Donald Trump was set to receive 36 million more shares of his social-media company on Tuesday, adding another $1.2 billion to the former president's net worth—at least on paper.

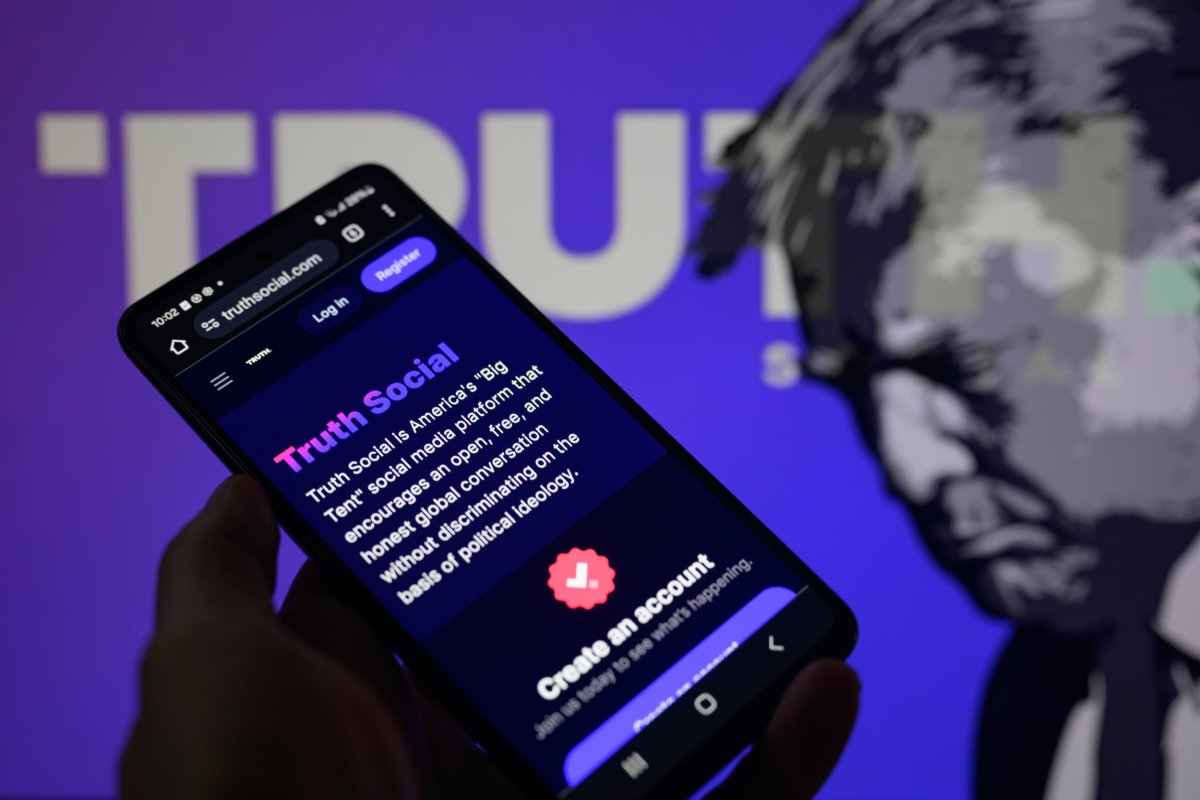

Trump Media & Technology Group, the parent company of Truth Social, closed trading on Tuesday at $32.50, making Trump personally eligible for the bonus—known in Wall Street parlance as an "earnout"—that was based on the stock trading above $17.50 for 20 trading days. Earnouts are incentives meant to reward insiders if a stock performs above a certain threshold for a set period of time following a merger.

Trump Media (ticker: DJT) went public on the Nasdaq on March 26 via a SPAC merger, trading as high as $80 in its first week before plunging during a period of wider market volatility. Shares have recovered from their lows in recent days, trading in the $30 to $40 range, though the stock fell a sharp 8 percent Tuesday.

Trump is the majority shareholder of DJT, with a stake of about 79 million shares—worth around $3 billion—before the earnout bonus is taken into account. With the earnout, his equity stake is up to 115 million shares, totaling about 65 percent of the company and worth more than $4 billion as of Tuesday's closing price.

When and how the cash-strapped former president can access those funds is a more complicated matter. Corporate executives and investors, including Trump, are barred from selling shares for 150 days after the stock goes public, as part of what's known as a "lock-up" period. That means barring an exception approved by the company's board, Trump won't be eligible to cash out any of his stake until late August at the earliest.

Even if he were granted an exception, given how closely the company is tied to his name and likeness it would be difficult for him to sell a significant portion of that stake without causing the stock price to fall sharply. Trump Media lost $58 million last year, on just over $4 million in revenue, and is widely viewed on Wall Street as a "meme stock" that isn't tied to the typical fundamentals that govern most publicly traded companies.

The presumptive Republican presidential nominee has been in criminal court in Lower Manhattan this week, where opening statements in his hush-money trial kicked off on Monday. He's already on the hook for hundreds of millions in legal judgments and bills from other cases against him, including a $83 million defamation judgment in the E. Jean Carroll civil case and another $450 million he owes the state of New York in a civil-fraud lawsuit. Trump is appealing both of those judgments.

Uncommon Knowledge

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

fairness meter

To Rate This Article

About the writer

To read how Newsweek uses AI as a newsroom tool, Click here.