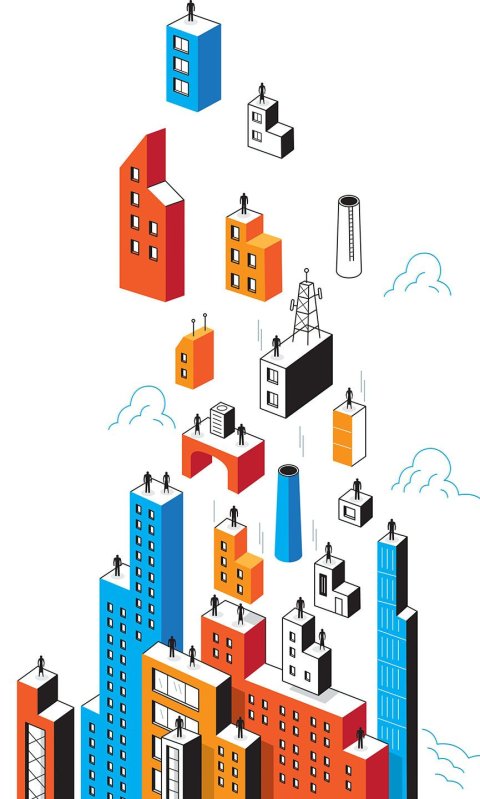

The new tax law written by House and Senate Republicans will help technology tear apart the way society has worked for 100 years. Which no doubt was an accident on Congress's part, but still…

Two provisions in the law—changes in taxes for homeowners and independent contractors—will add rocket fuel to a decadelong trend toward extreme mobility, which really got moving when Apple introduced smartphones and apps in 2007. In the following few years, we started to figure out that "cloud computing" wasn't something you did while under the influence of psilocybin mushrooms. Today, 2.5 billion people worldwide use smartphones, and we've come to expect ubiquitous access through the cloud to apps, services, media, friends, family, even money.

Now nearly anything we used to have to do in a specific place we can now do wherever we happen to be—and most of us want more of this. No sane company today would introduce a product or service that doesn't include a mobile app. Buy a bottle of Medea vodka and you get an app. (How long before we can just download booze?)

Extreme mobility has broad and deep implications. A generation or two ago, the goal for a wide swath of American adults was to buy a house, get a job and then live in that home and work for that company for decades. That version of the American dream has been hacked to pieces. Millennials are not buying homes, preferring to easily move when necessary. Homeownership for that demographic has fallen faster than for any age group, according to U.S. census data, and the overall rate of homeownership in the third quarter of 2017 was a paltry 63.9 percent—about the same as in 1967. U.S. homeownership rates peaked at 69.2 percent in 2004, when baby boomers were raising their millennials.

Mobility is even more of a transformational force when it comes to work. Just look at the rise of the gig economy—more and more people are opting for work instead of jobs. A recent Intuit study estimated that about 34 percent of the U.S. workforce is doing freelance gig work, and that will jump to 43 percent by 2020. In less than five years, just half of the working population will be tied down by a job.

Technology is the engine of extreme mobility. Apps are key to finding ways to make money, whether it's driving for Uber, selling stuff on Etsy or doing expert consulting through Catalant. Products like Zoom video conferencing and the Slack business chat app help companies operate virtually, so a team can work together no matter where they are. In every way, we're able to be freer from place or commitment than at any time since we civilized our way out of a hunter-gatherer lifestyle. Whether that's good or bad may make good fodder for CNN panel blather, but it's the inescapable reality of where we're heading.

The federal tax code has long supported our more fixed lifestyle. You got a tax break to be an employee instead of a gig worker (employees, for instance, end up paying only half of their Social Security tax; employers pay the other half), and you got a tax break on your home's mortgage interest and property tax payments. For much of the 20th century, those tax breaks fit society, encouraging the stability of long-term employment and homeownership. But now those goals are at odds with our lives and our economy.

The new tax law cuts back on mortgage interest and property tax breaks, which is expected to make homeownership less desirable and renting more desirable—which, in turn, should lead to the development of more rental properties, making renting cheaper and easier.

Same with work. The new tax law allows "sole proprietor" gig workers to deduct 20 percent of their revenue from taxable income—a sizable break that will make it even more attractive to get out of a job and freelance. Companies will welcome it. "Firms currently have a lot of incentives to turn workers into independent contractors," Lawrence Katz, a labor economist at Harvard, told The New York Times. "This reinforces the current trends."

Laudable goals all—if they were in fact the goals of those who wrote this new tax code. But Congress's support of extreme mobility appears to be an accident. The tax changes for homeowners were put in place primarily to offset revenue lost from other cuts, like dropping the corporate tax rate to 21 percent from 35 percent. If Congress set out to write a tax code that increased mobility, it could've gone much further.

For instance, single-payer guaranteed health care would be a huge mobility booster. People stay in jobs today just to get health insurance. If we truly wanted work mobility, the nation would separate health insurance from employment. Of course, most Republicans would rather eat cactus needles soaked in battery acid than push for national health care right now, so the new tax law instead tries to cripple the Affordable Care Act.

And then there's the criticism that the new law benefits the wealthy at the expense of everyone else. Economic mobility has always been at the heart of the American ideal. But instead of making economic mobility more extreme, the new law creates obstacles to moving up and doing better. The Tax Policy Center concluded that nearly 50 percent of the benefits of the tax law would go to the top 5 percent of household earners in the first year of the law. And by 2027, the center said, 98 percent of multimillionaires would still get a tax cut, compared with just 27 percent of households making less than $75,000.

The next time around, maybe Congress will adjust more aspects of tax law so it aligns with the new extreme mobility. And in keeping with the times, when Congress next passes a tax bill, it needs to make sure there's an app for that.