Social Security recipients might see some higher payments after the current Social Security Administration commissioner said overpayments will be charged at a reduced rate.

Occasionally, the SSA makes an error, which can lead to years of overpayments in your Social Security checks. When the organization finds out about these errors, however, it can add on severe penalties, including deep cuts to your future benefits or ending them altogether until the amount is repaid.

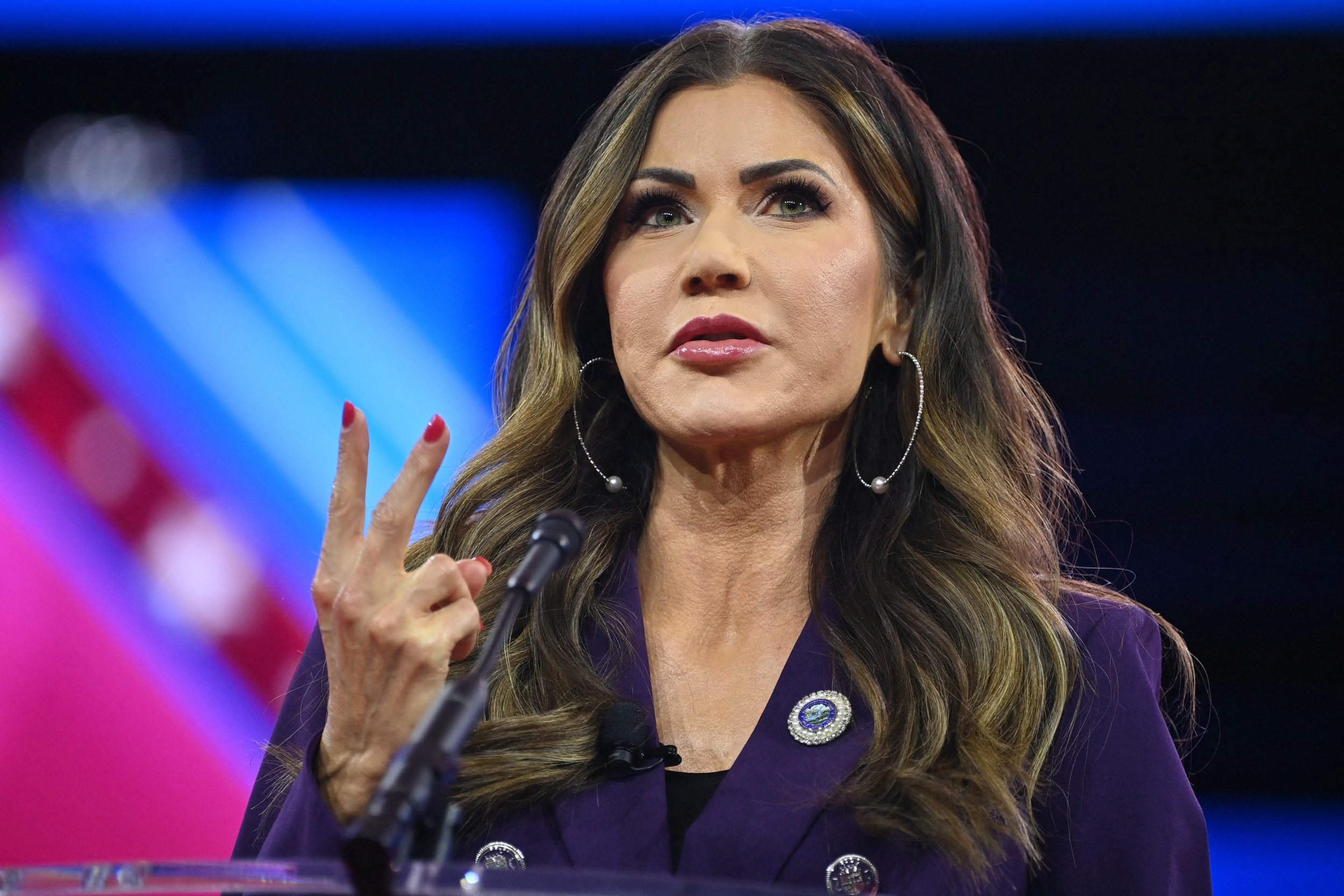

Commissioner Martin O'Malley said this will no longer be the case moving forward though, so seniors who received overpayments can breathe a sigh of relief.

"We are no longer going to have that clawback cruelty of intercepting 100 percent of a payment if people do not respond to our notice," O'Malley said during a Senate Committee on Aging hearing this week.

The end to clawbacks will begin this coming Monday, March 25. After that, the SSA will instead opt to reduce Social Security payments by 10 percent instead of ending beneficiaries' checks altogether in the case of an overpayment error.

O'Malley said the previous SSA process caused "grave injustices to individuals, as we see from the stories of people losing their homes or being put in dire financial straits when they suddenly see their benefits cut off to recover a decades-old overpayment."

Some other changes are in the works too. Now instead of putting the burden of proof on the recipient for who is to blame for the overpayment, the agency itself has that responsibility.

Beneficiaries will also have easier ways to pay back the overpayment over the span of five years instead of the suggested three they currently have.

And perhaps most importantly, if recipients don't feel the overpayment was their fault, they'll be able to apply for a waiver.

"It has to be remedied, not just for those in Pennsylvania and around the country who have been affected," Pennsylvania Democratic Sen. Bob Casey, chair of the Senate Committee on Aging, told WPXI-TV. "We've got to make sure this never happens again."

Alex Beene, a financial literacy instructor for the state of Tennessee, said in the majority of cases, the SSA is to blame for overpayment errors, which often leads to unjustly charging low-income Americans back.

"It's a step in the right direction," Beene told Newsweek. "While there are individuals who take advantage of situations involving overpayments, there are many who do not, and at the end of the day, the overpayment is more often than not the fault of the SSA's accounting system."

The SSA is also looking to reduce the average 38-minute hold time to speak to a customer service agent and help those with disabilities receive quicker decisions on their benefits.

"We are in a customer service crisis," O'Malley said.

Down the road, the SSA might also limit the number of years the agency can ask for repayment based on overpayments, according to the commissioner.

Keep in mind, just because the changes are going into effect this month doesn't necessarily mean your specific repayment amount will change. Seniors and those with disabilities who earn Social Security benefits will need to contact the SSA themselves to get new terms on their repayments.

Still, big picture, financial planner and GoodFinancialCents founder Jeff Rose said the move by the SSA could be significant for seniors working on a budget and could make the greater public look to the agency more favorably as it works to fix longstanding issues.

"By taking less money back each month, people are going to feel a bit more breathing room," Rose told Newsweek. "It's especially good news for seniors who lean heavily on their Social Security checks to get by."

Kevin Thompson, a financial planner and founder of 9i Capital Group, said there's still plenty of work for the SSA to do, namely its staffing shortage. This staffing gap is the largest the SSA has sustained in 25 years.

"They need to hire more staff as more individuals are entering the retirement system," Thompson told Newsweek. "It is all about the numbers."

As more Baby Boomers retire and enter into the Social Security system, problems will likely only increase if the SSA can't get the employee numbers up.

Read more: How to Retire Early

"Let's say you have one thousand workers in the system and one hundred thousand retirements occurring in a given year," Thompson added. "That may be good to have, being it is one worker handling one hundred applications. Now, let's say that retirement number was ten times that, and the amount of workers stayed relatively the same. You can see where the backlog and problem may persist."

Uncommon Knowledge

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

About the writer

Suzanne Blake is a Newsweek reporter based in New York. Her focus is reporting on consumer and social trends, spanning ... Read more

To read how Newsweek uses AI as a newsroom tool, Click here.