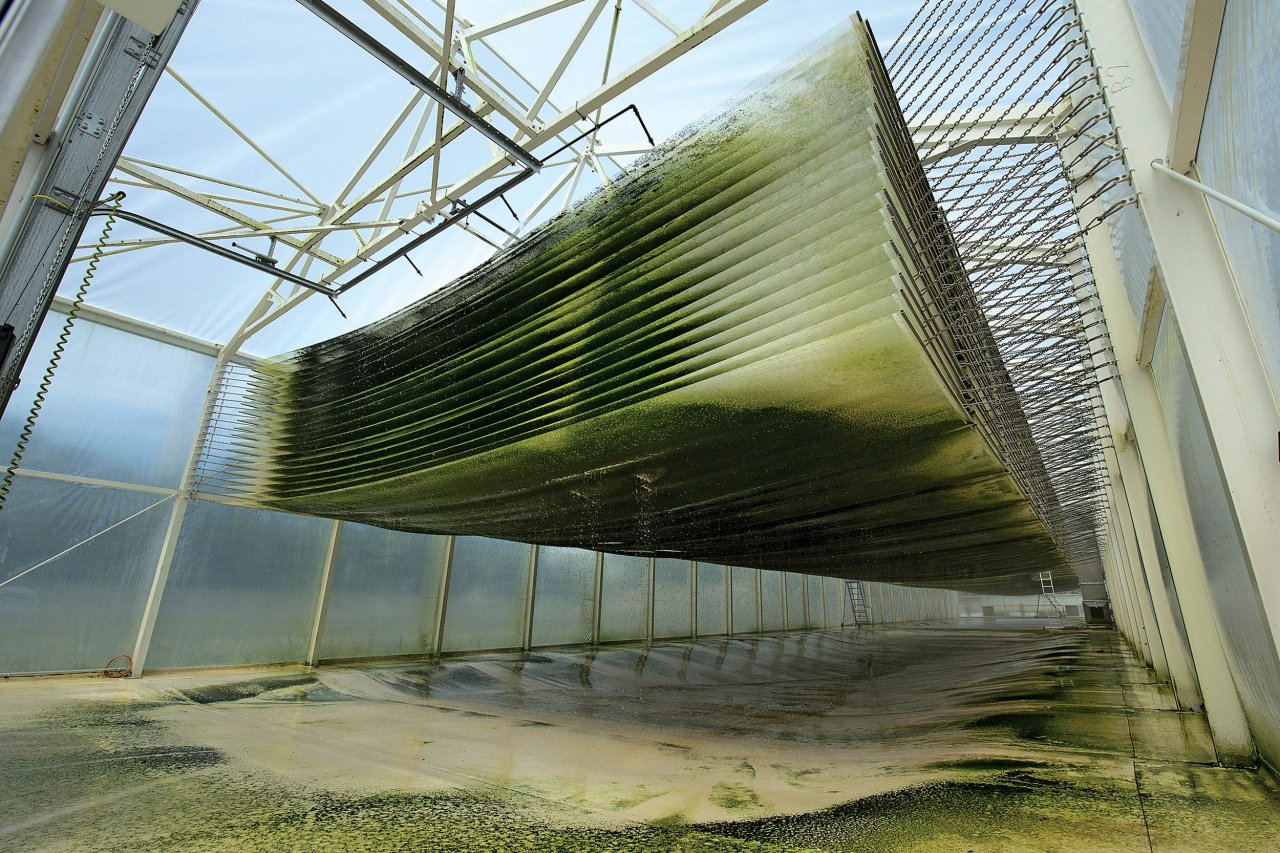

A mile from the Mexican border, on a patch of scrubland where the Chihuahuan Desert meets the low-slung mountains of New Mexico, lies $104 million worth of government investment in the form of 78 dirt-packed, plastic-lined pits.

In January, Mike Mendez, a 52-year-old scientist with parted hair and a weakness for cowboy boots and sweater vests, rented a car and drove the two hours from El Paso International Airport to this parched corner of the Southwest. He had spent five years of his life thinking about these pits, but still he'd never seen them in person.

Situated 10 miles outside of Columbus, New Mexico, population 1,628, the pits and the high-tech machinery around them were built by Sapphire Energy, which Mendez co-founded in 2007. The whole operation was the product of $85 million in funding from wealthy investors like Bill Gates, $50 million from the Department of Energy, $54 million from the Department of Agriculture (half of the government funds were loans and were paid back) and the technical know-how of some of the smartest minds in the biotech industry. The idea behind the venture was radical: Use synthetic biology, a promising new technology that lets scientists reengineer the genetics of living organisms, to take on the fossil-fuel industry—and do the whole thing with pond scum.

The company spent years unraveling the genetic pathways and manipulating the DNA of various types of algae and eventually engineered a handful of specimens that produced biofuels ready to be pumped directly into your gas tank. Sapphire called it "green crude," and the company had proved it could power all sorts of vehicles, from Boeing 747s to Priuses. The pits—or "ponds," in industry parlance—were built to house fantastic amounts of this biofuel-producing super-algae—enough to make a million of gallons of clean fuel. Enough to show the world that Sapphire's fuel was a scalable, viable alternative to the conventional crude whose use is rapidly warming the planet and raising sea levels.

"I can't believe the amount of money and amount of effort put into this," Mendez marveled as he pulled up to the Green Crude Farm and got out of the car. It was an intoxicating endeavor, and a lot of people bought into the dream.Businessweek named Sapphire one of the hottest startups of the year in 2008, as did The Wall Street Journal two years later. Other synthetic biology (synbio, for short) companies cropped up with similar biofuel plans, and investors poured hundreds of millions of dollars into the field. "Designing and building synthetic cells will be the basis of a new industrial revolution," Craig Venter, one of the fathers of modern synthetic biology, told The New York Times. "The goal is to replace the entire petrochemical industry." By 2018, Sapphire announced, the company would make 100 million gallons of fuel in its massive desert ponds; by 2025, they could produce a billion.

"I started Sapphire a long time ago, and we had a vision of a giant algae field you could see from space—and now I'm looking at it," Mendez told me after the trip. "It's the first time I see it. I'm in awe. Then I notice all the tumbleweeds."

GMO 2.0

When the bottom fell out of the energy market during the Great Recession, it took much of the nascent synbio biofuel industry with it. Competing with $140 barrels of oil was one thing, but $50 was untenable. "Fuel is the cheapest stuff on the planet," says Jamie Bacher, a former Sapphire employee who went on to manage a joint venture between Amyris, one of today's biggest synbio firms, and Total, the French oil giant. "Colloquially, you say, 'Oh, oil is really expensive these days.' But even at $100 a barrel it's cheaper than bottled water."

Oil and gas companies make pennies on the barrel—their profits come from producing billions of gallons. Sapphire, like the other giants of the heady days of the synbio boom in the late aughts, struggled to scale up to a level where it could get its prices down to compete with newly cheap oil and natural gas. So instead, many of the synbio companies attempted to sell their higher-priced product as a luxury good, to a market willing to spend a little more in the effort to save the world from climate change. Critics say this business model was doomed to fail. "Idealism is never a good idea in business," says Mark Bünger, a research director at Lux Research who focuses on synthetic biology and clean fuel. "Unless you can translate your idealism into sustainable economics, you're a charity and you need to have other sources of funding."

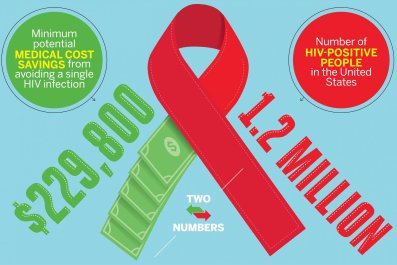

"I think everyone was drunk on the money coming into the space and drunk on the dream," Mendez says now. He left Sapphire in 2011; his visit to the company's New Mexico facility in January was to advise executives on what to do next, before the cash runs out. Sapphire is not alone in these dire straits. LS9, one of the first biofuel companies of the synbio era, which boasted partnerships with Chevron and over $80 million in funding, was sold for a paltry $40 million in February 2014. The stock value of Amyris, which kicked off investors' fevered interest in synthetic biology when it created an anti-malarial drug in the lab and then moved on to biofuels, dipped below $2 in February—down from a high of over $33 four years earlier. And a much-heralded $600 million investment by Exxon Mobil into a San Diego synbio firm—co-founded by Venter—ended in failure, layoffs and a declaration from him that biofuels "are just dead."

But this isn't simply another tech boom and bust; the possibilities of synbio, from novel medical applications to increased agricultural yields to bringing extinct creatures back to life, are myriad and enthralling. If the first big synthetic biology companies fail, it will have broad implications for the field and clean energy. "All the technology and all the promise and the possibility of someday having carbon-neutral fuels" will disappear, says Jay Keasling, head of the Joint BioEnergy Institute, a Department of Energy research center and a founder of both LS9 and Amyris.

Luckily, as it turns out, "there are easier products to make money from than fuels," says Sapphire's new CEO, James Levine. Using the technology platforms already built for fuel, the giants of the synbio business are turning hard—or "pivoting," in Silicon Valley tech-ese—to products that sell for much more than $2.49 a gallon. Evolva, a Swiss firm with offices in the San Francisco Bay Area that was founded to make unique cancer drugs and antibiotics, is making vanillin (vanilla extract), stevia and saffron. Amyris, the company that created the revolutionary synbio anti-malarial drug and then tried its hand at fuel, is manufacturing lotions and fragrances for perfumes. And Sapphire, with its advanced algae and vast ponds, is eying omega-3 supplements.

If the dream of producing massive amounts of clean fuel is to survive, the synbio business needs "wins," supporters say—even if a "win," in this case, is something like synbio saffron. A product made by genetically modified organisms in a laboratory, it could end up in our food without any labeling, and it infuriates environmental groups. Those groups are already gearing up for a very public fight over what they've dubbed "GMO 2.0."

So, in other words, the fate of one of the most promising technologies of the 21st century may come down to paella.

A Higher Smoke Point

The walls in the lobby of the South San Francisco offices of Solazyme, one of the biggest biofuel companies of the synbio boom, are lined with photos of Navy ships cruising the open seas, powered by the company's algae marine diesel. Next to a particularly impressive destroyer, there's a photo of a slightly befuddled-looking Arnold Schwarzenegger, then-governor of California, chewing on sugar cookies made with algae-derived ingredients.

In a conference room upstairs, Walter Rakitsky, the senior vice president of emerging business, tells me how in 2008, while the company was still focused on creating fuels from algae, someone decided to bake a cake with some algae oil. Rakitsky and others realized the potential quickly. The process of making food oils wasn't too different from making diesel, and with their technology, they could make food oils that were lower in saturated fat than, say, olive oil, or came with a higher smoke point. They could also produce something very similar to palm oil, which they say is an excellent alternative to the real stuff, often grown and refined in harsh conditions. Downstairs, in a shiny test kitchen, chefs in white coats offer me disconcertingly tasty ice cream and cookies and crackers made from the algae products.

Solazyme doesn't call itself a synthetic biology company anymore—it prefers "21st century oil company" these days. This is telling for a few reasons. First, there is no accepted definition for what synthetic biology is. (When I asked Drew Endy, a respected synbio evangelist at Stanford, he joked, "I know it when I see it.") But Keasling's definition is simple enough: "It's about engineering biology to do useful things for us," he says.

In practice, it works something like this: Scientists go to the lab bench and analyze the genetic pathways of algae, yeast and other organisms that can be coerced into making some byproduct. Algae, over the course of millions of years, naturally creates crude oil; yeast, of course, makes things like beer with relative ease. When researchers find a promising genetic direction, they can alter the organism's DNA to speed up the process.

Using this technology, synbio companies can tailor products to the food and chemical industries, which are thrilled at the prospect of cheap flavors and foods that come with reliable supply lines and shelf stability. Evolva focused on making therapeutics until 2009 but realized there was easier money in the food business. In December, it bought Allylix, a San Diego–based synbio company focused on biofuels and flavors. Today, Evolva is producing synbio versions of stevia, the popular sugar replacement; vanillin, the extract that sweetens about 99 percent of the "vanilla flavored" foods we eat; and saffron, the world's most expensive spice. Neil Goldsmith, the company's Oxford-educated CEO and founder, is candid when I ask why Evolva decided to make synthetic saffron. "Because it's really dear and because the supply chain is so dodgy," he says. In other words, there's lots of money to be made.

As Deep as Religion

There will be challenges, though. Last year, environmentalists and farmers gathered in Berkeley, California, for an event called "GMOs 2.0: Synthetic Biology, Food and Farmers." It was ostensibly a panel discussion, but in effect it was an effort to sound an alarm about the perceived dangers of foods derived from synthetic biology.

"There's a new synthetic ingredient we need to be aware of—a new product coming straight out of a petri dish," said Dana Perls, a staffer at the environmental group Friends of the Earth. "An extreme form of genetic engineering," she warned the audience.

The environmental groups' concerns about synbio food aren't just limited to eating products made by genetically modified organisms. The panel told the rapt audience of students and gray-haired locals that the new technology could disenfranchise people across the developing world. By producing, say, vanillin in a lab, synbio companies would put vanilla farmers in Mexico out of business, they argued. "These products threaten the livelihood of small farmers and people working on sustainable agriculture across the world," Perls told the audience. (Evolva disputes this and says its synthetic vanillin will compete against vanilla extract products, not natural vanilla.) Plus, the panel alerted the audience, ingredients made with synthetic biology do not have to be labeled if they're included in food products, and since they're created by living things—yeast or algae—they can still be labeled "natural."

The next week, a very different kind of synbio meeting was held across the Bay in a brick-and-timber warehouse in San Francisco, complete with sweeping views of the water. This time, synthetic biology executives and insiders were gathered to discuss the potential PR pratfalls that could affect the industry as it wades into the food space. Participants raised the specter of Monsanto's prolonged, public battle with anti-GMO activists; the folly of Olestra, the non-fat additive used in chips in the 1990s; and the foolishness of their industry's key term.

"Synbio, within the academic and research community, is a really cool phrase," one speaker said. (To ensure everybody would speak their minds, the event was held under "Chatham House Rule"—everything said was on the record for future publication, but the speakers would remain anonymous.) "Whereas, within the food sector, synbio couldn't be a worse term…you say 'synthetic' and people think artificial, fake."

The strong animosity environmentalists feel toward synbio and genetically modified food was dissected at length, too. "I think we need to think a lot about the fact that the opposing people have sort of a religion," one person said. "It's as deep as religion or patriotism. It's really hard to shake." It's a problem that was borne out in research undertaken by Todd Kuiken, a senior program associate at the Wilson Center in Washington, D.C., in 2013 and 2014. In focus groups, responders were largely in favor of synthetic biology tackling medical problems and clean biofuels, but when it came to food, 61 percent of respondents had negative views on using synbio to create food additives.

Indeed, Friends of the Earth has already capitalized on this unease. In 2014, the group approached Nestlé requesting a statement regarding the use of synbio vanillin in its Häagen-Dazs ice cream. Nestlé responded with "an answer that we have no plans to use any vanilla flavor other than pure vanilla extract, nor do we intend to source vanilla flavor produced through synthetic biology for Häagen-Dazs," according to a spokesperson. Friends of the Earth, however, used the response as the basis for a press release in which they lauded the brand for "doing the right thing by listening to the growing number of consumers who don't want synbio vanilla and other extreme GMOs in their foods." Meanwhile, Ecover, which owns the Method line of green cleaning products, caught so much flak for using synbio technology to create its "natural" detergent that it now denies synbio is involved in the production process at all.

"How do we explain scientists' motivations?" one person asked. "Most of us are not evil geniuses."

"We haven't had an iPod of food tech—something that really captures the consumers," another lamented.

Still Want to Change the World

A year and a half ago, Mike Mendez founded a synbio company, Pareto Biotechnologies, with Jamie Bacher and a few other scientists. Pareto is based in San Francisco, but Mendez works in a small lab just north of San Diego, at the Salk Institute, a famed research facility with the kind of ocean view millionaires sue each other over.

Pareto is focusing on high-value molecules. Mendez and Bacher won't say which, but the list includes flavors and other things people will eat. Their business model is the opposite of the old-model big synbio companies: Focus on the expensive stuff, don't try to change the world. Companies come to them and, for a fee, Mendez manipulates cells in the back of their lab, optimizing a molecule or creating a new one for them. "We're not painting the big dreams anymore," he says, laughing. "The lessons have been learned."

But the two haven't let go of what brought them to the field. "Synthetic biology needs wins. I think we, as an industry, are poised for that. I'm extremely confident that's going to happen," says Bacher. "The question is: Where does it lead to?" I ask him if he's talking about clean fuels—about once again trying to revolutionize the energy industry. "Fuel is part of the long-term dream," he adds cautiously, emphasizing the "long-term" part of that sentiment. But Mendez is more open about his struggles.

"I wanted to change the world, change the energy sector," Mendez says. "And now we're using the platform to make omega-3s. What's that going to change? That's a steep fall from grace. I think that's the scientist-dreamer in me. The MBA in the room says there's no shame here, we're gonna make money. And I'm embracing it because I see the long-term play. Because if we can make money, we can stay alive and there's a chance we can be there when we're needed.

"So I'm tempted. It's a drug. Maybe I need another shot of it."

This article was reported with support from the UC Berkeley-11th Hour Food and Farming Journalism Fellowship.

Correction: An earlier version of this story incorrectly named the synbio company founded by Mike Mendez, Jamie Bacher and other scientists; it was Pareto Biotechnologies. An earlier version of this story also incorrectly referred to the Sapphire Energy pits as made of concrete; they are actually dirt-packed and lined with plastic. This article was also updated to clarify that half of the federal government's investment in Sapphire Energy was in the form of loans that were eventually repaid in full by the company. In addition, this article was updated to clarify the nature of Nestlé's statement regarding the use of synbio vanillin in their Häagen-Dazs line of ice creams.