A shocking tax discovery led a woman to realize someone had been stealing her identity and Social Security number for years.

Raylynn Atkinson, a mom and dental assistant from West Jordan, Utah, lost her job in January. But that was just the start of her troubles because she soon realized her entire identity had been stolen, Fox 13 News reported this week.

Upon losing her job, she started looking into filing for unemployment, which was when she faced a major curveball: Someone had been using her Social Security number on several W-2 forms.

Atkinson came across three extra W-2s from employers for which she had never worked.

"I took it upon myself to call the top one," Atkinson told Fox 13. "The lady on the phone did verify that they are paying somebody under my Social Security number. The place is located in Bountiful [,Utah,] and says she is not responsible for looking at the taxpayer documents that she does payroll for."

The IRS confirmed the news: Beginning in 2022, Atkinson's Social Security number had been used for several jobs and was now permanently attached to her record.

Atkinson was then told by an unemployment office to call the Federal Trade Commission (FTC) and get an identity theft pin, but she said it is unclear how best to use it.

"I went to go log into Experian because that was another place that I have to look ... my credit file and my phone number that I've had for 10 years all of a sudden is no longer the phone number they have on file for my Experian account, so I can't even log into it," Atkinson said.

Local police also told Atkinson she'd need to file separate police reports in all the cities where her Social Security number was used.

In Kaysville, Utah, police said reports of identity fraud are increasing. If they can locate the perpetrator, they are typically able to get a warrant for their arrest.

Sometimes the fraudsters use the Social Security numbers to work a job illegally, but other times they use it to take advantage of unemployment benefits.

For Atkinson, the effects are widespread. She won't be able to file taxes online and instead will have to deliver them in person.

"Mine will never be my identity again. It will never be just my identity again because I'll probably always have something weird pop up," Atkinson said.

Steps to Take

For others who become a victim of identity fraud, there are a few things they should immediately do.

First, you need to freeze your credit and contact all credit bureaus. Victims will also need to file a report with law enforcement so there's a record of the fraud. The IRS will request you fill out form 14039 to document the fraud.

You should also get in touch with the Social Security Administration, which could already have different wages than reported on your W-2.

Identity Fraud Becoming Widespread

Social Security number fraud can steal identities and leads to millions of dollars lost each year. The FTC received more than 1 million reports of identity theft last year.

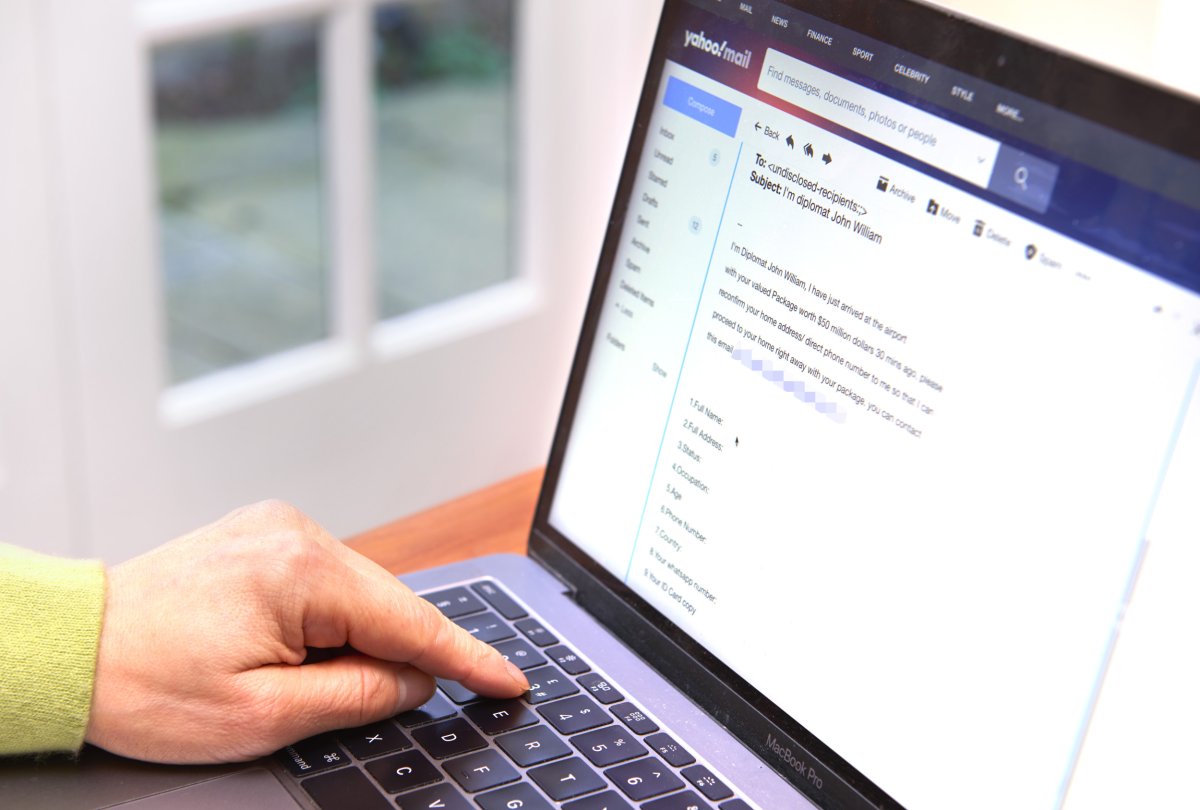

Hackers often find the numbers through Social Security data breaches or can target you with phishing emails and phone calls.

"Once fraudsters establish trust, they can trick victims into disclosing bank account numbers, debit card details, or other financial information," Zulfikar Ramzan, chief scientist and executive vice president of product and development at online safety platform Aura, told Newsweek. "Most phishing emails contain malicious links that lead to scam websites, or trigger malware downloads onto devices."

Some scammers even create fake AI-written job postings to gain Social Security numbers on job applications, then use them to steal applicants' identities.

And once your number is stolen, it can be difficult to keep the fraud from spiraling out of control.

"Identity theft has profound consequences for its victims," Alan Saquella, security and intelligence studies professor at Embry-Riddle Aeronautical University, told Newsweek. "They can have their bank accounts wiped out, credit histories ruined, and jobs and valuable possessions taken away. Some victims have even been arrested for crimes they did not commit."

In one case, Saquella said, a victim had to spend $19,000 in attorney fees to get a creditor off their back because someone used their Social Security number to take a $150,000 loan.

Tax season also means more numbers will be stolen, as scammers often pretend to be IRS agents in a phishing email or phone call.

"Bad actors also use targeted emails or text messages with language like, 'Get your max refund now or click here! Enter your account information to get your money,'" Jennifer Hessing, fraud analytics director at Wells Fargo, told Newsweek. "They're trying to either lure you with the promise of the money or they are trying to sometimes demand payment and use scare tactics and act with that sense of urgency."

The IRS will never initiate contact by email, text or social media, and all information regarding tax refunds will be sent through regular mail, Hessing said.

To protect yourself, Hessing recommends, file your taxes early and get an identity protection PIN to prevent others from filing returns with your Social Security number.

If you've been a victim of identity theft and would like to share your story, please reach out to personalfinance@newsweek.com.

Uncommon Knowledge

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

About the writer

Suzanne Blake is a Newsweek reporter based in New York. Her focus is reporting on consumer and social trends, spanning ... Read more

To read how Newsweek uses AI as a newsroom tool, Click here.