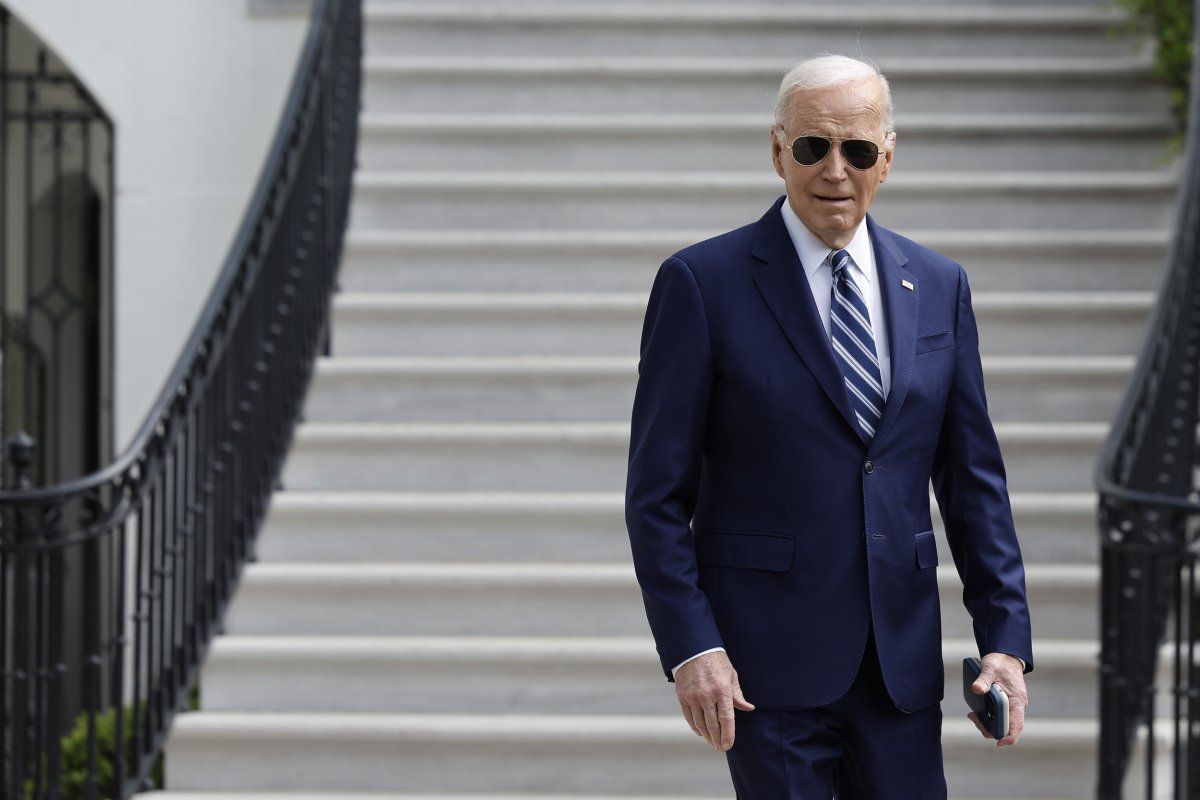

Taxes for a certain subset of individuals could reach beyond 50 percent in five states after a new proposal by President Joe Biden—and experts told Newsweek what that means for people and businesses in those states.

Biden has outlined a 2025 budget that would call for the highest top capital gains tax in more than 100 years.

"Together, the proposals would increase the top marginal rate on long-term capital gains and qualified dividends to 44.6 percent," the proposal said.

However, in some states, that would reach beyond 50 percent due to the state's added-on capital gains tax. This is the case in California (59 percent), New Jersey (55.3 percent), Oregon (54.5 percent), Minnesota (54.4 percent), and New York (53.4 percent).

Capital gains taxes typically apply to higher-earning stock and crypto investors, but the new taxes might cause many to see their profits drop significantly. This tax is different and in addition to the federal income tax, which at its highest reaches 22 percent before state and local taxes apply.

Read more: I've Been in Crypto Since 2011: Here's What I've Learned

Alex Beene, a financial literacy instructor at the University of Tennessee at Martin, cautioned Americans from reacting too strongly to the proposed plan, though.

"The tax increase narrative is a bit of fact and fiction," Beene told Newsweek. "The proposed 44.6 percent rate is certainly possible, but it would only apply under a separate part from the Biden administration's main capital gains rate increase and would also only affect individuals with taxable income exceeding $1 million and investment income over $400,000. It's not as startling of a shift in tax policy when broken down."

For those states that do see the capital gains tax skyrocket past, it's not out of the question they could see frustration from residents or even people relocate due to the tax implications of living there, however.

"States who add on to that tax burden with their own percentages find themselves in a difficult predicament if these changes were to occur," Beene said. "Many of the states that would be pushed over the 50 percent mark are already seeing people and businesses relocate to lessen their daily costs and tax bills. Targeting capital gains further could trigger more leaving those locations in favor of more financially friendly destinations."

Since investors with a $100,000 long-term gain would owe $54,000 of that to federal and state taxes in some states, the economy long term could suffer, finance expert Michael Ryan, who runs michaelryanmoney.com, said.

"This disincentivizes investment, the primary engine of economic growth," Ryan told Newsweek. "It also creates an incentive for policymakers to let inflation run hot to boost tax revenues from inflated nominal gains. Small business owners looking to cash out would face a bigger tax hit too."

Read more: How to Buy and Sell Stocks

If Biden's budget proposal gets passed, the corporate income tax would also rise to 28 percent.

It would also see a tax subsidy for crypto investors disappear. Previously, these investors have been allowed to sell their crypto at a loss and then claim those losses to go toward their tax liability. They are then able to buy the same crypto asset. However, that capability would no longer be permitted under Biden's new budget.

Reactions to the new capital gains budget proposal have many scratching their heads and worried about how it could affect the larger market.

"Increasing capital gains at this rate would be absolutely tragic," Kevin Thompson, a finance expert and the founder and CEO of 9i Capital Group, told Newsweek. "I truly believe if this were to occur in the coming year, you would see a massive selloff in markets due to others wanting to achieve a more favorable tax rate in the current year. Asset prices will be impacted if this were to occur, no questions about it."

Thompson said the U.S. government would increase its revenue by adopting this tax increase, but financial professionals would invariably choose other avenues of the tax code to help clients maintain their wealth. Still, residents in places like California and New York would suffer worst of all.

"States like California and New York have significantly different revenue needs than others," Thompson said. "The cost of living in these states, budget constraints and priorities will cause differences in tax rates. Investors need to realize the differences in the states in which they live, and as you have seen, a migration has occurred towards more tax-favorable states with the advent of remote work."

Uncommon Knowledge

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

About the writer

Suzanne Blake is a Newsweek reporter based in New York. Her focus is reporting on consumer and social trends, spanning ... Read more

To read how Newsweek uses AI as a newsroom tool, Click here.