In 2026, seniors can expect some steep price cuts to a range of medications, courtesy of the Inflation Reduction Act.

While the law was passed in 2022, prescription drugs are currently being negotiated for January 2026. At the moment, Medicare has picked 10 Medicare Part D drugs, with final prices set to be announced in September.

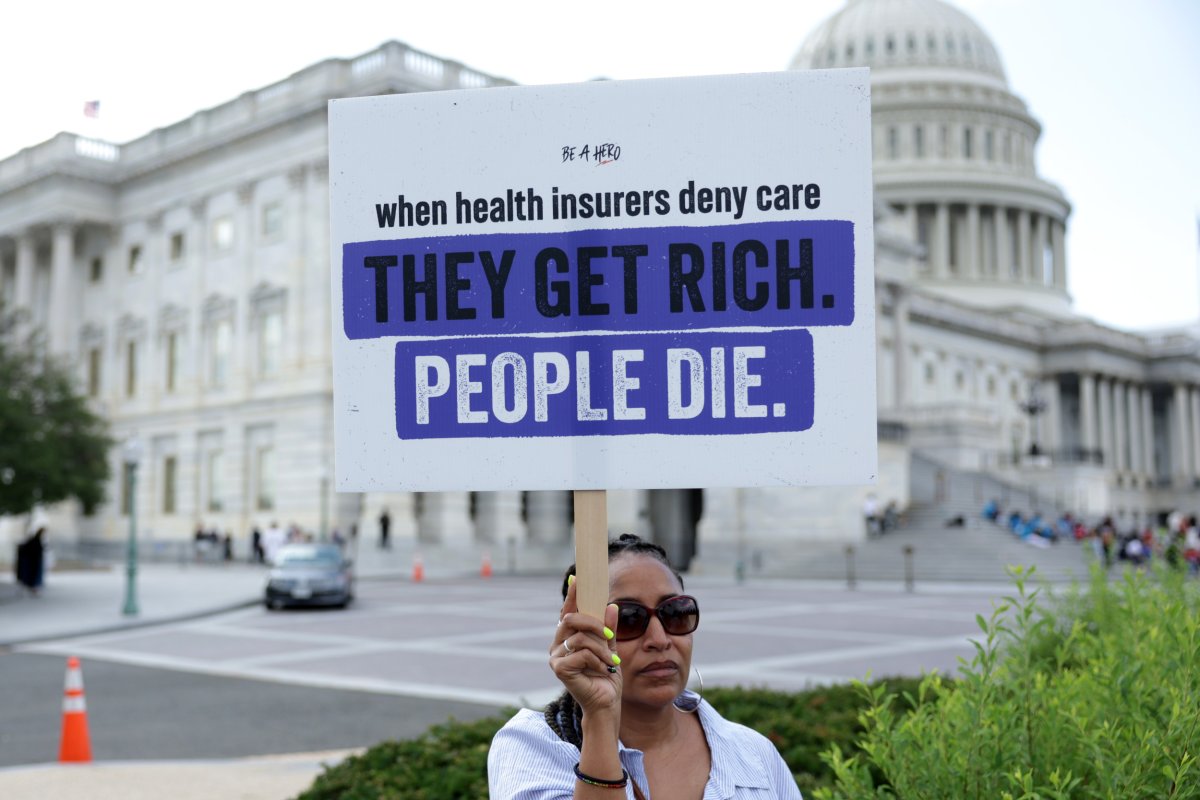

All 10 drugs are those with the highest yearly Medicare Part D spending, which means seniors often pay high out-of-pocket costs to use them. And due to the limited drug- pricing transparency, seniors typically can't predict how much of their money will end up going toward the often life-saving drugs.

"High out-of-pocket costs can be difficult for people to afford, especially seniors and people with disabilities," Monica Fawzy Bryant, chief operating officer of Triage Cancer, told Newsweek. "Over the years, we have heard countless stories of people going without their medications, skipping doses or losing their homes because of the high cost of drugs and lack of out-of-pocket maximum in Medicare prescription drug coverage."

That could change, according to the new price estimates. This is the full list of planned prices based on a typical 30-day supply of the drugs under negotiation, a recent analysis from the Center for American Progress showed.

While insulin product NovoLog FlexPen could be as low as $30, some drugs still rack up a significant price of more than $6,500, like cancer drug Imbruvica.

| Drug Name | Current Drug Price | Price After Negotiation |

| Eliquis | $247 | $123 |

| Enbrel | $5,152 | $2,576 |

| Entresto | $574 | $287 |

| Farxiga | $332 | $166 |

| Imbruvica | $13,096 | $6,548 |

| Januvia | $275 | $138 |

| Jardiance | $305 | $152 |

| NovoLog FlexPen | $60 | $30 |

| Stelara | $2,305 | $1,153 |

| Xarelto | $236 | $118 |

In all, around 9 million Medicare Part D recipients use the 10 drugs. For the most expensive drugs, the savings could add up to a whopping $6,500 a month.

Still, Chris Fong, Smile Insurance Group CEO, said the price savings will have a limited impact on seniors overall, considering the few drugs included. But that's not to say seniors won't stand to benefit later on through the Inflation Reduction Act.

"The price negotiation part of the act will have a limited immediate effect on those seniors who are taking the medications that are being negotiated," Fong told Newsweek. "This is still good news for the future. We hope to see more and more medication prices being negotiated to help relieve the financial burden on seniors."

Altogether, medication price negotiations aren't a novel idea and have long been accepted globally as a way to curb costs for those in need of life-saving drugs, insuranceQuotes.com analyst Michael Giusti said.

"By not negotiating, the United States has been a global outlier. That doesn't mean it isn't going to continue to face resistance from the industry," Giusti told Newsweek.

"The real interesting question is going to be how the Medicare negotiations will reverberate through the rest of the economy. Private insurers are already negotiating with the drug-makers through their pharmacy benefits managers. The question is going to be whether the concessions Medicare squeezes out will influence those private negotiations further."

More Health Care Changes Ahead

That's not the only change headed Americans' way when it comes to their health care costs.

By 2029, Medicare expects to negotiate prices for 60 commonly used medications.

The Inflation Reduction Act also created an out-of-pocket maximum of $2,000, with the dollar figure depending on if patients are taking generic or brand-name drugs. The new rule takes effect in 2025 for anyone with prescription drug coverage through a Part D plan.

Fong said for one of his clients, the out-of-pocket cap will save thousands on a cancer medication. The drug, which normally costs $15,000 per month, will now be limited under the $2,000 rule.

"Many Americans have to decide between buying medications or buying food or paying their mortgage or rent," Fong said. "If we add and expand the medication negotiation to include more medications and those who are on non-Medicare plans, we see this as a positive change to help Americans not have to decide between being healthy, eating, or having a place to live."

Uncommon Knowledge

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

About the writer

Suzanne Blake is a Newsweek reporter based in New York. Her focus is reporting on consumer and social trends, spanning ... Read more

To read how Newsweek uses AI as a newsroom tool, Click here.