According to a recent poll, nearly nine out of 10 Russians say 2014 has been a great year for their country. In the wake of the annexation of the Crimea in March, Russians have been riding a wave of patriotism, nostalgia and triumphalism.

President Vladimir Putin's approval ratings have climbed to a whopping 86 percent, while Russian state TV whips up almost Soviet-era levels of xenophobia and hatred of the U.S. In the meantime, Russia's security forces are aggressively rolling back the Internet and civil society.

The Duma, backed by the Russian Orthodox Church, has been busy churning out ultraconservative legislation on everything from banning bad language in movies and plays to regulating women's high-heeled shoes, which, in the opinion of some Duma members, are bad for fertility.

What comes next? As the famously sober Putin perhaps doesn't know, after every party comes a hangover. On the face of it, the U.S. and E.U.'s limited sanctions on just over 100 Putin cronies and 20 companies associated with them haven't done much direct harm. The Kremlin has also shrugged off the Group of Eight's suspension of Russia's membership—in fact, it may even have helped to boost Putin's popularity.

"The feeling of isolation has driven the population to believe that no one in the West loves us," says Alexei Grazhdankin, deputy head of the Levada Center, a Moscow-based polling group. "So there's nothing left to do but rely on the current leadership." But in truth, the real cost of Russia's annexation of Crimea could be the economic prosperity that has been the cornerstone of Putin's 14-year hold on power.

First and foremost, sanctions have scared foreign direct investors and, much worse, international capital from coming into Russia. Since the annexation of Crimea, Russian companies have found it all but impossible to raise money abroad.

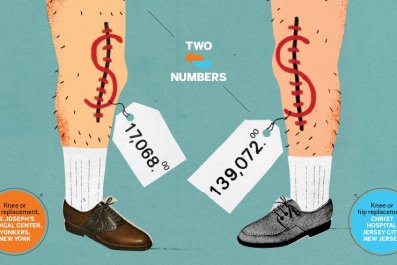

The first six months of the year saw syndicated loans for Russian commodities producers plummet 82 percent to $3.5 billion, compared with the same period in 2013. Bond sales by Russian companies also fell through the floor, from $19 billion from March through May last year to less than $2 billion this year.

As a result, Russian banks and companies have turned to Sberbank, VTB Bank and other domestic lenders—and ultimately Russia's central bank—to meet their combined $191 billion of foreign debt payments due this year. This year alone, Putin's trusted economic aide Elvira Nabiullina, now chairman of the central bank, had to double financing for commercial lenders to more than $142 billion in April.

The Kremlin's response? Blame meddling foreigners and claim that Russia can proudly go it alone. "Both the authorities and the public have interpreted every serious crisis in the world's major economies in the last 30 years as the result of foreign influences, not as a result of domestic policy," according to Vladislav Inozemtsev, a professor of economics and director of the Center for Post-Industrial Studies in Moscow. "Russian authorities in recent years have been so successful in convincing its citizens that all evil comes from the outside that they may have become convinced of it themselves."

Yet at the same time, Russians with cash are sending it offshore in unprecedented quantities. "The business class [is] terrified about the potential further expansion of sanctions," says Mark Galeotti, a global affairs professor at New York University. "But it's not something they can yet publicly articulate—or at least they don't feel comfortable doing so."

Instead, they're voting with their pocketbooks. According to the Central Bank of Russia, capital flight from Russia hit $75 billion in the first half of the year—more than twice 2013 levels—as investors and ordinary Russians ditched the ruble en masse. The World Bank and the International Monetary Fund (IMF) have estimated that total capital flight from Russia this year will top $100 billion.

True, after a decade and a half of sky-high energy prices, Russia has deep pockets: Its sovereign Reserve Fund and the National Wealth Fund stand at $87 billion each. But already the post-Crimea cash crunch is forcing the Kremlin to dig into those pockets.

Last month, Russia's finance minister announced that part of the State Pension Fund would be invested in infrastructure projects in Crimea—including a $4.3 billion bridge over the Kerch Strait to link the peninsula to Russia proper—and the Duma voted to allow the National Welfare Fund to cover losses at the state-owned VEB bank sustained as a result of the Sochi Olympics.

But Putin's, and Russia's, problems go much deeper than just cash flow. Putin's reaction to an economic slowdown has been to boost state monopolies in the oil and gas sectors—patriotically dubbed "national champions"—at the expense of entrepreneurship. For all of Putin's talk about modernizing the economy, Russia remains, at base, a petrostate with nukes.

Export duties on oil and gas account for 49.4 percent of the Kremlin's federal revenues. Since Putin came to power in 1999, state enterprises' share of the economy have risen from 30 percent to over 50 percent, according to a recent study by BNP Paribas. At the same time, the swollen bureaucracy and security apparatus sent Russia plunging down Transparency International's corruption rankings from 82nd in 2000 to 127th today, jointly with Pakistan and Nicaragua.

The current crisis will only deepen Russia's reliance on natural resources. "The measures the president is proposing will certainly limit competition and freeze modernization," Alexei Kudrin, a Putin adviser who served as Russia's finance minister for more than a decade, told Bloomberg last week. "They will lead to an increase in market regulation and protectionism."

Already, the hidden costs of Crimea are starting to hit Russia where it hurts the most: the oil and gas sector. In June, U.K.-based banks HSBC and Lloyds withdrew from a $2 billion trade finance deal between BP and Rosneft, Russia's largest oil producer, whose CEO, Igor Sechin, has been blacklisted by the U.S. for his role in Crimea's annexation.

Financing for Gazprom's ambitious $38 billion South Stream project, designed to pipe Russian gas to the Balkans along the floor of the Black Sea, has also run into difficulty, as well as political opposition from the European Union, which has asked Bulgaria to suspend work on its section of the pipeline on the grounds that Gazprom's control of the new pipes violates E.U. regulations.

Ukrainian Prime Minister Arseniy Yatsenyuk has lobbied vigorously for Brussels to declare the entire project illegal. "South Stream aims to increase Europe's dependence on [Russian] energy, remove Ukraine as a transit country and increase Gazprom's influence in Europe," Yatsenyuk said earlier this month. "We call on the E.U. to block South Stream altogether."

Annexing Crimea has certainly made Russia poorer. But has it at least made it safer? Many commentators—for instance, Ukrainian TV's Savik Shuster, who called Putin "Europe's new Hitler"—have presented Putin's Crimea adventure as an exercise in imperial ambition and confidence. But the evidence points the opposite way: that Putin invaded Crimea out of fear and defensiveness, to keep the city of Sevastopol out of NATO's hands and recover at least some influence in Kiev after the utter failure of President Viktor Yanukovych to win support for his pro-Russian policies.

Yet the result of the Crimean annexation and of the low-intensity insurgency that Russia is quietly fueling has been to push Ukraine closer to NATO and the E.U. For sure, Sevastopol will now never be a NATO base. But Russia has grudgingly acknowledged the legitimacy of Petro Poroshenko's election as president of Ukraine and has been unable to prevent him from signing an E.U.-Ukraine Association Agreement with Brussels.

Ukraine is now set on an inexorably Westward path, though even Poroshenko makes it clear that this doesn't include NATO membership. As far as Ukraine goes, Russia has reached a kind of bloody stalemate: The mouse lost its tail but ended up escaping Westward and, ultimately, to a place of greater safety.

Which is more than can be said for Russia. Among the patriotic giddiness, there are signs that Putin's praetorians are beginning to attack each other in the quest for power and money. It's a replay of security-service clan wars that have periodically surfaced as police and spooks compete for ever larger chunks of Russia's economy.

In June, Major General Boris Kolesnikov, deputy chief of the Interior Ministry's Main Directorate for Economic Security and Anti-corruption, apparently managed to push past two police guards and leap out of a sixth-floor window to his death. He and his boss had been charged with entrapment, bribe-taking and racketeering.

But according to Galeotti, an expert on Russia's security apparatus, Kolesnikov's department "is not only a potentially powerful political asset—whoever controls economic crime investigations is especially useful to the Kremlin—but also a lucrative source of revenue," because police who uncover evidence of corruption demand large bribes for their silence, or use the information to steal multimillion-dollar businesses.

Putin will doubtless ultimately rein in his feuding spooks. But he faces a far more fundamental problem: The economic cost of Crimea threatens the social contract that has been at the base of his power. Russians so far have been happy to surrender liberty in exchange for prosperity. But as the country slides toward recession—with the IMF predicting economic growth of less than 1 percent—Russia is now more isolated and economically precarious than at any previous point in Putin's tenure.

"The first alarm signals will sound when it will be too late to react," predicts Inozemtsev. "We will probably see a repetition of the dramatic events of the late 1980s. Of course, this may not happen for a while."

For the time being, Russia's cash reserves and the still-high prices of commodities will buoy up Putin's illusion of power. But in reality, the triumphal year of 2014 is more likely to go down in history as the point at which Putin's patriotic dream collided with harsh economic reality.