Vodafone's launch of M-Pesa in Romania earlier this year slipped beneath the news radar in Europe, where most people are unfamiliar with mobile money.

It marked the mobile payment system's European debut, and was quickly followed by the April launch of Paym in the UK. Last month, news also surfaced that Facebook, always keen to capitalise on a trend, is in discussions to develop a cross-border mobile remittance service for the European market.

Mobile money allows users to store and send money on their mobile phones. After depositing cash into their mobile money accounts via "agents," users are credited with an equivalent amount of digital currency, which can then be used to transfer money or pay for goods, services, and even airline tickets. The virtual money can also be unlocked as cash-in-hand after showing ID and entering a PIN.

Although mobile money is a new concept in Europe, it has exploded in popularity across Africa since 2007, when Vodafone's Kenyan affiliate, Safaricom, first launched M-Pesa. It now boasts 45,000 agents serving 18 million customers in Kenya, and in 2013, M-Pesa transactions were worth $35m - more than a quarter of the country's GDP when annualised.

Africa has the highest mobile money penetration rate in the world, according to a report released this year by GSMA, an association representing some 800 mobile services companies worldwide. And at least 52% of all live mobile money services take place south of the Sahara.

Mobile money is rapidly altering the way African businesses and consumers conduct financial transactions, and its significant socioeconomic impact on the continent could prove instructive for the West.

In Ivory Coast, tech entrepreneur and blogger Diaby Mohamed regularly sends money from his office in the country's economic hub and former capital, Abidjan, to family members 900km away in the north with just a few swift taps of his mobile phone.

After receiving instant SMS notification, Mohamed's recipients simply take their phones to an agent and withdraw the cash.

"It's easier for me," Mohamed says. "I can stay in the office and send them money and they can collect it at any of the main shops there."

For Mohamed, CEO of interactive marketing agency, Social.ci, mobile money forms an indispensable part of his day-to-day living. "I use it daily to pay bills – electricity, water, digital television, and can use it to buy calling credit," he says. "Last week I was trying to buy a new domain name for a startup project and I was able to use mobile money."

Mohamed is one of five million mobile money subscribers in Ivory Coast (that's more than 40% of the adult population), and 98.3 million registered mobile money account holders across 36 African countries – more than twice the number of Facebook users in the region.

Globally, mobile money users engaged in 431 million transactions worth $7.5 billion in June 2013 alone, with 42.2 million accounts active in sub-Saharan Africa in that month.

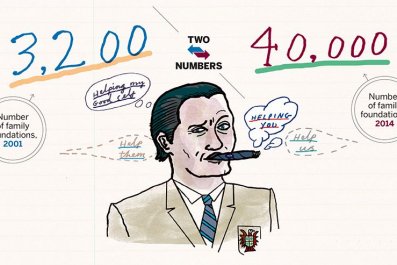

M-Pesa's success in Kenya spawned other operators across Africa, including MTN Mobile Money, airtel Money, EcoCash, Orange Money and CELPAID. Today, at least nine African countries, including Kenya, have more registered mobile money accounts than bank accounts: Cameroon, the Democratic Republic of Congo, Gabon, Madagascar, Tanzania, Uganda, Zambia and Zimbabwe. East Africa, nicknamed the "Silicon Savannah", accounts for a particularly high proportion of mobile money users, and represents just over a third of total registered accounts globally.

MTN launched mobile money in Uganda in 2009 and it now registers over 28 million transactions each month, ranking second in the number of active mobile money customer accounts across the globe.

"Cash is king and the king is dead," says MTN group chief commercial officer, Pieter Verkade. "Mobile money is filling a void. Whether it's fishermen at Lake Victoria, pharmacies or small traders, many entrepreneurs are using this service - there's no requirement to travel to the capital to deposit cash."

Vincent Kiyingi, head of IT at Pride Microfinance, based in Kampala, agrees. "The amount that goes through mobile money in one month is more than the amount of money that has gone through commercial banks since inception," he says.

Meanwhile in Kenya, 2.4 million people now use M-Shwari, a credit and savings product for M-Pesa customers, launched by Safaricom and the Commercial Bank of Africa in 2012. The system allows customers to apply for quick loan approvals with no fees or paperwork, and earn interest on savings accounts set up through their mobile phones. M-Shwari continues to grow, and users have now collectively deposited 1.8 billion Kenyan shillings ($21.2m).

In Africa's largest economy, Nigeria, however, mobile money's potential has been hamstrung by the exclusion of mobile operators from implementing the service, poor targeting of the unbanked rural population and a powerful, and often hostile, banking lobby.

"Mobile money is not as popular here as it is in east Africa," says Mark Essien, founder of Nigerian hotel booking portal Hotels.ng. The website allows customers to book rooms at any one of its 3,800 affiliate hotels via mobile money platforms, but only a few such payments take place every month. However, Lagos-based Essien finds that his company spends thousands of dollars a month on calling credit using mobile money.

Mobile money's upward trajectory in Africa looks certain: around 70% of mobile operators surveyed by GSMA said they plan to increase their investment in the platform in 2014, and mobile-related businesses and e-commerce are predicted to create at least 10 million jobs in Africa between 2015 and 2020.

Can mobile money's African success story be replicated in Europe? "In Germany, if somebody makes a transfer between banks, it's not instant and you don't get an SMS," Essien says. "If that stays the same, then I think an alternative service that offers that possibility can actually make mobile money catch on."