In the aftermath of the 2008 financial crisis, much of the country was enraged because not a single Wall Street hotshot—the guys who got us into the mess—was prosecuted. While there are many financiers who could have been made to take the perp walk, there's also a case to be made that the fault lies with those who laid the intellectual foundation upon which a market-driven financial crisis could happen in the first place.

That brings us to Michael Jensen, a tenured finance professor at Harvard Business School, where he has spent the bulk of his career. Few still believe in the message he sold everyone on in the 1980s—not even at HBS—but the damage is done, and his legacy is an ugly one. So why does he still have a job? He has tenure, for starters, but the other reason is that when Harvard Business School talks about making the world a better place, it's just posturing. What it's about is making money. And in the 1980s, Jensen brought the school a lot of money and (for a few years) intellectual credibility. But that's getting ahead of the story.

In 1970, Nobel Prize–winning economist Milton Friedman published an essay in The New York Times Magazine titled "The Social Responsibility of Business Is to Increase Its Profits." Flouting the midcentury view (and that of the most influential faculty at the Harvard Business School) that the best type of CEO was one with an enlightened social conscience, Friedman claimed that such executives were "highly subversive to the capitalist system." His tone was snide. "[Businessmen] believe that they are defending free enterprise when they declaim that business is not concerned 'merely' with profit but also with promoting desirable 'social' ends, that business has a 'social conscience' and takes seriously its responsibilities for providing employment, eliminating discrimination, avoiding pollution and whatever else may be the catchwords of the contemporary crop of reformers. In fact they are—or would be if they or anyone else took them seriously—preaching pure and unadulterated socialism."

He then described the concept of the executive as "agent" of the company's shareholders: "In a free-enterprise, private-property system, a corporate executive is an employee of the owners of the business. He has direct responsibility to his employers. That responsibility is to conduct the business in accordance with their desires, which generally will be to make as much money as possible while conforming to the basic rules of the society."

Friedman didn't shy away from taking alarmist stances. If you want to get noticed in economics, you pretty much have to do so—just ask Paul Krugman. "[Speeches] by businessmen on social responsibility," Friedman wrote, "may gain them kudos in the short run. But it helps to strengthen the already too prevalent view that the pursuit of profits is wicked and immoral and must be curbed and controlled by external forces. Once this view is adopted, the external forces that curb the market will not be the social consciences, however highly developed, of the pontificating executives; it will be the iron first of Government bureaucrats."

Setting aside the hysterical tone of the above, as well as its exaggerations—the idea that the pursuit of profit is "wicked" has never been "prevalent" in the United States—Friedman made a compelling argument not just to those in whose interests he argued (shareholders) but to a managerial class that was on the verge of a nervous breakdown. Imagine the beleaguered CEO of a major American firm in the 1970s, hectored by employees, environmentalists and public opinion, all while being besieged by products from Japan that weren't just better but also cheaper.

Friedman was suggesting the release of those people from their obligations—contractual or otherwise—to anyone but the shareholder. They'd let their good nature get in the way of getting the job done, he was arguing, and it was time to throw off such naïve notions for the good of the country—nay, for capitalism itself.

It was a remarkable intellectual sleight of hand. Executives who act in ways most of us would consider moral—with an eye to the environment or some other social goal—are, Friedman said, acting immorally. When Joel Bakan interviewed Friedman for his 2005 book, The Corporation: The Pathological Pursuit of Profit and Power, the economist repeated the point he'd made nearly 40 years before, but with a twist. In Friedman's view, "hypocrisy is virtuous when it serves the bottom line," Bakan observed, "[whereas] moral virtue is immoral when it does not."

Even in 2005, Bakan was able to find a professor at HBS who was willing to channel Friedman's "brand of cynicism [that is] old-fashioned, mean-spirited, and out of touch with reality." According to then–HBS professor Debora Spar, corporations "are not institutions set up to be moral entities…. They are institutions which really only have one mission, and that is to increase shareholder value."

Just a small sample of people who've actually "set up" corporations would seem to suggest that such a blanket statement is entirely without merit. Yvon Chouinard, the CEO of Patagonia, certainly had a larger mission in mind. John Mackey, co-founder of Whole Foods, wouldn't agree with that premise. It also seems likely that the founders of Harvard, itself a corporation, wouldn't have either.

What's truly unfortunate is that if one considers the work of midcentury thinkers at HBS, the faculty stood almost alone in insisting that character had a part to play in management. Until it decided to hire the man who thought managers had no character at all.

The Unholy Birth of Corporate Raiders

By the late 1970s, after nearly three-quarters of a century of existence, Harvard Business School had carved out a nice little niche in the management universe. It had proved itself a dependable supplier of prescreened and highly motivated graduates to big business. HBS was still a dependable supplier of highly motivated graduates in the 1980s, but they weren't going to big business anymore. They were headed to Wall Street and consulting.

HBS also continued to put a high gloss on the management myth of the day, but those myths were increasingly finance-related, in particular the merits of shareholder capitalism. And it continued to deliver pseudo-intellectual capital that practitioners could use to justify their decisions. In the 1980s, HBS had abandoned its mission of trying to educate an enlightened managerial class. Instead, it threw its lot in with Wall Street as it was dismantling the edifice of American industry HBS had helped build. HBS had nurtured the professional manager from his birth and then helped to kill him.

The main way it did so was by endorsing the innocuously named "principal-agent theory" popularized by Friedman. While much of the faculty of HBS was still trying to figure out how to help American management resurrect its reputation and its fortunes as the 1980s began, Michael Jensen, then a professor at the University of Rochester's business school steeped in the University of Chicago's free market tradition, was making sure the good name of managers stayed buried. Along with William Meckling, the dean of Rochester's business school (and a graduate student of Friedman's), Jensen wrote a 1976 paper that would change everything. In "Theory of the Firm: Managerial Behavior, Agency Costs and Ownership Structure," he laid the groundwork for the most radical change in the hierarchy of power in corporate America since the robber barons gave way to professional managers.

Arguing that managers had become too entrenched and lacked discipline and accountability, Jensen and Meckling posited that investors were more trustworthy than managers as custodians of the American corporation. Managers weren't going to voluntarily reform, they said, so the system had to be adjusted so that they would be forced to do so. No longer would they be their own judge, or be judged by a jury they had picked, that is, their board. The market was henceforth to be judge, jury and executioner.

Until Jensen came along, executive pay was largely tied to company size—the highest-paid CEOs ran the largest companies. But the unproductive diversification of the conglomerate era had resulted in excess capacity, flat or declining profits, and stagnant share prices. As a result, the Dow Jones Industrial Average was basically flat from the mid-1960s through the early 1980s. That excess capacity played a large part in what Jensen called the "capital market restructuring revolution of the 1980s." Companies sitting on large piles of cash—and there were many, because executives back then were loath to return money to shareholders—suddenly became the target of hostile acquirers. The age of investor capitalism began, and its heroes were not CEOs but corporate raiders like Carl Icahn and T. Boone Pickens.

A wave of deregulation then created the active market for corporate control, with the new belief that the shareholder was supreme, absolving managers of responsibility to any "stakeholder"—employees, communities, society itself—except shareholders. The bottom line was all that mattered.

John McArthur, then dean of HBS, liked Jensen's message and invited him to HBS as a visiting professor in 1984. In a 1999 vanity project about McArthur's tenure, The Intellectual Venture Capitalist, HBS trotted out a rationale for hiring him: "Jensen had been interested in testing his unorthodox ideas against the experiences of practitioners and had agreed to come to HBS on a temporary basis to get increased access to high-level decision makers in business." Hogwash. "Theory of the Firm" was testable only in the sense that Keynesian economics is testable, or a theory of whether a hurricane might sweep beachfront houses out to sea is testable—you can debate the issues until you're blue in the face, but at some point, you just have to see what happens.

A course grounded in agency theory that Jensen developed at HBS—The Coordination and Control of Markets and Organizations—was designed to make students more "tough-minded" and shift them from the "stakeholder model" of organizational purpose. It became one of the most popular electives at the school. Agency theory wasn't new, but Jensen's resurrected form of it provided academic justification for the takeover movement, and HBS provided its revolutionary soldiers.

Ethics-Free MBAs

In a 1994 paper Jensen wrote with Meckling, "The Nature of Man," he cited the story of George Bernard Shaw asking an actress if she would sleep with him for a million dollars. When she agreed, he changed his offer to $10, to which she responded with outrage, asking him what kind of woman he thought she was. His reply: "We've already established that. Now we're just haggling about the price." The authors then concluded that we're all whores. "Like it or not, individuals are willing to sacrifice a little of almost anything we care to name, even reputation or morality, for a sufficiently large quantity of other desired things."

The solution they offered was premised on this cynical view of man and, having started from the assumption that we are all whores, they naturally ended up with prescriptions for making us well-behaved whores. "Unlike theories in the physical sciences," wrote Sumantra Ghoshal, a professor at the London Business School, in his 2005 paper, "Bad Management Theories Are Destroying Good Management Practice," "theories in the social sciences tend to be self-fulfilling…. This is precisely what has happened over the last several decades, converting our collective pessimism about managers into realized pathologies in management behaviors."

In other words, if everybody assumes you're a whore, you might as well grab as much money as possible while you're still in demand. "[By] propagating ideologically inspired amoral theories, business schools have actively freed their students from any sense of moral responsibility," concluded Ghoshal. Managers were not to be trusted; shareholders were. It was one of the most remarkable about-faces in the history of education. And by hiring Jensen, HBS threw its lot in with the cynics.

Graduates of HBS had always been drawn to finance, but in the 1980s they began heading to Wall Street and private equity firms in droves. Whereas in 1965 only 11 percent of HBS MBAs entered the fields of consulting or investment banking, by 1985 the two fields took in 41 percent of the school's graduating class. And many of them would play a significant role in downsizing—that is to say, gutting—the traditional manufacturing and product firms that previous HBS graduates had helped build.

The shift is indicative of the MBA's nose for power. Before the 1970s, companies' increasing cash piles had lessened their dependence on banks. But as those cash piles evaporated, the pendulum had swung back in finance's favor. In a capitalist economy, power equals money, and between 1983 and 1992, the proportion of professional managers in the nation's top 1 percent of household wealth holders showed a marked decline, while that of people working in finance spiked. And so that's where the MBAs went. "For most of the 20th century, social organization in the United States orbited around the large corporation like moons around a planet," wrote University of Michigan business administration professor Gerald Davis in "Corporate Power in the 21st Century." But by the time Jensen was through, "any lingering doubt about the purpose of the corporation, or its commitment to various stakeholders, had been resolved. The corporation existed to create shareholder value; other commitments were means to that end."

"Business educators legitimized the notion that good management might mean dissolving the firm to improve shareholder return," wrote management historian J.C. Spender in BizEd magazine in 2016, "without concern for the social costs to employees who lost their jobs or to communities that lost employers."

Ah, yes: all that nonsense about the social responsibility of business. It turned out that was all just posturing. Recent studies by the Aspen Institute show that when students enter business school, they believe that the purpose of a corporation is to produce goods and services for the benefit of society. When they graduate, they believe that it is to maximize shareholder value.

Jensen provided intellectual underpinning for the leveraged buyout boom in two Harvard Business Review articles during the 1980s, arguing that the threat of being taken over—and fired—effectively created a market for corporate control, which helped executives stay focused. He also argued that the high indebtedness engendered by leveraged buyouts forced executives to be much more focused on their operations of their companies. And finally, if and when executives did participate in LBOs by amassing their ownership stake, their incentives would then be directly linked to the company's stock price. Following Jensen's argument, takeovers and LBOs would cure the nation's economic woes.

Twenty-two percent of the 150 largest public companies in the United States as of 1980 had merged or been acquired by 1988, with another 5 percent taken private. The highly public spectacle of the takeover of RJR Nabisco was an object lesson for all CEOs who weren't used to looking over their shoulders. Downsizing became the hymn song of the managerial church. Thanks in large part to President Ronald Reagan's tax cuts and deficit spending, the U.S. economy found its footing again after 1982. However, as Walter Kiechel pointed out in a 2012 article in Harvard Business Review, unlike in the 1950s, "[the] rising tide didn't lift all boats. In the name of beating foreign competition, completing (or avoiding) takeovers, and serving the interests of shareholders, it became acceptable to sell off businesses that didn't fit the new corporate strategy and to lay off battalions of workers."

Jensen was rolling at that point, spewing out blanket claims, such as "Corporate takeovers do not waste resources; they use assets productively," and "Shareholders gain when golden parachutes are adopted." And it all came with the good seal of approval of Harvard Business School.

Jensen, who joined HBS full-time in 1989, expanded his remit with a 1990 Harvard Business Review article, "CEO Incentives: It's Not How Much You Pay, but How." Along with co-author Kevin Murphy, he opened the piece with one of the most absurd remarks in the history of executive compensation: "There are serious problems with CEO compensation, but 'excessive' pay is not the biggest issue. The relentless focus on how much CEOs are paid diverts public attention from the real problem—how CEOs are paid."

Three years later, President Bill Clinton, who had campaigned on reining in executive compensation, eliminated the tax deductibility of any portion of executive compensation above $1 million, unless the compensation was performance-based. It doesn't get much better in the annals of unintended consequences than this: Not only did the law increase many pay packages—salaries converged around the $1 million mark—but the shift away from salary and toward stock options resulted in the greatest explosion in executive compensation in history. In 1992, CEOs of Fortune 500 firms made an average of $2.7 million. By 2000, it was up to $14 million. Stock options as a percentage of compensation rose from 19 percent in the 1980s to nearly 50 percent in 2000. What also increased: short-termism and the tendency for executives to "manage" earnings, using aggressive accounting to give Wall Street analysts a "smooth" earnings trajectory on which to base their forecasts.

Jensen was right that CEO compensation would rise in the case of outperformance, but he was wrong about the fact that CEOs would suddenly be at risk of being fired for underperformance. The compensation of America's corporate executives shot up in the 1990s, regardless of—and sometimes in spite of—their performance.

Jensen's finance-based theory of the corporation lost significant credibility in the wake of the 2007-10 financial crisis. Specifically, observed Gerald Davis, the ideas that financial markets are "informationally efficient" and that "it is appropriate for corporate governance mechanisms to guide corporations toward share price as their North Star" were revealed to be, well, extremely misguided. "The merits of this view are debatable," wrote Davis; "less so are the hazards to the economy when it is broadly accepted by executives, investors, and policymakers. Indeed, some would go so far as to argue that the financial view of the corporation helped create the crisis we are in now. There is no doubt that finance and financial markets are central to what public corporations do. What is less clear is that an ownership society is a workable model for prosperity and security."

Way back in 1951, the chairman of Standard Oil of New Jersey—the company founded by the ultimate robber baron, John D. Rockefeller—said: "The job of management is to maintain an equitable and working balance among the claims of the various directly affected interest groups...stockholder, employees, customers, and the public at large." During the Jensen era, many people forgot about that.

But then we all sort of remembered it again. Even shareholder-friendly Jack Welch, the longtime CEO of General Electric, eventually came around. In March 2009, he told the Financial Times, "On the face of it, shareholder value is the dumbest idea in the world. Shareholder value is a result, not a strategy…. Your main constituencies are your employees, your customers and your products. Managers and investors should not set share price increases as their overarching goal…. Short-term profits should be allied with an increase in the long-term value of a company."

Maybe, just maybe, we're not all whores.

Rendering Business History Irrelevant

Even when people started to get a little nervous about the effects of shareholder capitalism on the American economy, Jensen wasn't apologetic. Indeed, he went in the other direction, ripping into fellow members of the HBS faculty if they strayed too far from his orthodoxy. William Lazonick got an HBS faculty post in 1984 at the invitation of Alfred Chandler, followed by a stint as president of the school's Business History Conference. He made the mistake of challenging the new king of finance when in 1992 he presented his paper "Controlling the Market for Corporate Control: The Historical Significance of Managerial Capitalism" in a seminar centered on the work of Jensen.

Lazonick was known to be a critic of Jensen's ideas on shareholder value, but a critic in the academic sense—you sat across from each other on a podium during a seminar, or you traded barbs in the gentlemanly forum of academic journals. Not this time. "Some sparks flew during the seminar," Lazonick recalls. "Jensen was king of the hill, and he objected to me…daring to question him. He was livid that he had been set up in front of all his colleagues to be critiqued by an outsider. He told [HBS professor Thomas] McCraw not to invite me back, and I wasn't...for another 17 years. And keep in mind that the year before that, I had been president of the Business History Conference. Have no doubt about it, the most powerful man at HBS in the early 1990s was Michael Jensen…. He was much more engaged with students, those students were all going to Wall Street, and Wall Street firms were all sending money back to HBS. The net effect of it all was that agency theory rendered business history irrelevant."

Lazonick thinks his experience shows intellectual cowardice. "Almost immediately after they hired [Jensen], shareholder value ideology quickly took a dominant position at HBS, even though, from their own experience, the vast majority of faculty members did not believe it. But there was absolutely zero critique. Even from those who should have known better...there wasn't a peep. It's quite sad."

"Both [Harvard President] Derek Bok and [HBS Dean] John McArthur should have known better, but they went out of their way to recruit Jensen," says Lazonick. "I asked a member of the faculty who is actually still there about it, and he said that McArthur thought that's where the money was, and hiring Jensen would bring in donations from Wall Street."

Lazonick saves his greater condemnation for those at HBS who should have stopped the rise of Jensen. "They had a tradition at HBS which could have said that this isn't the way business should be operating, Instead, they just went with the flow. They kowtowed to Jensen."

The Pretense of Knowledge

In 2004, again with Murphy, Jensen wrote, "Remuneration: Where We've Been, How We Got to Here, What Are the Problems, and How to Fix Them." It wasn't that anybody was looking to Jensen for solutions to the problems he'd played a large part in creating, but consider his quandary: Just a decade before, he was the man with all the answers. By 2004, no one had any more questions for him; his ideas were bankrupt. So he asked them of himself. "Two hundred years of work in economics and finance implies that in the absence of externalities and monopoly," he thundered, "social welfare is maximized when each firm in an economy maximizes its total market value." Ignoring the gaping holes in the remark—those "externalities" include, say, pollution that companies end up shirking responsibility for, or the crumbling of a community when a CEO closes a factory simply to juice share price—the "implied" increase in social welfare was just that: implied.

Jensen's thesis was given its final kick out the door when Ghoshal at the London Business School laid out a comprehensive rejection of agency theory. He began by dismantling Friedman's—and by extension, Jensen's—argument that shareholders are the "owners" of a company. They're not, at least if by "own" one means it in the way one can own a car or an iPhone. "We...know that the value a company creates is produced through a combination of resources contributed by different constituencies," Ghoshal wrote. "If the value creation is achieved by combining the resources of both employees and shareholders, why should the value distribution favor only the latter?"

Why not adjust the model? Because it's nice and neat. What's more, it's probably beyond the capability of economists to come up with the mathematics that describe how human organization, with all its complexities, really works. "Such a theory would not readily yield sharp, testable proposition, nor would it provide simple, reductionist prescriptions," observed Ghoshal. "With such a premise, the pretense of knowledge could not be protected. Business could not be treated as a science, and we would have to fall back on the wisdom of common sense."

In recent years, Jensen has been on a futile quest to alter his legacy. He showed his kinder, gentler side in 2011 with his paper "Putting Integrity Into Finance." Along with co-author Werner Erhard (the creator of the Erhard Seminars Training movement), Jensen claimed to have revealed "a heretofore unrecognized critical factor of production." That factor? Integrity. Jensen claimed to offer "an actionable pathway to increasing integrity" and concluded that "integrity thus becomes a necessary (but not sufficient) condition for value maximization and for a great life." There may be no better evidence for the pitfalls of the tenure system than this.

What did Michael Jensen achieve, in the end? He helped a generation of businesspeople lower its opinion of itself and give in to its baser motives. For all his economic equations and insistence on the testability and refutability of the logic of his opinion—and it was just that, an opinion— he released CEOs, institutional investors and Wall Streeters from the obligation of considering anything but their own narrow wants and needs.

Management adopted those parts of agency theory that suited their needs and ignored the rest. American managers loaded their companies with debt, per Jensen, they started paying themselves in equity and options, per Jensen, and they did everything they could to juice the value of that equity. And in doing so, they sacrificed long-term value for short-term gain, often engaging in outright fraud to bring it about.

Here's one thing Jensen didn't talk about much when he talked about the wondrous world of hostile takeovers: the insider trading it unleashed. Those crimes first came to light in 1986, when Dennis Levine of Drexel Burnham Lambert was arrested, accused of making $12.6 million from insider trading and charged with obstructing justice and attempting to destroy records. Levine implicated Ivan Boesky, an arbitrageur, who then implicated Martin Siegel (HBS '71), formerly of Kidder Peabody but then working for Drexel Burnham Lambert. And here's a fun fact for your next cocktail party: It was insider trading in the shares of Enron, which Michael Milken had helped finance, that tipped investigators off to Levine. A number of HBS graduates were ensnared in the ensuing investigation, including Siegel, Paul Bilzerian ('77) and Ira Sokolow ('81).

Fred Joseph ('63) was CEO of Drexel during this scandal, although he denied any involvement in the insider trading schemes and claimed he was only guilty of "surprising naïveté." The feds bought that, and the Securities and Exchange Commission merely reprimanded him for failing to properly supervise his star employee.

In a 2005 interview with The New York Times, Jensen discussed the propensity of executives to be overly optimistic about forecasts that support lofty share prices. "[If] executives would present the market with realistic numbers rather than overoptimistic expectations, the stock price would stay realistic. But I admit, we scholars don't yet know the real answer to how to make this happen." That's called ethics, and Jensen is right: Harvard Business School doesn't know how to teach ethics as well as it knows how to teach financial engineering, and it never will.

In 2003, the school added a Leadership and Corporate Accountability course that sounds like a direct repudiation of Jensen: "decisions that involve responsibilities to each of a company's core constituencies—investors, customers, employees, suppliers, and the public," with discussions on insider trading rules, the fall of Enron, human character, employee responsibilities, labor laws, corporate citizenship, socially responsible investing and serving the public interest. But in this, its influence is akin to pushing on a string. Because Michael Jensen helped create a Frankenstein monster no one knows how to kill.

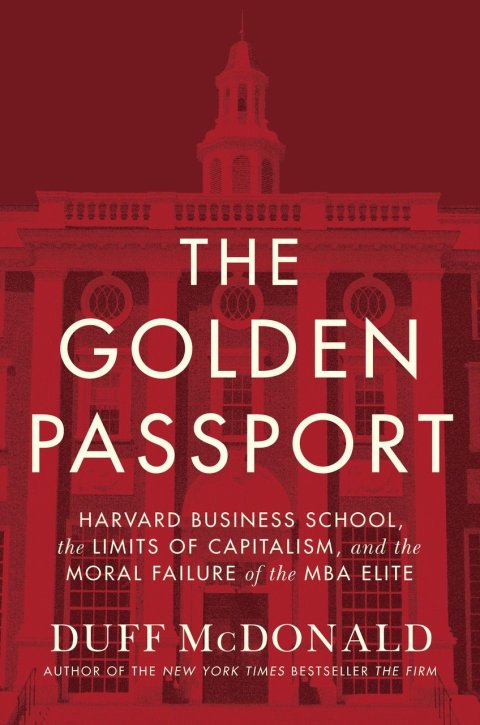

Reporter's note: When I began researching The Golden Passport, from which this excerpt derives, I asked Harvard Business School if it would be interested in making administrators and faculty available for interviews or providing access to the school's extensive historical collection. To my surprise, HBS told me that it had zero interest in engaging with me, and would not make a single person at the school available for an interview, from the dean on down. HBS did offer to make historical material available to me on an ad hoc basis, except for any material from the past 50 years—something that I could get myself, thanks to the internet. I asked on a handful of occasions over the next three-plus years if they'd changed their mind, and when I went back to them one final time, they declined again.

Adapted from The Golden Passport . Copyright © 2017 by Duff McDonald

Reprinted here with permission of HarperBusiness, an imprint of Harper Collins Publishers.