While 2024 Social Security payments got a boost from the yearly cost of living adjustment (COLA), many Americans will face taxes on their monthly benefits.

All Social Security checks are taxable by the federal government, but most Americans are able to get by with their benefits without being taxed by their state.

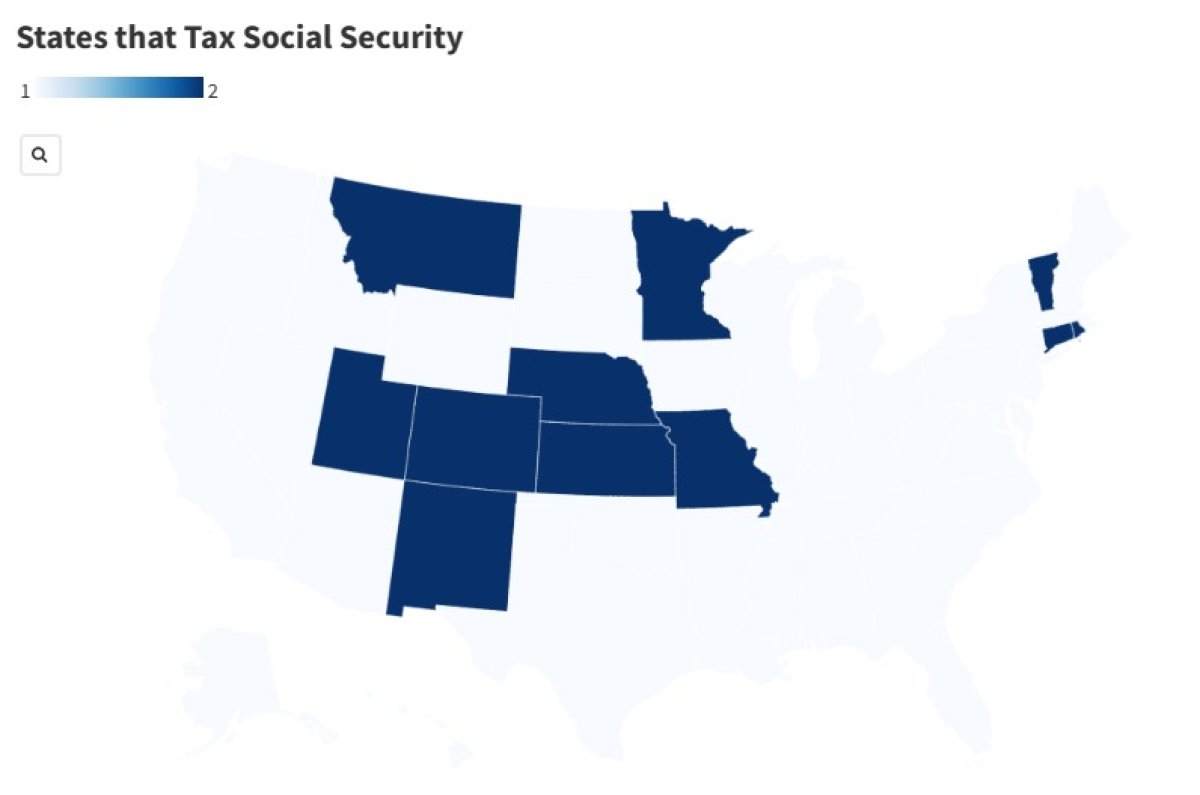

However, this is not the case in the following 11 states: Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, Rhode Island, Utah, and Vermont.

Individual taxes will differ by state, as each has its own rules about handling federal retirement benefits.

There are some caveats, however.

In Connecticut, all seniors with an adjusted gross income of more than $75,000 (or $100,000 for couples) can deduct the majority, if not all of their benefits.

Read more: The Best Types of Savings Accounts to Watch Your Money Grow

And Kansas Social Security beneficiaries can opt out of state taxes as long as their adjusted gross income is below $75,000. Meanwhile, Missouri seniors don't pay taxes if bringing in an income under $85,000 (or $100,000 for married couples).

Montana has a similar rule for those who make less than $25,000 annually, allowing them to deduct all of their income.

Other states, like Nebraska, limit taxes for those making under $44,460 and plan to eliminate the state income tax on Social Security by 2025. Meanwhile, New Mexico residents get out of taxes on their benefits as long as they make less than $100,000 yearly.

There is no specific yearly income that exempts you from taxes nationwide, as Rhode Island implements a limit at an annual adjusted income of $86,350.

Vermont has a tougher income requirement to meet, taxing all Social Security benefits for those making over $50,000, although people making between $50,000 and $60,000 get a partial exemption.

Utah, on the other hand, taxes all benefits if you make more than $30,000 as an annual adjusted gross income.

Alex Beene, a financial literacy instructor at the University of Tennessee at Martin, said because most of these states adopt income requirements for Social Security to be taxed, many retirees are still safe from seeing their benefits taxed.

Read more: 7% Interest Rate Savings Accounts

"For the vast majority of those collecting social security, their income has gone down substantially due to retirement and/or a reduction of hours towards the end of one's working lifespan, so the likelihood of them getting taxed is lessened," Beene told Newsweek. "Still, with rising prices, every dollar counts, and additional taxes need to be considered in your plans."

However, if you're in any other state, you should be in the clear and can get out-of-state taxes on your benefits.

Finance expert Michael Ryan, founder of michaelryanmoney.com, cautions retirees from ruling out a state as a retirement destination just because of the tax stipulations.

"Don't simply rule out an entire state if you see it has a Social Security tax," Ryan told Newsweek. "The ultimate financial impact depends massively on your specific income situation and filing status. That's why consulting a qualified tax pro is crucial if you're considering relocating for retirement."

Uncommon Knowledge

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

About the writer

Suzanne Blake is a Newsweek reporter based in New York. Her focus is reporting on consumer and social trends, spanning ... Read more

To read how Newsweek uses AI as a newsroom tool, Click here.