Updated | In 2013, James "Jimi" Crawford founded a company called Orbital Insight, barely noticed at the time amid the Silicon Valley froth. Crawford had worked at NASA for 15 years and wrote software for Mars rovers. He left NASA to run engineering for Google Books, and while there he noticed that Elon Musk's SpaceX and other new companies were driving down the cost of building and launching satellites. Crawford saw an opportunity to collect and analyze what he anticipated would be a deluge of images from a surfeit of new satellites that would circle the Earth, taking readings and pictures. Orbital Insight's first product looked at images of cornfields all over the world, analyzing the health of plants to predict yields for traders who bet on future price swings.

About two years later, Silicon Valley's top investors decided Orbital Insight might be huge. Venture firms pumped $20 million into Crawford's company in June 2016 and then another $50 million in September 2017.

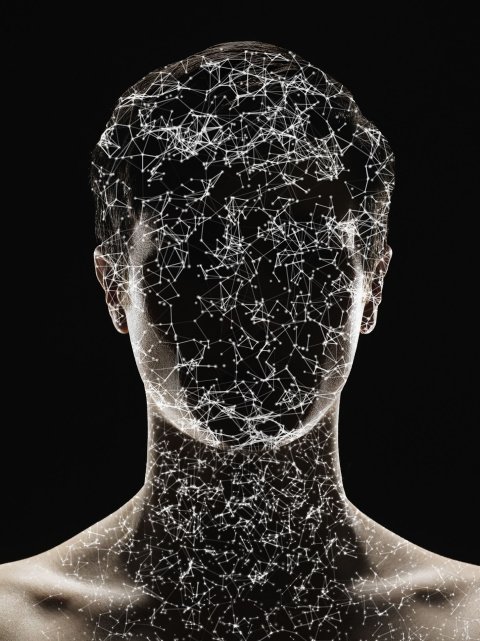

That surge of excitement wasn't because Crawford (or investors) suddenly got smarter—it was because of significant advances in alternative intelligence. "In 2015, for the first time ever, computers got better at object recognition than humans," Crawford has explained. AI can learn to recognize a tree or ship and see patterns amid billions of objects in images and data. Prior to such AI breakthroughs, satellite data were infinitely less useful—too cumbersome to be analyzed at fast enough speeds by traditional algorithms running on computers. Using AI, all that raw output from satellites can help traders, investors and corporations know things they could never know before and almost as soon as they happen.

Early in 2017, Orbital Insight got attention for being able to mix data from various sources to find pirate fishing boats that had gone dark by turning off their radio beacons—a discovery more useful to maritime law enforcement than business, but a strong proof point for the company's technology. In the fall, Crawford's team relied on data from a new type of satellite technology called synthetic aperture radar to peer through Hurricane Harvey's clouds as the storm hammered Houston. The usual satellite photos, as you might guess, can't see through clouds. Knowing the extent of flooding during the hurricane proved tremendously helpful to insurance companies that would have to settle billions of dollars of claims later. Those two wins—the pirate ships and Harvey—helped convince hedge funds and major banks to pay Orbital Insight millions for data sets that might help them learn something about natural resources, the movement of goods or anything else that the competition didn't yet know. "We've only just begun to uncover a handful of signals, but we've already seen the impact they can have on financial, energy and insurance markets, as well as society as a whole," Crawford said in a statement.

As Orbital Insight's business has grown, it has been hiring aggressively, looking for data scientists, marketing managers and talent recruiters. But that's only the beginning. Orbital Insight and companies like it are ravenous for raw satellite data, so they are buying it from satellite companies, adding more fuel to the satellite boom. The relatively inexpensive, small satellites that observe conditions on Earth are the fastest-growing segment of the $260.5 billion global satellite industry, the Satellite Industries Association said in a report in July 2017. That's helping create a cascade of jobs, from rocket scientists (of course) down to maintenance workers who sweep launch pads. In December, LinkedIn listed more than 11,084 satellite industry job openings in the U.S.

Orbital Insight is just one of a many new companies in an exploding field called alternative data. The market for alternative data was about $200 million in 2016 and is expected to shoot to more than twice that by 2020, according to research firm Tabb Group. Alternative data refers to data outside of mainstream information, such as government statistics, stock prices, company financial reports and consumer credit card transactions. Alternative data comes from sources such as cellphone signals, "internet of things" sensors on industrial equipment, online videos, tweets, searches, social media likes—and satellite images.

Making use of all that raw data often means connecting several types of data to get a glimpse of a trend otherwise impossible to spot. AI makes that possible. The alternative data industry could not exist without AI. And an alternative data industry could not exist without humans. At a time when most of the rap against AI is that it will kill jobs, the rise of the alternative data business shows how AI can create jobs nobody even thought of before.

Double Data-ing

It's easy to believe artificial intelligence is about to automate away truck drivers, radiologists, accountants, fast-food clerks and just about every kind of manufacturing job and leave the world with just two classes of people: a thin layer of rich geeks on top and then the rest of us—a giant, grumbling population of families living on government-issued guaranteed incomes and spending our days doing little more than playing with model trains or clicking down YouTube rabbit holes. When Quartz surveyed 1,600 readers this past July, 90 percent agreed that half of today's jobs will be lost to automation in five years—though in classic human thinking, 91 percent of respondents said other people's jobs will be axed, not their own.

In recent months, however, some smart folks in the business world have been arguing that our future isn't so bleak, rolling out study after study showing AI will create many more jobs than it will destroy. A study by tech analyst firm Gartner concluded that by 2020, AI will automate 1.8 million people out of work but will create 2.3 million jobs—a net gain of 500,000 jobs. Capgemini, a consulting group, released a report saying that 83 percent of companies that implemented AI found that the technology created new jobs. Deloitte, another consulting firm, studied automation in the United Kingdom and found that 800,000 low-skilled jobs were eliminated because of AI, but another 3.5 million positions were created, and those new jobs pay on average $13,000 more per year than the jobs that went poof.

Such statistics aren't always comforting in the face of an AI threat that seems so obvious. If we build self-driving trucks, millions of truck drivers will be rendered obsolete. We have dealt with the AI-driven chatbots replacing the human customer-service reps who used to answer our calls about how to buy the right size shoe or fix a finicky cable TV box. Last year, Deloitte did another study showing that within a decade, AI will automate away 39 percent of jobs in the legal sector—mostly lower-level paralegals and legal secretaries. We are familiar with those kinds of jobs and can easily imagine how people will get hurt if they are replaced by AI.

It's harder to imagine industries that don't yet exist and how they will create jobs for all types of workers, not just those who have an innate knack for writing code or designing a computer chip. That's what makes the alternative data industry intriguing now: It is one of the early, emerging industries that has come into being because of AI. (Others range from the business of making computer chips specifically to run AI to a budding field of "AI ethicists" who teach AI to behave well.)

The investing world awakened to alternative data thanks to an event in April 2016. Foursquare, the location-based social networking app, detected something odd in its data from the 50 million people using its apps to log the places they visited. At the time, the Chipotle restaurant chain was working to bounce back from a 2015 E. coli scare, and it reported that seasonal foot traffic to its restaurants appeared to be getting back to normal. But Foursquare noticed that its users who had previously visited a Chipotle were going to other restaurants instead. The foot traffic was due to promotions that lured in newcomers who just wanted to get a cut-price burrito. That meant Chipotle was losing its loyal customers. Foursquare made note of this in a blog post just before Chipotle reported earnings that showed that sales dropped 30 percent. Suddenly, traders around the world wanted the kind of magic Foursquare possessed.

In recent years, the generators of new kinds of raw data have been exploding. We carry cellphones everywhere, creating sometimes-anonymous and sometimes-not data about where we are when we do certain things. Newfangled sensors track industrial parts, air quality, how many steps we walk. The more we do online, the more data our activity generates—and these days we shop, talk, socialize, bank, work and watch TV on computer or phone screens.

A single source of data might result in a narrow insight into people's behavior, but there is exponential value in crossing different kinds of data sets. "No matter how large your data set, you'll always miss the bigger picture if you're viewing it in isolation," Adam Gibbs of alternative data company Enigma tells me. "The true value of data lies in connecting many pieces together from various sources to create a holistic view."

That's where AI becomes critical. It works somewhat like a research assistant. You tell it that you have a theory about what might be learned by cross-referencing different kinds of data and set the AI loose to crawl all that data and learn on its own, looking for complex patterns that would escape even brilliant humans. And unlike a human, an AI bot can absorb and learn from massive floods of data in an instant.

Matei Zatreanu, founder of alternative data company System2, noted that AI learning coupled with multiple data streams can help investors see the world at a granular level, such as understanding the decisions of individuals. "You can look at credit card data—that gives info on an individual person," Zatreanu told Business Insider. "The huge difference is, unlike marketers, I don't care that your name is Rachael and you live at a certain address. I just care that a person with ID 345 used to shop at a Whole Foods but then—all of a sudden—an Aldi opens up in your neighborhood, and now I see that person with ID 345 no longer shops there, and I see an Aldi transaction. That means Whole Foods potentially lost a customer."

Such insights can suggest trends stock traders or hedge fund managers can bet on. The slightest edge from alternative data can be worth hundreds of millions of dollars—the difference between an underperforming fund and a hot "alpha" fund. "The ability to source and analyze alternative data has become an essential skill for professional investors," said Tammer Kamel, CEO of alternative data provider Quandl, in a statement.

With so much money at stake, unique alternative data has become highly valuable, and that's luring entrepreneurs to start all sorts of alternative data companies. Aclima and Understory rely on sensors to zero in on superlocalized weather patterns. Premise gathers prices from local stores. Enigma connects the kind of data governments have long supplied—like what doctors are prescribing to Medicare patients or which models of cars are coming into U.S. ports—in new ways, creating alternative data out of traditional data. Reveal Mobile is crossing GPS data with credit-card transactions to figure out people's patterns during the day. "When you go on errands, we'll be able to see that you go to Home Depot first, then the grocery store, then go to lunch," Reveal CEO Brian Handly said at a recent Newsweek conference on data and finance. Marketers might be able to anticipate your pattern and send you a lunch discount offer the minute you pull into the Home Depot parking lot.

All these companies are hiring AI specialists and programmers. They're also looking for people who are not necessarily technologists but know how to ask interesting questions for the AI to check out. Foursquare would never have made hay about the Chipotle data if someone hadn't thought to wonder whether the foot traffic was from new or old customers. An expert in iron ore might know questions to ask AI about the movement of barges to get some insight about whether production globally is up or down.

This is all new work—jobs nobody could've imagined a decade ago, when the iPhone first came out.

IoT Jobs

Many jobs are getting created downstream from the hedge funds and alternative data companies. Look at the activity stirred up by one class of alternative data company that buys enormous amounts of information collected by "internet of things" sensors. More than 8 billion connected things are already deployed worldwide, according to Gartner, and that's expected to rise to 20 billion by 2020. Global spending on the IoT is expected to grow nearly 16 percent a year through 2020, when the market will reach $1.3 trillion, according to technology analyst firm IDC. That's a lot of commerce—and that means a lot of jobs for employees at all levels. Verizon, for instance, needs an army of workers to install IoT sensors in millions of street lamps. Those sensors track noise levels, air quality, the number of cars in parking lots and other factors. Other companies are hiring IoT designers and managers—retailer Target hired a vice president of IoT last year. Without AI making all that data valuable, little of this would be happening.

We are in the midst of an AI-driven data-gathering boom. In business circles, the meme is that "data is the new oil"—and finding new data is the new prospecting craze.

Which takes us back to satellites. By creating a rich market for satellite data, companies like Orbital Insight fund growth in the business of designing, making, launching and operating satellites. That's given birth to new companies such as Planet—founded, like Orbital Insight, by former NASA scientists. Planet is making satellites about the size of a footlong sub, and it operates 200 in orbit and raised $183 million in funding. Another young company, PlanetIQ, is working on launching a 12-satellite constellation.

Down the satellite food chain, new satellite operators drive business for satellite manufacturers in the United States (Boeing, Orbital ATK, SSL) and overseas (Dhruva Space in India, NanoAvionics in Lithuania). Those manufacturers, in turn, buy from makers of electronics, antennae, solar panels, nuts, bolts and everything else that goes into a satellite. The workers in factories making the nuts and bolts for satellites may not know anything about AI, but AI is a big reason they're employed.

It's impossible to count how many downstream jobs are already directly attributable to AI, yet there's no question AI makes data far more valuable than ever—the way the mechanized loom made cotton more valuable 250 years ago by greatly multiplying what could be produced with cotton.

It's true that AI will automate away vast numbers of jobs in coming years. But emerging sectors like alternative data promise to give many more humans something to do more productive than watching Simon's Cat all day.

Correction: A previous version of this article referred to Planet as "Planet Labs." The company changed its name from Planet Labs to Planet in 2016. A past version of this article also misstated the number of satellites Planet operates. It currently operates 200 satellites.