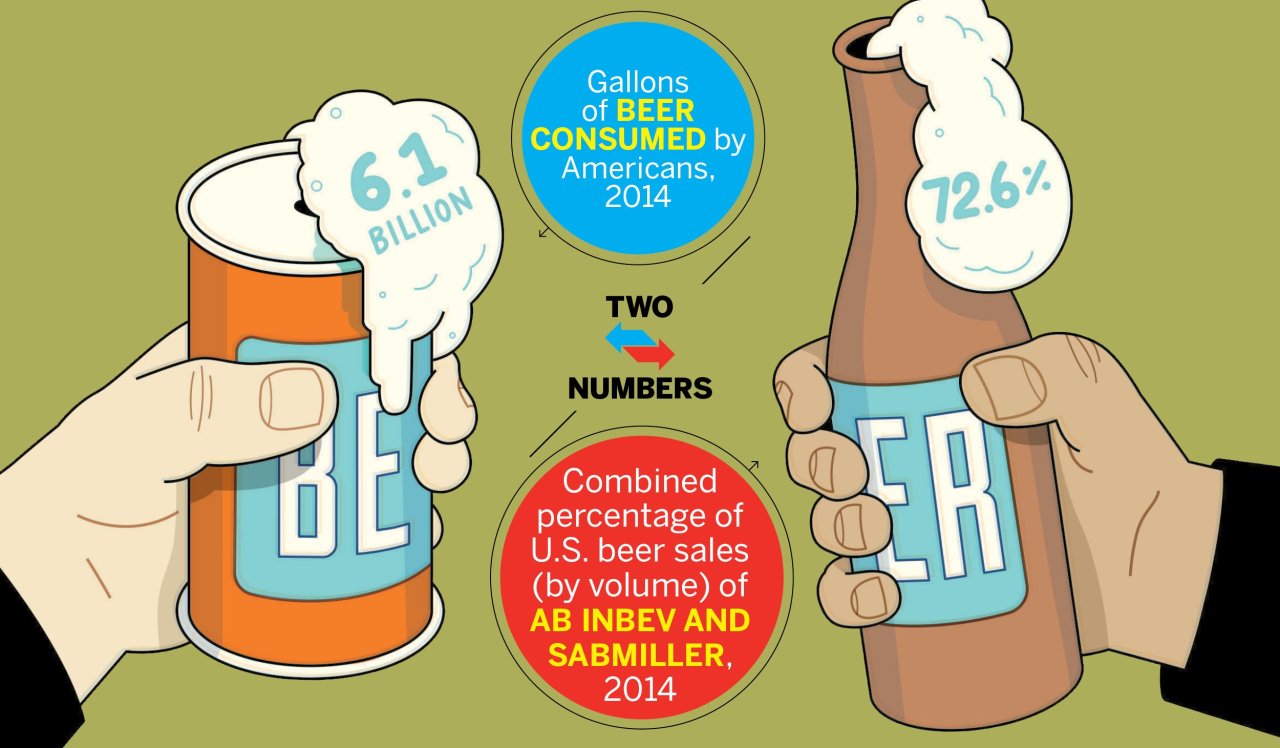

The $100 billion merger of the world's two biggest brewers will bring together the companies that produced more than 70 percent of all the beer sold in the United States last year. That's a lot of foam.

Americans drank around 6.1 billion gallons of beer in 2014, not including flavored malt beverages and other beer-related products, according to the Brewers Association. That's around 45 billion bottles of beer, which is enough to fill about 9,242 Olympic-sized swimming pools. This equates to about 26 gallons a year per person 21 or older. (Let's pretend students don't drink.)

Anheuser-Busch InBev and SABMiller are working to finalize terms of the deal, the biggest beer acquisition ever and one of the top mergers in history. ABI is headquartered in Belgium and is responsible for America's best-selling beer, Budweiser, as well as Stella Artois and Corona. It started talks in September about taking over SABMiller, its main rival, which is based in London and makes Miller, Coors and Blue Moon. After the merger, it's likely the superbrewer will control about one-third of global beer production.

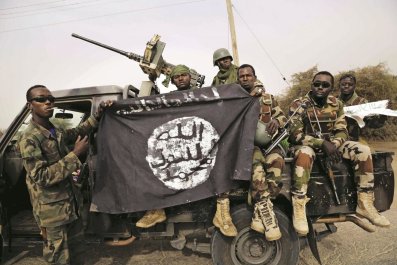

Analysts say ABI wants to tap into SABMiller's success in emerging markets, particularly in Africa, where it has deep roots and currently dominates in several countries. Asia and South America are also considered lucrative markets for expansion.

With competition from the boom in craft beers, sales growth for large mainstream breweries in developed markets has slowed. "It signals a shift in strategy that has been happening over time for large multinational beer companies, away from growth in the developed world to the developing world," says Bart Watson, chief economist at the Brewers Association. "They're turning themselves into a global business."

Some in the beer industry worry that the new megabrewer could be detrimental for small brewers trying to land their craft beers on store shelves. The deal is expected to face scrutiny from the U.S. Justice Department. Domestic regulators and others abroad could force the brewers to shed some of their overlapping assets to avoid reducing choice for customers.

Daniel Kleban, co-founder of the small brewer Maine Beer Company, located in Freeport, sees it as a defensive move by the big companies. "This is all an attempt to stem the tide of small, independent breweries' growth," he says. "They want to dominate the global beer market, that's no secret."