Facebook seems ready to radically reimagine credit cards—minus the "card" part, of course. It's already a foregone conclusion that by next decade carrying a plastic card to buy stuff will be as anachronistic as hauling around a boom box to listen to music.

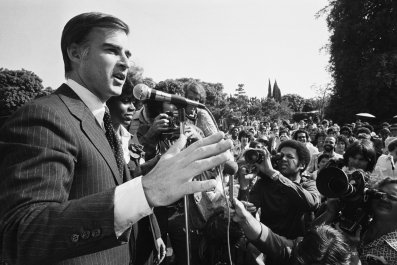

Facebook is reportedly going to give its Messenger app the ability to make payments, much like Apple Pay or Android Pay. This direction became evident way back in 2014, when Facebook hired mobile payments whiz David Markus away from PayPal to run Messenger. (Some enterprising folks at The Information analyzed Messenger source code and found telltale signs of a coming payments capability.)

By itself, a Facebook pay service is not super interesting. It smells like me-tooism. Samsung has it, and even Amazon just announced a payments service. These are just another way to do what we've been doing, since all mobile pay services run on top of existing credit card accounts. Facebook Pay would simply be a Visa card on Facebook.

The interesting part would come next. If Facebook provides you with the ability to pay, starts collecting your transaction data and adds that to your social data that already says a lot about your character—well, then Facebook will have the kind of information it needs to become a stand-alone credit card company.

That would mean Facebook could jettison Visa, MasterCard and FICO scores and directly offer you credit based on everything its machines can learn about you—while charging much lower interest rates and cheaper fees than current cards. It would be free from all the costly infrastructure and middlemen now involved in credit cards.

"They'll be in perfect position to extend credit and become a financial services company," says Jeff Stewart, chairman of Lenddo, a company that knows a lot about this space. Facebook Pay could slap the current financial services industry into a disorienting spin. The effect would be similar to the way free, Internet-based Skype messed up the high-priced, phone-line-based long-distance calling business.

Credit, as it has evolved since the 1950s, is cold and impersonal, completely based on numbers—what you owe, what you've paid, how much money you have. The numbers all get hacked down to one number: a credit score. The bigger and more complex the global financial system gets, the less it cares about anything other than your number. Nobody knows you at your bank. Your personal story is white noise in the software. Your "character" fits into their algorithms about as well as peanut butter fits into the workings of a Swiss watch.

One consequence of this system is that it's rigged against poor people, unbanked people and young people. They can't get credit, so they can't generate the numbers that would prove they should be given credit. It's these several billion people who would be the most enthusiastic first customers of a new kind of credit based less on numbers and more on character. This would mark the emergence of social credit.

Lenddo, founded in 2011, helped prove social credit works. Its insight was that your social information could better determine whether you'd pay back a loan. Lenddo got the idea from scientific studies that showed real-life social circles are great predictors of certain kinds of behavior. One study showed that your friends are a great predictor of whether you'll get fat; another proved the same about smoking.

Lenddo proved the concept works for loan repayment by testing it for three years in developing countries. Instead of looking at real-life social circles, the company analyzed the Facebook connections of people applying for a loan. Lenddo says its software is as good or better than typical financial software at determining creditworthiness and deterring fraud.

Other companies have been working on similar software. Affirm takes a slightly different approach, mixing social data and other public information about a borrower into its formula. Asked why one particular person got an Affirm loan, CEO Max Levchin—who, like Facebook's Markus, came from PayPal—replied, "I wouldn't know. Our math model says he's OK. Probabilistically, he's good for the money."

So let's say Facebook decided to get into credit, perhaps using Lenddo or Affirm. First of all, there'd be no more "applying" for a credit card. Facebook would have all the data it needs about you. So even if you've never borrowed a dime, you could be standing in front of a big-screen TV in a store and instantly find out if you could get credit to pay for it through Messenger. Credit would be more of a fluid part of life rather than a fixed account with a credit limit.

Online, Facebook could use lending to make its ads more valuable. Since Facebook would be your credit card, it could let you just click on an ad and buy the thing, taking you from ad to purchase with zero friction. It might even give away credit to make more money on ads and commerce. Traditional credit cards couldn't hope to compete against that.

Who would sign up? In the U.S., about half of the population between ages 18 and 34 doesn't own a credit card, according to MyBankTracker.com. Other polls show the members of the young generation have little loyalty to banks but are heavy users of Facebook Messenger (even if Facebook has lost a lot of its hipness) and mobile phones. The target market is even more enticing in places like India and Asia, where populations skew younger, smartphone use is rocketing and great swaths of people have never even had a bank account.

Regulation, particularly in the U.S., could slow development of this. (Lenddo had to test outside the country because it would've run afoul of U.S. regulators.) Governments want to be able to track money and make sure, for instance, that software doesn't even accidentally discriminate against certain kinds of people. But that's going to get worked out. Protecting the old U.S. credit card industry at the expense of progress would only hand some company like China's WeChat a great, yawning opening to take the lead in social credit.

Anyway, who wants to be reduced to a number? For thousands of years before credit scores, lending was based on reputation. That's how George Bailey made loans in It's a Wonderful Life. Technology, ironically, can take us back to a more human way of doing things.

I'm now considering my circle of friends and wondering if I'll ever get a loan again.

Correction: A previous version said Jeff Stewart is Lenddo's CEO. That has been corrected.