Xu Li Chin isn't quite sure what has happened to his once-thriving business. For 20 years he has been the owner of a company just outside Shenzhen in southern China that supplies medical equipment. He started small and grew steadily, first via exports to a variety of countries in Southeast Asia, the United States and even Japan, and more recently riding the growth in China's own economy.

Now that homegrown growth has diminished, the industries he supplies suffer from overcapacity, as does his own, where price-cutting to maintain market share is now rampant. And last month his world got even more complicated when he lost a key export customer in Japan, which told him it was moving back to a homegrown supplier. The Japanese yen has depreciated by nearly 20 percent against the renminbi over the past two years, "and they said it made sense for them to switch" suppliers. "Now," Xu says, "we'll never be profitable this year, and to be honest I'm not sure when we will be."

Competitive price cuts, slowing growth, the disruptive impact of rapid currency adjustments: Welcome to the global economy, circa 2015. If businessmen like Xu in China—ostensibly still one of the relative bright spots amid the gathering global gloom—is depressed, then the world has problems, quite possibly big ones.

Two specters now loom over the global economy, one tied directly to the other: deflation, and beggar thy neighbor currency wars. On January 22, Mario Draghi, chief of the European Central Bank (ECB), ended months of speculation and announced what asset markets pretty much the world over had been waiting to hear: The ECB would jump into the same pool that his counterparts in Tokyo and in Washington had long been swimming in. He said the ECB was going to implement quantitative easing (QE): European central banks would directly buy the sovereign bonds of the 19-member eurozone, effectively pumping money into the economy, which in theory would cause prices to rise. The ECB pledged to do so for as long as necessary in order to achieve price stability—or, as Draghi put it in a press conference, "a sustained adjustment in the path of inflation."

In December, consumer prices in the eurozone had fallen 0.2 percent, the first such drop in five years, and with economic growth minimal pretty much throughout Europe, the prospect for further outright declines in the price level had clearly concentrated the minds of European central bankers. (At least those outside of Germany's Bundesbank, which opposed the adoption of QE. For Germans, the prospect of Weimar-style hyperinflation always lies just around the corner.)

And Europe is not alone. A monthly survey of China's manufacturing sector—the HSBC/Markit Flash Manufacturing PMI—showed a slight contraction, but that's not what got people's attention: Input prices fell to their lowest level since the height of the global financial crisis nearly seven years ago. That partly reflected the steep drop in crude oil prices in the past few months—by itself a deflationary force globally—but input prices were weak across the board, reflecting a slowing economy more broadly. The report "enhanced our concerns over deflation," said Nomura International economist Chang Chun Hua, and made it more likely the China's central bank will join the ECB in the fight against declining prices.

In a world of pronounced economic weakness, the United States is supposed to be the outlier—an economy finally gathering strength after years of financial crisis-induced slow growth. To fans of QE, the better growth numbers lately are a vindication for a U.S. Federal Reserve policy that's been in place since 2008. Under Ben Bernanke and now Janet Yellen, the Fed has bought roughly $4.5 trillion in bank debt, mortgage backed securities and U.S. government bonds since the crisis. But even here the deflation hawks are worried. The U.S. consumer price index fell 0.4 percent in December, surprising most economists, and January will likely show a similar decline. After six years of near zero interest rates, those numbers were all but unthinkable to most mainstream analysts.

Why do declining prices—which, to the average consumer everywhere, would seem to be a benefit (who doesn't want to pay less for stuff?)—put the fear of God into economists and policymakers? For an answer to that, turn only to the recent history of Japan, whose "bubble" economy burst in the early 1990s, and which tried and failed to escape from a deflationary spiral for about a decade.

Economists call a deflationary spiral the "fallacy of composition," which, as Nomura Research Institute chief economist Richard Koo explains, refers to a situation "in which behavior that is correct for individuals or companies has undesirable consequences when everyone engages in it." Thus, when you know that something you want to buy will be cheaper next month, it's rational to hold off. But in a general deflation, that pretty much means everyone is holding back on buying anything, which contracts an economy and puts further downward pressure on prices, thus triggering the same decision-making loop.

Deflation, in other words, is how depressions arise—and it is to be avoided at all costs. Japan didn't do a good job of that. From 1990 onward, falling land and equity prices alone destroyed 1.57 trillion yen in wealth. "No other nation in history has experienced such a large economic loss during peacetime," according to Koo.

Even before Bernanke became chairman of the Federal Reserve board—he was a governor for three years before succeeding Alan Greenspan—he had fixated on Japan's experience. A scholar of the Great Depression while a professor at Princeton, he was fascinated by how deflation had brought down what was then the world's second largest economy. As far back as 2003, Bernanke gave a speech in Tokyo in which he urged the Bank of Japan (BOJ) to figure out ways to, among other things, use its balance sheet to reflate the economy. He was, in other words, urging QE in Japan—which the BOJ eventually adopted—and which he would be forced to implement himself as Fed chairman in the U.S. when its own bubble burst in 2008.

Now Draghi has joined them. The question is, do QE and zero interest rate policies work? In Japan, recent data show an inflation rate above the flat line—2.6 percent in December. To QE's supporters, that means the answer is: yes…eventually. In the United States, supporters say it helped prevent a second Great Depression and eventually helped to boost growth, particularly by aiding a recovery in interest rate-sensitive industries such as housing and autos.

Skeptics, however, note that there is more than $2 trillion in Fed-supplied reserves sitting on bank balance sheets in the U.S.—meaning big banks took advantage of cheap money from the Fed but did not in turn lend all that money at similarly low rates to customers, as envisaged by the Fed. That is evidence, argues David Malpass, president of Encina Global, an economic consulting firm, that there's "no longer any link from central bank reserves to private sector money." Skeptics like Malpass believe that Draghi will find the same to be true in Europe, and that there will be very little macro bang for the QE buck (or, in this case, euro).

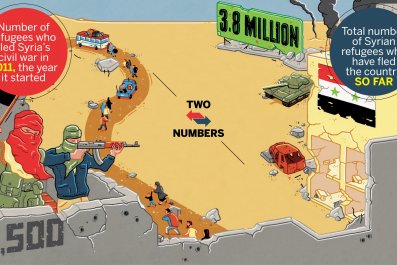

At the same time, some economists warn, loose monetary policies feed what they say is becoming a destabilizing round of currency devaluations. Japan's QE policies have helped drive down the yen by nearly 20 percent against the dollar and China's renminbi in the past two years, and 14 percent against the euro. On the day Draghi announced his QE intentions, the euro weakened sharply against both the dollar and the yen. National politicians usually like weaker currencies because they believe they help domestic companies by fueling exports. That's why, when one country does it, others tend to follow. Currencies are already weaker in Southeast Asia, and some smart hedge fund managers have already begun to bet on devaluation in South Korea.

That leaves the two largest economies in the world, the United States and China, with a very significant decision to make: how to respond. Under Yellen, the Fed has stopped its QE bond-buying program and has said it wants to start "normalizing"—that is, hiking—interest rates later this year. But with the yen and euro continuing to weaken, an interest rate hike would only put increased upward pressure on the dollar. Eventually, that will hit exports and make a lot of big U.S. companies squeal. A stronger dollar, meanwhile, helps contain any inflationary pressures in the U.S., which are barely existent to begin with. Thus, skepticism is mounting that there will be any increase in interest rates from the Fed this year—part of the reason the U.S. stock market reacted so positively in the wake of Draghi's announcement and bond yields remained under pressure.

The men who run China's economic policy have an even tougher decision to make. Their economy is slowing, and now all of Beijing's major trading partners (except, for now, the United States) are devaluing their currencies. All compete with Chinese exports. For decades, Beijing has loosely tied its currency to the dollar, allowing a slow, steady appreciation in the face of incessant criticism from abroad that it was "manipulating" the renminbi to gain advantage. Beijing, in other words, feels the pain of men like Xu Li Chin, and if the globe's quiet currency wars intensify, Beijing's hand could be forced.

Is a once unthinkable thought—a Chinese devaluation—suddenly becoming thinkable? That would roil global markets. It would also, among other things, intensify the globe's deflationary pressures, as prices for Chinese goods (in dollars or euros or yen) decline. "We're at a point," says a Tokyo-based hedge fund manager who has been warning of such a scenario for months, "that when pretty much everyone is trying [via devalued currencies] to export deflation, a lot of folks are likely to catch it." QE or no QE.