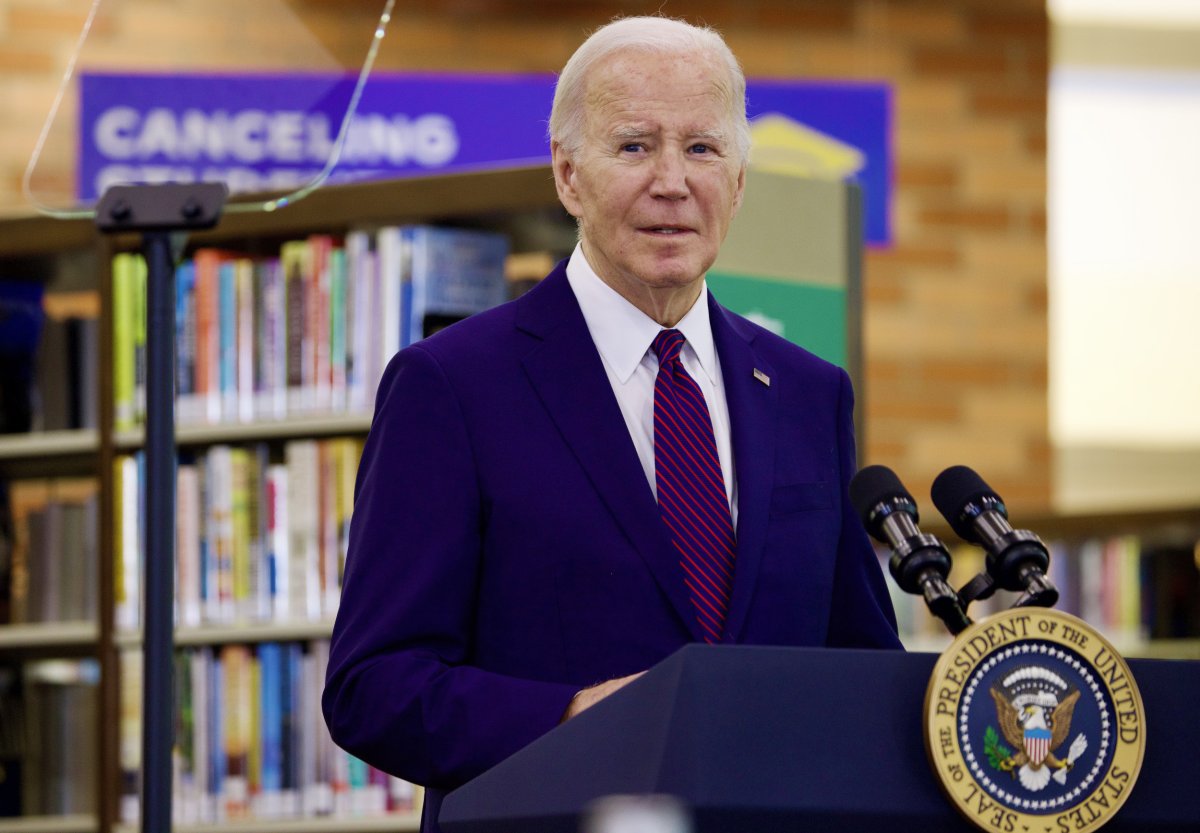

President Joe Biden's student loan forgiveness plan issued on Monday could unexpectedly boost prices in the housing market, particularly impacting first-time homebuyers, a new report from Realtor.com says.

The relief plan, intended to increase economic accessibility by canceling or reducing student loan debt for over 30 million Americans, could enhance purchasing power for many potential homeowners by reducing or eliminating their student debt, according to the report issued Monday.

Read more: First-Time Homebuyer Guide

Experts say that increase in buyer capability could exacerbate the already fierce competition for affordable homes, potentially leading to higher prices due to the stagnant supply of available housing.

Ed Pinto, co-director of the American Enterprise Institute Housing Center, told Realtor that there could be an unexpected downside to the increased buying power.

"People could qualify for more house because they have more buying power, but because this does nothing for housing supply, the increased buying power will result in higher home prices."

Realtor's data backs Pinto's concerns. With the median home list price standing at $424,900 and mortgage rates hovering around 6.82 percent, the market is already challenging for many Americans. The injection of more capable buyers into the market could push those prices even higher, particularly impacting the affordability of homes in lower price brackets, which are often targeted by first-time homebuyers, Realtor said.

The report also suggests that while the student debt relief might help individuals save up for larger down payments, the overall impact could instead make homeownership less accessible for many.

"We have an affordability crisis in our country when it comes to housing," Vance Barse, a San Diego-based financial planner, told Realtor. "The most common complaint we hear from millennials and Generation Z is their frustration around the fact that they cannot afford a house because they are riddled with student loan and other types of debt."

According to data issued by the U.S. Department of Education, as of the end of last year, Millennials, ages 25–34, carry the fourth highest average student loan debt at $32,760, while Gen Z, ages 24 and younger, holds the lowest average at $14,085.

Biden's new student loan forgiveness plan could offer relief to millions of those borrowers, and more, potentially reshaping the economic landscape for a large segment of the population. According to the proposal, borrowers could see up to $20,000 of accrued interest erased, with the total cancellation affecting roughly 4 million individuals outright.

Additionally, more than 10 million borrowers are expected to benefit from a minimum of $5,000 in debt relief.

According to Realtor chief economist Danielle Hale, "Relieving student debt will free up money for people to spend on other priorities, which is likely to include either homebuying or renting."

The administration's plan, if implemented, also extends benefits to borrowers who have been in the student loan system for decades, offering forgiveness to those who began repayment 20 or 25 years ago, respectively for undergraduate and graduate loans.

The policy also includes provisions for borrowers enrolled in income-driven repayment plans.

Those borrowers will see the interest accrued since entering repayment completely forgiven if they earn less than $120,000 annually. The administration said that is designed to prevent the ballooning of loan balances due to accumulating interest, which has historically pushed many borrowers into a cycle of debt that outpaces their ability to pay down the principal.

Read more: How to Consolidate Student Loans

This is the Biden's latest bid at canceling student debt. In June of last year, the Supreme Court blocked an attempt by the Biden administration to cancel up to $20,000 in student debt for borrowers.

With an increased amount of disposable income, the impact could show itself in the housing market. As buyers come into a potential windfall via the student loan savings, Realtor notes that the demand in an already tight housing market could drive prices up.

Newsweek has reached out to the White House by email for comment on Tuesday.

Uncommon Knowledge

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

About the writer

Aj Fabino is a Newsweek reporter based in Chicago. His focus is reporting on Economy & Finance. Aj joined Newsweek ... Read more

To read how Newsweek uses AI as a newsroom tool, Click here.