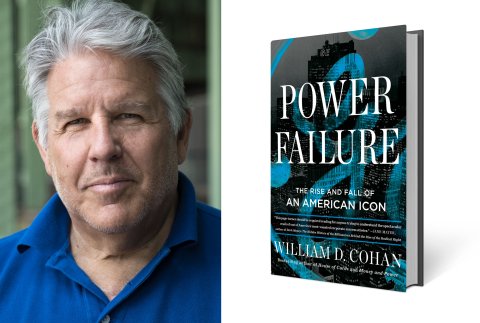

Once the ultimate blue-chip stock and known in every American household by its catch phrase, "we bring good things to life," General Electric is now being dismantled and sold for parts. Bestselling journalist and financial journalist William D. Cohan explores what happened to the storied company in his new book, Power Failure: The Rise and Fall of an American Icon (Portfolio). In this Q&A, Cohan shares what he thinks was the ultimate reason for GE's failure, what Jack Welch would have thought about the dissolution of his "juggernaut," the most surprising thing he learned while researching the book and much more.

You worked at GE Capital in the '80s. How did a company that started out making light bulbs end up with such a high-powered financing arm?

At that time, GE Capital was important, but not as important as it became during the following 15 years. It was willing to take chances on companies that few others would, but it expected to get paid for its risk-taking, something I admired. Jack [Welch] saw the arbitrage opportunity between the extremely low-cost at which GE could borrow—given its AAA-credit rating—and what it could charge borrowers. Jack just kept pushing that advantage into all sorts of interesting business lines—from financing leveraged buyouts (which I did) to financing auto inventories and manufactured-home communities—and then to opportunities around the world.

Which parts of Jack Welch's management style should companies emulate today?

That he was really good at spotting and developing talent, when others couldn't or didn't, and he was also surprisingly open-minded when considering business proposals from his people. He was willing to have his mind changed by a cogent, well-considered argument. Many CEOs claim to being willing to listen but few actually do. Jack did.

Is the global economy more or less favorable for U.S. companies now than when Welch started as CEO?

Many U.S. companies still have a material competitive advantage when competing on a global basis. We still have the best technology, the most adventurous entrepreneurs and risk-takers, the most-admired capital markets and the highest rewards for those ideas that succeed. That remains a pretty potent combination. Are other nations catching up and providing some stiff competition? Absolutely. But I have faith that the creative instincts of Americans remain unsurpassed, that is if we can keep our political system from imploding.

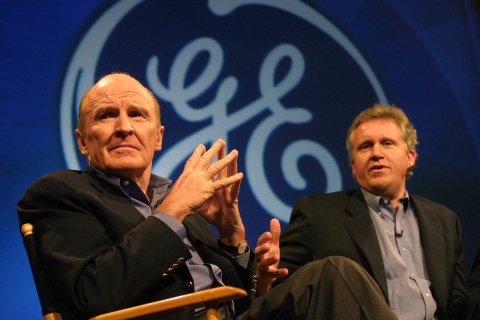

Welch grew GE into the biggest company in the world at the time he turned it over to Jeff Immelt, only to have the company eventually dismantled. Welch blamed his successor. Immelt tells a different story. Where does the truth lie?

As usual, the truth lies somewhere in the middle. There's no question that Jack hyped the company and wowed the Wall Street analysts who covered it and the shareholders who invested in it. Its valuation got out of hand, far beyond how an industrial and finance company should trade. But that was Jack's magic. He got people believing, much the way Elon Musk has made a whole host of people believers in Tesla, and its crazy valuation. I think Jeff suffered from hubris. He made a lot of poor, and unfortunately consequential decisions, from paying too much for Alstom and selling NBCUniversal too cheaply to kind of freaking out during the 2008 financial crisis. The combination of Jack's hype and Jeff's hubris was fatal. And that's why GE is slowly but surely being dismantled after an incredible 130-year run. It didn't have to happen this way. But the choice of a company's CEO really matters.

What do you think was the most significant reason for one of America's most reliable blue-chip stocks to dissolve?

It's such a good question. And there are many reasons—overpaying for acquisitions, selling companies too cheaply, failing to understand the risks inherent in a massive finance company, overpromising and underdelivering, inviting an avaricious hedge fund into the shareholder base—but I think in the end, it came down to hubris, somehow believing that GE was exceptional and that no matter what decisions its management made, for better or worse, they would all be for the best. In the end, though, GE was a bit like a game of Jenga, all good until mistakes start being made, and then causing the whole structure to collapse.

In a final death knell, GE announced in 2021 that it would split into three companies. What do you project for the future of the three former GE divisions?

I suspect that each of them will eventually get bought by other companies and that soon enough there won't even be remnants of the original GE left. Each of three companies will be publicly traded, meaning they are for sale to anyone at any time, and they are each a leader in their industries—power systems. medical equipment and the manufacturing of jet engines. The jet engine business is clearly the crown jewel but the others are fairly dominant too in their respective industries. I suspect any of their competitors, or a private equity firm, would love to own any one of them, if that becomes possible, which it surely will when they start trading publicly in 2023 and 2024. It's hard to fathom that the company that was once the world's most valuable, admired and powerful will soon be no more. But how and why that happened is what Power Failure is all about.

Are you persuaded that there were synergies in running these companies under one umbrella? Is there a more general lesson about the costs and benefits of conglomerates?

Wall Street can be very faddish, appearing to award high valuation multiples to companies without any discernible rhyme or reason. That's what happened to conglomerates in the 1960s, '70s and '80s. GE was a diversified company before then, of course, but was focused on its industrial businesses—manufacturing appliances, power systems and jet engines. Once Wall Street started rewarding companies for being conglomerates, Jack and his immediate predecessor, Reg Jones, began diversifying GE into areas where it had traditionally not had much of a presence. Bigger seemed better and a virtuous cycle was established. Jack was all in. He built up GE Capital. He bought RCA, itself a conglomerate that owned NBC. He bought Kidder Peabody, an investment bank. He bought a bunch of insurance companies. He got GE into the business of manufacturing health care equipment. And pretty much everything he did turned to gold. But it remained an open question whether it all added up to a coherent and "synergistic" whole. It probably didn't, but most of it worked well together. Now, that's a moot question, of course. It is being broken up into three companies and dissolving after 130 years. Jack Welch would be furious if he were still around to see what's become of the juggernaut he built.

What is the most surprising thing you learned when researching the book?

I had no idea GE had once owned RCA. After World War I, Woodrow Wilson wanted an American company to control the radio technology that had proved so useful to the Allies during the war. So Wilson (and FDR, then the acting Secretary of the Navy) basically insisted that GE start RCA, that GE also buy the American subsidiary of British Marconi and that it not be allowed to sell its groundbreaking radio technology to the British because of national security concerns. Then, in the 1930s, the Justice Department sued GE to force it to divest RCA (on monopolistic grounds), which GE did. But, in 1985, when GE bought RCA for more than $6 billion—then the largest acquisition of all time—there was barely any mention that GE had previously owned it, had been forced to sell it off and now was buying it back. And for what it's worth, GE's acquisition of RCA turned out to be one of the best M&A deals of all time.