This article first appeared on the Council on Foreign Relations site.

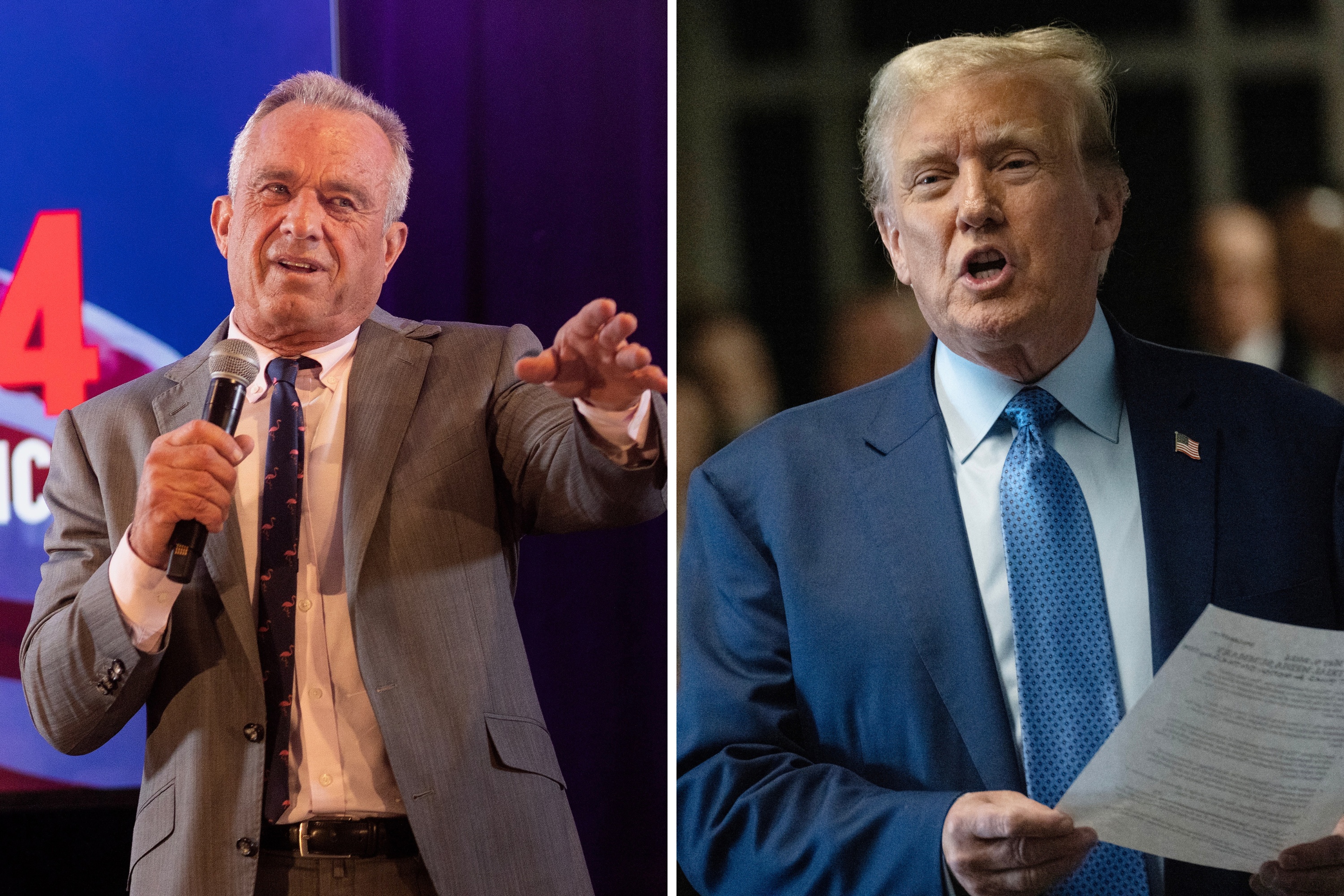

The election of Donald Trump creates extraordinary uncertainty about the future course of U.S. economic policy.

Markets don't like extreme unknowns, and there are valid reasons to fear that Trump's policy proposals on trade and our economic alliances would be seriously disruptive to the global economy.

As of writing, Dow futures have fallen more than 2 percent, taking down equity markets worldwide. Gold has risen more than 2 percent, while the Mexican peso has fallen around 9 percent.

Others have written in depth about the policies of the new president in the areas of trade and immigration, which were the centerpieces of his campaign. This article looks at other elements of the economic agenda.

President-elect Trump seems set to pursue a dramatic, even radical, revamping of the U.S. economy. His advisers have signaled that, on assuming office, he will use executive orders in a wide range of areas, including trade, immigration and financial regulation. Beyond that, though, he will need congressional support.

While he will have the advantage of Republican majorities in both houses, his economic policies are in many respects outside of traditional Republican orthodoxy, suggesting that he will need to build bipartisan coalitions on specific issues.

His plans for an aggressive tax cut and advancing critical campaign promises—in areas such as infrastructure, repealing and replacing Obamacare and energy reform—are likely to fall short of the 60 votes needed in the Senate to advance. The critical question will then be whether he seeks to build coalitions across party lines at a time where there are limited areas of consensus.

The Short View: A Worried Market and a Lame Duck

Even before Trump takes office, the election will guide progress on the economic agenda. The current and future president—and perhaps more important, the Federal Reserve—will need to calm markets and signal confidence in the resilience of the U.S. economy.

Trump also will need to walk back his suggestions during the campaign that he would renegotiate the debt or interfere with the independence of the Federal Reserve. Providing that reassurance will not be easy.

As for fiscal policy, the lame-duck session of Congress that begins on November 14 will need to, at a minimum, pass an appropriations package before the current funding bill expires on December 9. This, along with the National Defense Appropriation Act and a water development bill that would include resources for Flint, Michigan, and Hurricane Matthew relief, appear to be the only "must-pass" pieces of legislation in the session.

While some elements of the president-elect's economic agenda could be addressed as add-ons to these bills, the more likely scenario is that difficult decisions will be left for the next Congress. Consequently, it appears increasingly likely that, as regards the economic agenda, the lame duck will indeed be lame.

The Long View: Confrontation and Gridlock

Once in office, Trump has the executive power to pull out of trade agreements, restart the Keystone XL pipeline and bring trade cases against China, all central promises he made on the campaign trail. Enacting core elements of his program beyond those initial actions, however, would require cooperation with Congress.

What this means for fiscal policy is far from clear. Over the past year, with the economy on steady ground and the Federal Reserve seemingly committed to a slow, steady normalization of interest rates, there was a reduced sense of urgency on the fiscal front.

It is likely that, while we could now see some fiscal easing, particularly in the context of a fiscal year 2018 budget that will see pressure to ease the sequester caps, it appears likely that Congress will continue to demand that new spending initiatives be "paid for" by new revenue or spending cuts elsewhere.

The logic behind a grand bargain that would link comprehensive tax reform with efforts to put entitlements on a firmer long-term basis remains on the table. But the election campaign that concluded saw little support on either side for curtailing entitlement programs (beyond Republican calls to replace Obamacare).

Repatriation Is a Mother Lode of 'Pay-Fors,' but Pay for What?

Short of a grand bargain, there does seem to be bipartisan interest in a deal that would allow for a repatriation of foreign income by U.S. companies. (Trump appeared to support such a deal during the campaign.)

By some reports, there is $2.5 trillion in profits parked offshore by U.S. companies, and a deal to bring back that money could raise as much as $200 billion in revenue. Much of the low-hanging fruit has been used, and so the repatriation bill (which also shifts taxation to a hybrid territorial system) is critical not only as a matter of tax policy but also for what else it makes possible.

But if repatriation is on the agenda, what would it pay for? Trump has articulated a wide set of economic issues on which he would like to move forward. At the top of the list would appear to be an effort to repair our aging infrastructure, on which there would appear to be bipartisan support.

Large-scale tax cuts also will be on the agenda, but nonpartisan analysis suggest that Trump's plan would lead to massive increases in the deficit, unless Congress assumes unrealistically high growth rates. I expect, and hope, that Congress would balk at this plan. Even for a pared-down set of cuts that also reformed corporate taxes, a repatriation deal would likely be needed as part of the package to compensate for revenue losses.

And of course he would have strong Republican congressional support for a reform of Obamacare, which could also require pay-fors.

Looking abroad, the economic agenda includes an array of international challenges. Brexit, growing pressures on the eurozone and what to do about rising trade imbalances with China and other emerging markets—all are set to be challenges to the new administration.

Policies attacking China for currency manipulation (at a time when China is spending reserves to resist depreciation, the opposite of what the law seeks to prevent) are sure to provoke retaliation and disrupt growth and trade.

Financial policies are also on the agenda. A deal raising the federal debt limit also will be needed next year. Separately, appointments for the administration on financial policy will be watched closely.

Trump has called for a revamp of the regulatory framework adopted after the Great Recession, but aside from a dislike of Dodd-Frank legislation, it is not clear whether there is a consensus on how to proceed.

The Federal Reserve also will be an issue, with a significant number of seats on the Board of Governors open (or likely to open) over the next year. In addition, the new administration is expected to move to appoint a financial vice chair and replace Janet Yellen in 2018, at a time of challenge to the Fed from both the left and right.

Finally, on the housing front it is unlikely that we will see movement on the government-sponsored enterprises, or GSEs, and on the framework for supporting homeownership.

The outlook for the economy may depend on whether the new president resists the temptation to overuse executive orders to force rapid and contentious changes to the U.S. economy and instead looks to Congress to build strong governing relationships and a coalition for reform.

In any scenario, we are taking U.S. economic policy in uncharted directions. The results are likely to be consequential for the economy for some time to come.

Robert Kahn is the Steven A. Tananbaum senior fellow for international economics at the Council on Foreign Relations.

Uncommon Knowledge

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

About the writer

To read how Newsweek uses AI as a newsroom tool, Click here.