they got so incredibly complicated.

What is the difference between pricing and reimbursement?

Pricing and reimbursement are entangled to some extent. Drugs may ultimately have several different prices, but the first one is the list price, which comes from the manufacturer. The list price is not necessarily the price that most people pay. In some cases, hardly anyone pays it. But the list price serves as the basis for many subsequent calculations.

Reimbursement is the amount the insurer pays for the drug, whether it's a private insurer, Medicare or Medicaid. Typically, depending on the type of drug, the insurer pays either the physician directly, the drug manufacturer or an intermediary, such as a pharmacy benefit manager.

The PBM pays a heavily discounted price. Physicians buying the drug directly also receive a discount. So do wholesalers. None of these entities pays the list price.

What drugs do physicians purchase and from whom do they purchase?

Typically, the drugs purchased by physicians are those that must be given by infusion. But physicians usually make these purchases through an intermediary—a PBM or a wholesaler such as McKesson or Cardinal Health. These companies buy the drugs from the manufacturer and the physician buys it from the intermediary. The physician then administers the drug to the patient in the office, bills the insurer and is then reimbursed by the insurer.

That sounds very complicated.

It's really complicated. Purchasing prescription drugs is different from other kinds of purchasing. When you buy a car, you are the decision-maker. You are the customer, you choose what car you want, and it's up to you whether or not you want to pay whatever it costs. You go to a dealership and buy a car. With pharmaceuticals, the customer—the patient—is rarely the decision-maker. Usually, the physician makes the decisions. And the patient doesn't pay the cost directly either. The patients aren't usually writing the check. There may be a copay or coinsurance, but the majority of the cost is usually covered by the insurer.

Unless the individual has an insurance plan with a high deductible on prescription drugs or no insurance coverage at all.

Correct.

How does a pharmaceutical company determine an appropriate list price for a drug?

Before diving into this explanation, I think it's important to emphasize that there are a lot of good actors in the pharmaceutical industry. In my experience, most people in this field do want to innovate and create drugs that benefit patients. And there are bad actors, which we have heard a great deal about recently. Drug prices are increased astronomically without explanation. List prices are set extraordinarily high. I'm going to focusing on the good actors.

Determining the price of a new drug is both science and art. So many different elements must be considered, and there's no formula. All the different factors must be weighed. The clinical value is the most important aspect. Is this drug helping people live longer? Is it helping them live better? Also, how does it compare to competitors? Are there competitors? Will payers pay for the drug? Can patients afford the copay? What is the average copay for a patient? What are other drugs priced at? How much will the company have to give in government-mandated discounts, such as the 340B clause in Medicaid? What are the cost-of-doing-business discounts to PBMs or wholesales?

We often hear about the cost of development, and that is an important part of the story. But I think these expenses are considered very early on, when a company is first deciding whether or not to develop a drug. Companies will evaluate the cost of a clinical trial, the salaries for the people who run the trial, etc. When they have a sense of those expenses, they look at what the drug would ultimately need to cost in order to cover those expenses and whether charging that amount is viable. The amount that companies spend on R&D is baked in at the start.

Do pharmaceutical companies project about what they want the profits from a certain drug to be by the time its patent expires?

I have not seen that. There's no magic number stated at the outset. The typical approach is to estimate what they can charge for a drug based on its value to patients, how it compares to the competition and the other factors I mentioned above.

Estimating what a drug is worth, though, depends a lot on the size of the market.

How so?

Drugs with a market of 10,000 or 20,000 people—that is, for a condition diagnosed in that many people—will be priced quite differently from a drug with a market of 1,000 patients.

And a drug with a 1,000-patient market will be more expensive because it results in fewer sales?

I think that's generally fair to say. That drug will not necessarily be 10 times more expensive than a drug for 10,000 patients. But it will cost more, because the company still had to spend a few hundred million dollars to create it. This is why some drugs for extremely rare diseases are incredibly expensive.

Once a company sets the list price, what entity is the first to push back against it?

These days the push back seems to come from everywhere: insurers, policymakers, physicians and even patients to some extent, though less so.

Patients are primarily concerned with access. So if they feel the price will lead their insurer to not cover the drug, they may push back against the cost. The same is true for physicians, who are concerned about their patients having access to the most beneficial medications. Physicians also want to prescribe drugs without limitations imposed by the insurer.

The majority of pushback directly against the pharmaceutical company's list price comes from the insurer and increasingly from policymakers. For example, Marathon Pharmaceuticals recently halted the launch of its muscular dystrophy drug after Senator Bernie Sanders and other legislators expressed outrage after the company announced an $88,000 price increase.

Why do insurers fight the list price?

Most insurance companies set a budget at least a year in advance. So for big insurance companies, the 2017 budget for pharmacy benefits was decided some time ago. If a new drug is likely to be hard for that budget, the insurer might try to insist on a lower price.

Some degree of push back is expected now, and we are seeing insurance companies managing prescriptions in different ways to control costs. Some require prior authorization as a way to slow down the process. Some require step therapies, where an individual must try one drug before another is prescribed. Sometimes that requirement is appropriate because it ensures that physicians are sticking to the FDA indication, but sometimes the purpose is to slow down the spending.

Is that practice manipulative against patients?

That's the unfortunate aspect in all of this. The patient, who is the user and who should have the loudest voice here, often doesn't. The patient isn't the decision-maker. In many cases, decisions are being made for patients. They wait to see what their physicians prescribe and what their insurance company will pay for.

But patients are paying for their drugs, even if that payment is indirectly through monthly insurance bills.

Right, they're probably paying for their insurance. Many plans have significantly increased their monthly payments and deductibles.

You don't feel the cost in the same way when you're not handing money across a counter.

It's an interesting mindset. When it comes to the point of sale on drug, we've already paid the insurance so often we are unaware of the actual cost.

Prescription drug payments are not normal consumerism.

Not at all.

Does everyone pay a discounted prices?

Usually, a PBM is the entity buying from the drug company, and the insurer reimburses the PBM. In a flow chart of this chain, the pharmaceutical company would be at the top. That company sells the drug to a wholesaler or PBM, and the PBM sells to the physician if the drug is infused, or if the drug is oral, it may be shipped directly to the patient.

So the PBMs are the ones who negotiate the initial discount from the list price?

Yes. PBMs ask for discounts from pharmaceutical companies. Sometimes a PBM may refuse to stock a drug if the discount isn't sufficient, or may list a drug on a lower benefit tier, which means more costs being passed onto the patient, which is unattractive to pharmaceutical companies. PBMs have negotiating power, and the discounts they receive have been getting steeper and steeper.

Do PBMs serve a purpose?

PBMs do serve some purpose in the pharmaceutical supply chain. I am not an expert in this specific area, but I believe that some of these companies have value-added services beyond transporting drugs from the manufacturer to the physician or other end-user. Sometimes they contribute to disease management by ensuring patients adhere to their prescriptions, for example. But they don't all do this, and I don't know if they are delivering enough of a benefit to justify the cut they're taking.

Does the extent of the discount vary?

Yes. The more mass-market drugs, such as statins and other commonly used medications, are usually more discounted for PBMs. Some of the more niche drugs won't be assigned as big a discount.

Every disease is treated very differently. Whether the drug is oral or intravenous makes a big difference because they are reimbursed totally differently. Intravenous drugs are reimbursed to physicians, whereas oral drugs are reimbursed to the point-of-sale, such as the local retail pharmacy where the patient picked up the prescription.

It's so confusing.

It is. I'm helping my mother figure out Medicare, and if this weren't my job, I don't know how I would help her navigate all this.

Let's say the list price is $10. How might the pricing structure for the different entities follow?

In this example, the PBM might pay $6. Because the PBM wants to make a profit, it charges the insurer $8. The insurer won't necessarily shell out all $8; instead, that entity will pay $6 and the patient will have a copay of $2.

In this example, the pharmaceutical company would not be taking a loss at $6.

No. Figuring out profit is complicated. A pill is relatively inexpensive to make. The chemicals might cost just 50 cents, but that doesn't account for the money that went into the development.

When companies report profits, they may look at the whole brand, all their products combined. Some biotech companies have been in existence for 15 years and are still not profitable, even though they have products on the market. The overall profit reported is the best measure of how much a company is making. That number accounts for everything put into development.

Do you agree that drug prices are too high?

I think there is a way to bring more of a value-based system into pricing and reimbursement. Right now, our reimbursement system imposes a lot of limitations on how creative we can get with pricing. If prices could be based more on value, I think that would address the problem to some extent.

What would that look like?

The really expensive drugs are usually the infused products. These tend to be large molecules that can't fit in a pill. These are the more novel drugs. They are more expensive to develop, more expensive to make and more expensive to buy.

Currently, the way these are reimbursed is the physician buys the drug from an intermediary, administers the drug to the patient, bills the insurer, and the insurer has a set percentage it will reimburse.

Sometimes, a drug may be used in two different cancer types. In one type, the patient may live six months longer with a great quality of life, justifying the $100,000 price tag. But in the other cancer, the benefit is not as great. But the price for the second disease cannot be changed without also changing the price for the first disease. That's a big dilemma for companies.

Many policymakers are looking at how to alter our current system for that scenario. There's a sense that people don't feel they're getting what they're paying for. Many companies want to incorporate value into pricing, but there are limitations on what they can do.

How did we get here?

Over the years, many piecemeal efforts have tried to fix the reimbursement system without impacting patients' access to care. I really do believe that the U.S. has the best access to health care and medicine of any country. The Medicare Modernization Act was an attempt to bring reimbursement, to a more reasonable level, which I think it did, but it also created other issues. That same piece of legislation created Medicare Part D, giving Medicare patients coverage for oral drugs. But again, that coverage comes at a cost.

My perspective is that change is coming. And it's better if all the entities involved in the supply chain to come up with ideas that benefit everyone.