The Supreme Court recently agreed to hear a case that threatens the workability of President Barack Obama's controversial health care reforms in 36 states. If five of the court's nine justices rule against the Affordable Care Act, millions of people may no longer be able to afford coverage. The other big losers would be America's health insurers.

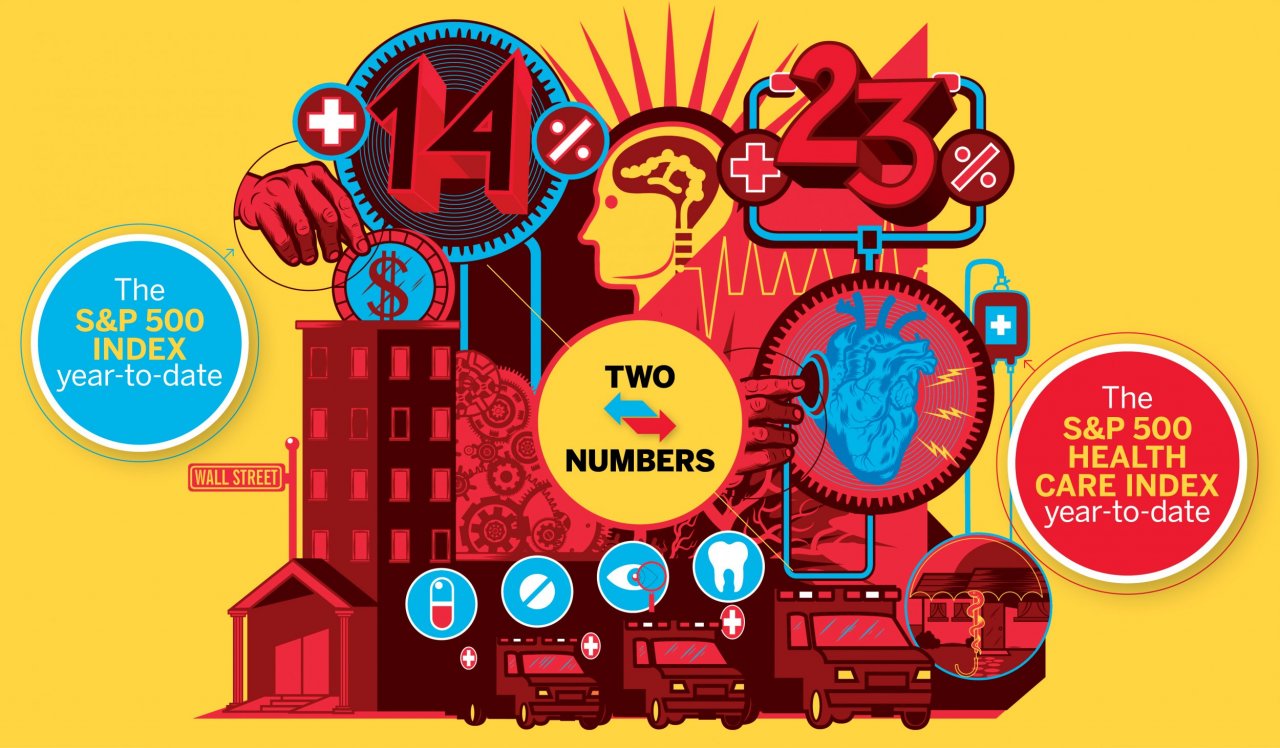

Since the new health care system got under way in January, health care providers have prospered. The S&P 500 health care index, a proxy for the industry that includes insurers, hospitals, equipment providers and drug companies, has increased 23 percent year-to-date (by November 21), while the broader market has gained 14 percent. Health insurers have been the biggest winners, with major stocks outpacing the health care index. So far this year, UnitedHealthcare stock is up 30 percent, WellPoint is up 39 percent, and Aetna is up 28 percent. All three major health insurance providers are currently trading at or near record highs.

It's no wonder. Underlying earnings for those companies have been strong. At the end of October, all three health care providers beat market earnings forecasts when they reported third-quarter earnings. And both Aetna and UnitedHealthcare raised their forecasts for the full year. "Actually, we think all of our businesses are really better positioned than they were as we entered into 2014," UnitedHealth Group CEO Stephen Hemsley said at the time.

To work, Obamacare depends on the individual mandate, the requirement that everyone must purchase health insurance. That translates into millions of new customers for health care companies—8 million have bought insurance on the new exchanges, though it's unclear how many of them were previously uninsured. Another 7.9 million were covered by the expansion of Medicaid.

For the less affluent, the government provides assistance tied to income. If the Supreme Court stops that assistance in some states due to a technicality, insurers are likely to see their revenue drop.

"We remain optimistic about the long-term membership growth opportunity through exchanges," Joseph Swedish, CEO of WellPoint, said at the time of his company's recent earnings release. So far, the stock market seems to agree.